Kauai Real Estate Q3

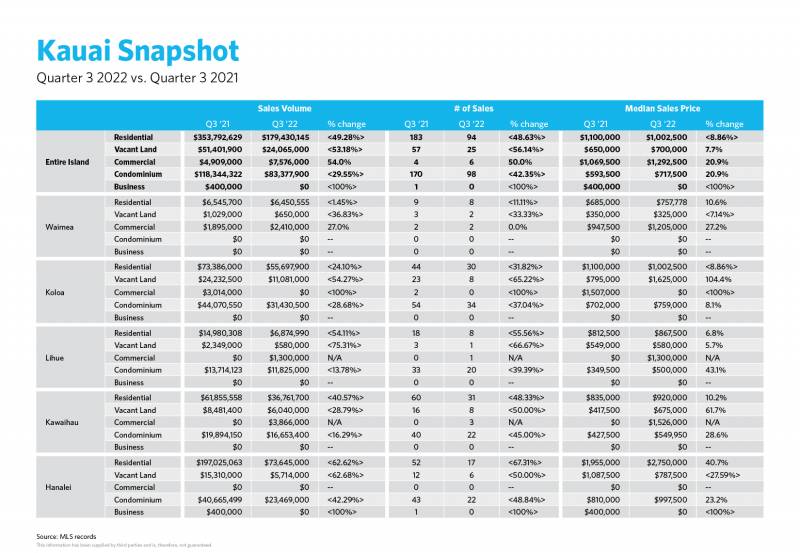

While we broadly and generally describe current real estate market activity as “historically solid,” the descriptive metrics denoted in the snapshot graphic below signal an unambiguous inflection point. While it remains a “Seller’s” market, with strong property values and continued limited inventory, active Buyers are in a more powerful position than in recent years as the pool of Buyer’s has shrunk significantly due to global economic uncertainty and rising interest rates and slowly inventory has been creeping back up.

The most telling statistic of a more subdued real estate market is the drop off in sales volume; island wide residential sales volume dropped nearly 50% from $353M in Q3 2021 to $179M in Q3 2022. North Shore residential sales volume also saw a steep year on year decline dropping 62.6% from $197M in Q3 of 2021 to $73.6M during the same period this year.

The sales volume decline was paralleled by a drop off in the number of sales. During the third quarter of 2021, there were 183 residential sales; during that same period of 2022, there were only 94 sales representing a 48.6% decline. In the North Shore residential market, there were 17 residential sales during this past Q3 versus 52 during 2022 – a 67.3% decline.

Anecdotally, high end activity on Kauai still feels historically strong heading into Q4. There are currently 13 properties in escrow on Kauai with asking prices above $5M and 3 properties in escrow with asking prices north of $10M.

If you’d like to explore the numbers a bit deeper, check out the market snapshot below for Q2 2022, or via the following links for enlarged versions – Kauai Snapshot Q3 2022

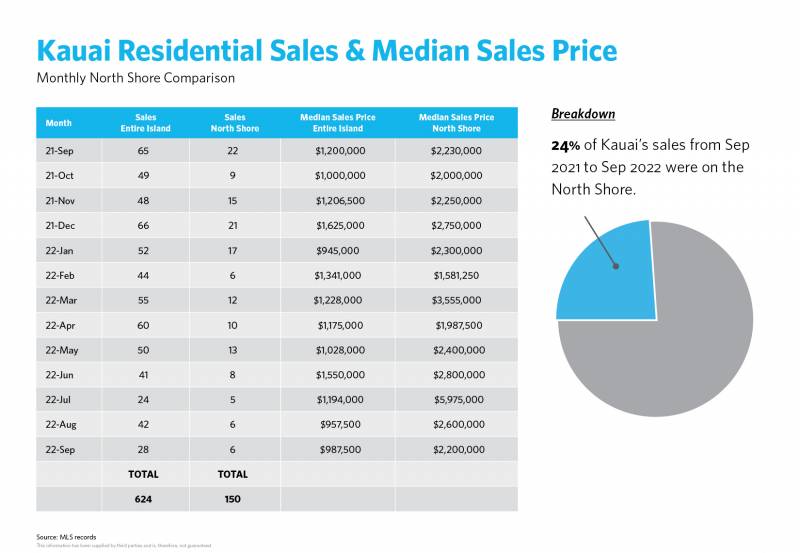

Monthly Sales and Median Price Statistics

The below chart depicts monthly sales and median prices for both the entire island and the North Shore and another representation of the market slow down. The past three months (for both the entire island and the North Shore) represent the fewest sales during any three month span of the prior 13 month series.

