HARPTA

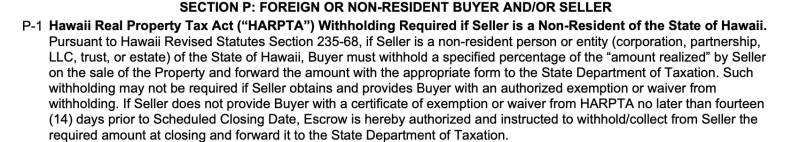

There is a 50/50 chance you don’t know what HARPTA is and/or you didn’t see it on the contract. Non-resident withholdings are uncommon across the country with only 17 states with the requirement so it’s important to have a conversation with your realtor about it. It is explained in section P-1 of the Hawaii Purchase Contract, which I’ve attached here:

“HARPTA” stands for the Hawaii Real Property Tax Act. This is the withholding of tax on the disposition of Hawaii real property by non-resident persons. The intent of HARPTA is to make sure that nonresidents comply with Hawaii’s Income Tax Law.

How Much is Withheld?

A tax withholding of 7.25% of the gross sales price. This is a lot of money, I know…

Refunds?

You can get a refund when you file a Hawaii income tax return after the end of the year or you can file a Hawaii Form N-288C for a tentative refund after closing. Refunds normally take 4-6 weeks except during the tax season.

More Information

Still have questions? www.harpta.com is a great website if you need additional information. Click here to connect with me! I would love to learn more about you and what your real estate needs are.

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.