So you’ve officially made the decision that you want to invest in a vacation rental condo in Hawaii, now it’s time to sharpen your tools and get to work. Here are some of the tools that I use. I am happy to share with you directly, just ask for them.

Many aspects of this post will ring true for properties throughout Hawaii. But since I live on Maui and specialize here, please let me know if you are considering other islands so I will connect you with an awesome agent. He is from our team who specializes in the specific market that you are considering.

For the entire purpose of this blog, it is important to understand that I help buyers/sellers sell real estate, and not investments. All rental income figures are based on present day and historical figures. Cost figures are also relatively current. All of these variables can and do change. So it is important to evaluate every scenario, and conduct as much due diligence as possible when making your purchasing decision.

This post works in concert with a couple other complimentary pieces that I have published. For those who are looking to shoulder the workload of operating a vacation rental on their own, and thus drastically improving the ROI, be sure to check out this post.

Toolkit For Purchasing a Hawaii Vacation Rental Property

Spreadsheets, Spreadsheets, & More Spreadsheets

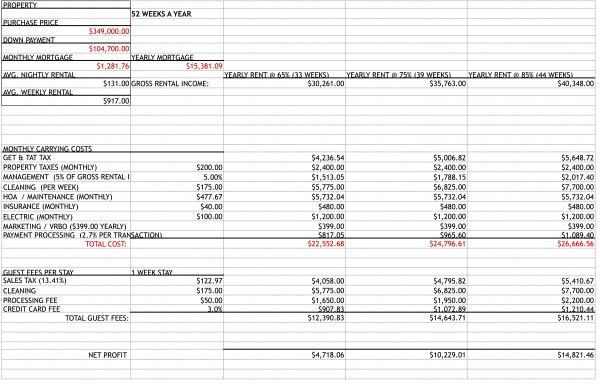

I have a client who very intelligently sets up a multi-tier spreadsheet for analyzing different properties with different average occupancy schedules. Spreadsheets are in order for him to properly forecast different market conditions, and the build up time required to obtain highest levels of optimization.

This is the spreadsheet that my client sets up. Please understand that all of these figures will vary from property to property. They are also affected by other rental factors that are part of the buyer’s due diligence. This is probably a bit hard to read, so if you are interested, please reach out to me directly.

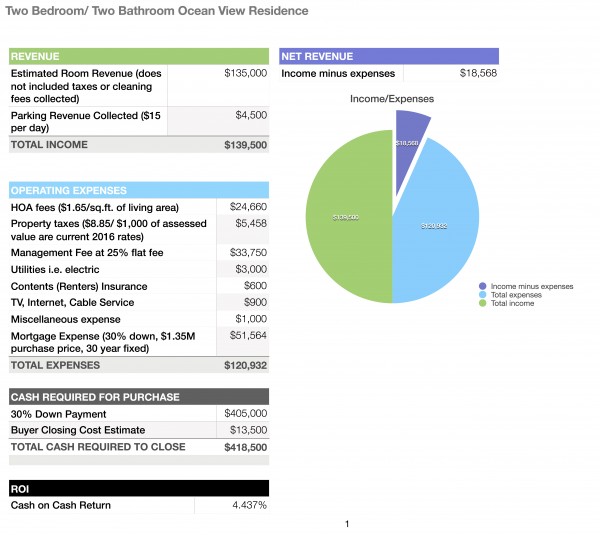

This is a basic budget that I mocked up for a client, which did include the cost of a conventional loan. Please also understand that property tax rates and amounts often change on annual basis. The mortgage rates also change at a moment’s notice. In the above scenario, we are looking at an annual cash flow of $18,568 and a cash on cash return of 4.437%.

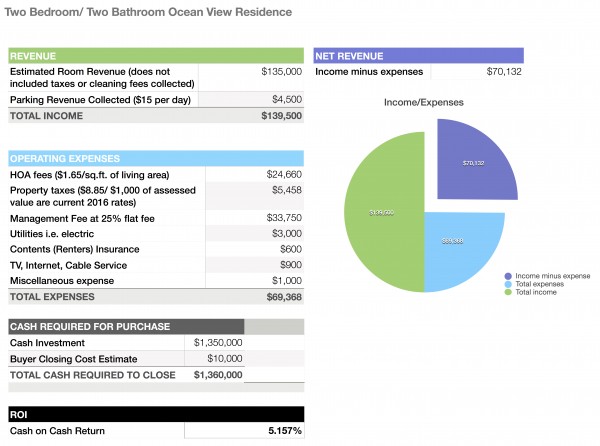

The same property and scenario as the one before it albeit an all cash purchase with an annual cash flow of $70K and a slightly higher ROI

Owners will delight that they will be cash flow positive in the above 30% down scenario, which is the minimum down payment for almost all condo-tel type properties. Albeit there are some select scenarios where the cash required is a slightly lower %.