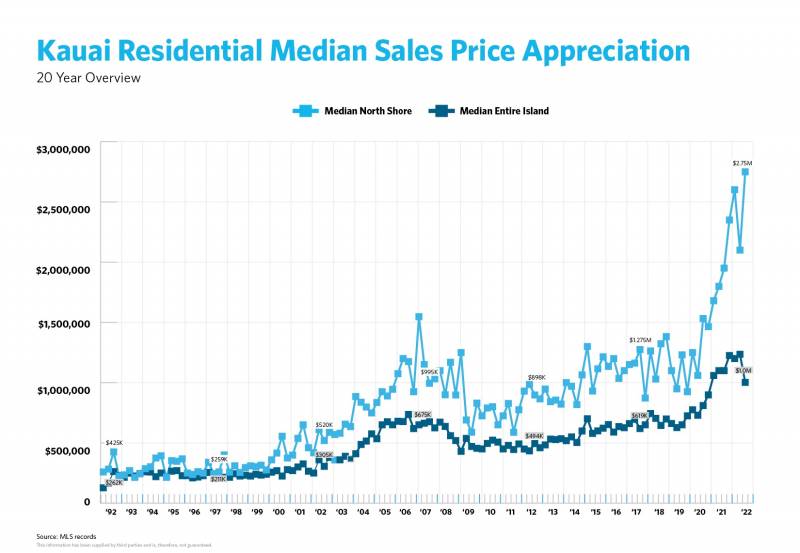

Long-Term Quarterly Median Sales Price Trends

The long-term data shows that values remain very high. Also, as the number of sales drop to rather small sample sizes as the market slows, the variation of the median prices will increase and must be considered in any quarter to quarter evaluation. As is always the case, as we move forward with a limited sample size, we will need to monitor the trend more than any single data point.

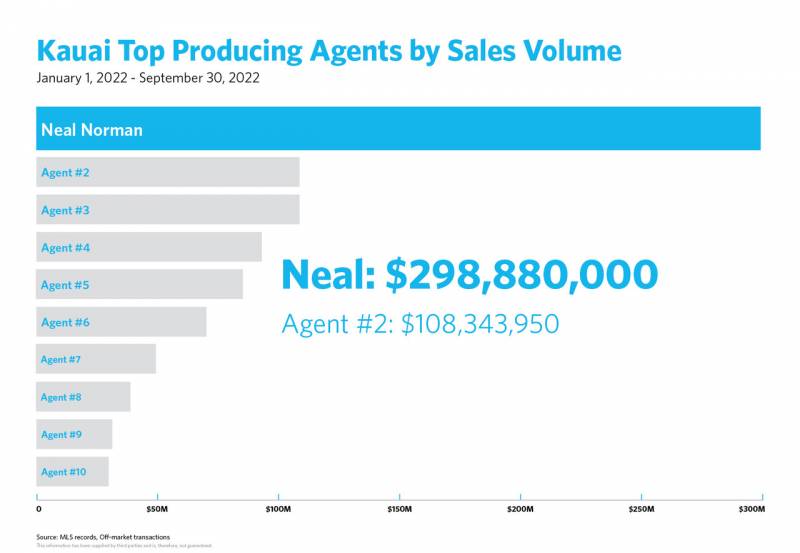

Despite slowing sales volume, it was another solid quarter for our team and the broader real estate market in general. As always, we greatly appreciate your trust and your business in the process of buying and selling real estate on Kauai.

Explore more of our beautiful listings at www.nealnorman.com.

Would you buy a house so perfect it could be located in San Diego, down the street from Disneyland …

Would you buy a house so perfect it could be located in San Diego, down the street from Disneyland …

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.