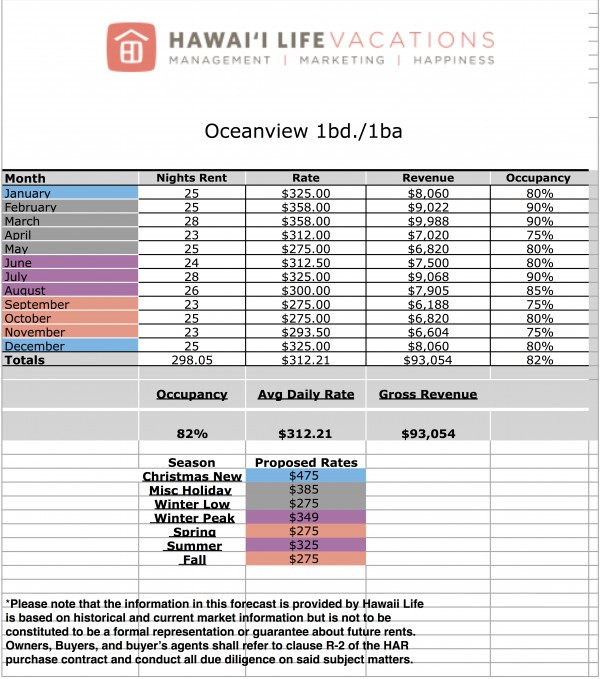

Tool For Estimating Gross Income

This is a spreadsheet rate calculator that I use to analyze properties that generate anywhere from $40k to over $400k in gross annual income. Please remember that there are a number of factors that come into play here. So with a new property, it does take some time to get up and running to full optimization levels. In our program, we have seen tremendous gains from year 1 to year 2. So it’s important that you budget for this ramp-up time period, and also for other economic factors (macro or micro) which will affect your numbers.

Fixed & Variable Costs Associated with Ownership

Please stay tuned for a future post that addresses all of the cost figures in detail.

3 Facets of Real Estate Investment

When educating my buyer client’s about purchasing property here in Hawaii, I try to stick to 3 main facets for consideration:

Lifestyle

If you haven’t been to Hawaii before, you need to make it happen ASAP. For those who have been here, there is a reason you keep coming back. It is simply one of the most awesome places in the entire world. I do my best to educate my clients and allow them to fall in love with this place (not hard to do). If you consider calling Hawaii home for any portion of the year, it is a good idea that you research in advance and determine which island is best for you.

Once this has been determined, you need to figure out which part of the island appeals to you most. Next from there, which neighborhood or condo complex? Going further, look at the bedroom and bathroom counts, square footage, views, amenities, floorplans etc. This is what I call the lifestyle aspect. For most people who own property here, it is the #1 most important aspect of ownership.

The Ka’anapali Ali’i (center building above) represents one of the most desirable lifestyle locations in the world. Direct golden sand beachfront, fantastic ocean activities directly out front, upscale amenities, across the street from world-class golfing, and unbeatable sunsets. Try the Ali’i on for size here with our 2 bed/2 bath #282 ocean view vacation rental and browse all Ka’anapali Ali’i ownership opportunities here.

Cash Flow

There is no question that some areas/condo complexes rent better than others. But equally as important in this equation, is to determine exact operational costs. Because I am in the business of vacation rentals, I have a very good idea for those specific areas/complexes. Even more so, what specific assets are most profitable on a cash flow basis.

Seasoned investors understand that by leveraging cash flow, one can reduce debt (if applicable). Thus increasing equity assuming a flat or appreciating market, and/or to leverage the cash flow proceeds to acquire more property.

Glass walls disappear and the ocean emerges at Konea 607 at the Honua Kai Resort. Honua Kai has seen some incredible capital appreciation in the last couple of years. Get a taste for all of the ownership options here – Hokulani Tower and Konea Tower. This fine property is offered for vacation rentals through our program here – Konea 607 vacation rental site.

Capital Appreciation (Equity Build-up)

This is the most difficult aspect of the education process. Just like everyone else, I wish I had a crystal ball. Hawaii, for the most part, is an equity based market because our prices are so high. Also, historically speaking, our prices doubles every 10 years.

There are specific factors that do lead to capital appreciation, including, but not limited to: location, overall rarity, age of construction, aggregate rental income, strong financial planning among the association. Personally, I really love new construction and new developments. I can think of countless new development properties here on Maui where prices have risen and relatively outpaced the rest of the market. On Maui, we have very little new inventory, so getting on the ground floor of that here can be extremely rewarding.

The 10% Rule

As a general rule of thumb, I try to help my clients who are strongly concerned about their ROI. Help them seek out properties that, on an annual basis, will have a gross income that is 10% or higher than the asset acquisition cost. For simplicity, a $1M property that grosses $100k or more per year.

Net income is another story and it takes a more detailed analysis to come up with this figure. Many independent rental management companies like ours will charge 25% or less management fee for full-service vacation rental service. Opposed to front desk operations like Aston or Outrigger (just a few of many), which charge considerably more, in the 40%-50% range.

As a general rule of thumb, you can expect that your remaining carrying costs (excluding the cost of a mortgage if applicable) will amount to another 25% or so. So doing some simple math at 25% management fee scenario:

$100k gross – $25,000 management fee – 25% other carrying costs = $50k net.

Furthermore:

$100k gross – $25,000 management fee – 25% other carrying costs = $50k net – $25,000 other carrying cost = $50k net $50k net / $1M acquisition cost = 5% ROI, straight cash on cash return.

Priceless moments enjoyed on Ka’anapali Beach where we can host 7 people in our direct beachfront 2 bed/2 bath Whaler #102 vacation rental. Browse all ownership options here: Whaler at Ka’anapali Tower 1 real estate and Tower 2 real estate.

Consult with Your CPA/Tax Attorney

I highly recommend that you consult with the property financial professional, who can help you fully realize the potential of owning investment property in Hawaii. Savvy investors know that most rental expenses; including property taxes, repair and maintenance expenses, management fees, capital improvements insurance, and professional services, are deducted in the year you spend the money.

Let’s not forget one key deduction, which is depreciation. Depreciation does work differently from the aforementioned expenses. Depreciation is the process used to deduct the costs of buying and improving a rental property. Rather than taking one large deduction in the year you purchase (or improve) the property, depreciation distributes the deduction across the useful life of the property. The IRS has very specific rules regarding depreciation. So if you own rental property, it’s important to understand how the process works. Because land does not wear out, decay, or get used up, it is not depreciable.

Modified Accelerated Cost Recover System

Any residential rental property placed in service after 1986 is depreciated using the Modified Accelerated Cost Recover System. This is an accounting technique that spreads costs (and depreciation deductions) over 27.5 years, which is the amount of time the IRS considers to be the “useful life” of a rental property.

Depreciation can be a valuable tool if you invest in rental properties because it allows you to spread out the cost of buying the property over decades. Thereby reducing each year’s tax obligation. Of course, if you depreciate a property and then sell it for more than its depreciated value, you will owe tax on that gain through the Depreciation Recapture Tax. But an excellent way to avoid this is to conduct a 1031 Tax Deferred Exchange.

You want to make sure that you work with the right professionals as tax laws are complex. You can also save yourself a tremendous amount of tax exposure if you understand the rules, and how to make them work to your benefit.

Time For a Business Trip to Maui to Identify Your Purchase

My wife and I own this studio, Hokulani #833 at Honua Kai. It is a perfect place to stay if you are able to leave the kids at home. Have some time to yourself, and spend some time with me identifying the right property for you. In the event that you need to bring the whole family, please browse our entire portfolio here.

So, now you’ve got the wrench and screwdriver. But what good is it if you don’t have the nuts and bolts. I am here to open the entire toolchest. Please let me know how I can be of service.

Jeremy Stice REALTOR (Broker #21286) Maui, Hawaii Top 100 Realtor recipient in State of Hawaii (out of 14,000 Realtors) 2014, ’15, and ’16 808.281.2178 Direct Jeremy@HawaiiLife.comWant to follow my blog via email updates, please enter it below. This will not be used for any other reason than automatic blog updates that I post.

Subscribe to Hawaii Life Real Estate Brokers » Jeremy Stice by Email.

Jon broek

March 16, 2018

Great article Jeremy please keep me updated love Maui and intend to buy soon

Jeremy Stice

March 20, 2018

Aloha Jon,

Thank you for the kind words and I will certainly keep you updated. I will be sending you a private email now. Thank you for reading and commenting.

Justin Kemp

April 13, 2018

Great Article. My wife and I have been pondering buying a rental on Kaua’i for 2 years now. I’m actually working with a HawaiiLife agent on Kaua’i. The places that we are looking to buy happen to be leasehold properties. I’m wondering if you could suggest any mortgage brokers in Hawaiithat work with mortgages for leasehold properties. Keep up the good work. I love the HawaiiLife articles I find..

Jeremy Stice

April 14, 2018

Aloha Justin,

Mahalo for taking the time to reply. I wish you the very best in your property search endeavors on Kauai and know that you are in good hands with one of our fine Hawaii Life team members. I am going to reach out to with a direct email now to see how I can help you with your specific needs.