Strategic Home Financing in Hawai’i: Harnessing the Power of 2-1 Buydowns

This spotlight series features a loan expert from Element Mortgage, our preferred lender.

Over the course of the last year, Hawaii’s housing market has experienced profuse growing pains. Although there are still many multiple-offer situations in the most desirable neighborhoods across the island, we are currently in the midst of a “buyer-friendly market,” or a market that tends to favor negotiations on the side of the buyer.

In any shifting market, it is important to grasp the tools and concepts that will help you better understand your options as a consumer. Keep reading to learn about an alternative option to traditional financing that will help prospective home buyers get off the fence, all while adding some frills to the marketing plan of a future home listing to make that property more attractive to potential buyers.

Often, homeowners will indicate in their property listing that they are willing to help with some of the buyer’s closing costs to speed up the sale of the home. These payments are defined as seller concessions, or a fund that a seller offers to reduce the cost of buying a home.

One way to use seller concessions is to fund a subsidy that lowers the interest rate for the first two years of the home buyer’s 30-year fixed-rate mortgage. This is known as the Temporary Buydown.

This financing strategy is often referred to as the 2-1 Buydown because the interest rate is two percentage points lower during the first year of the mortgage and one percentage point lower during the second year of the mortgage. At the end of the two-year term, the interest rate adjusts to the original interest rate, or note rate that was locked in when the purchase contract was originally accepted.

Real World Example

Let’s look at this example: A home buyer is purchasing a house on Oahu for $1,050,000. Assume this buyer contributes 20% towards the down payment and their qualifying note rate is 7%. During the first year of the mortgage, the home buyer has their interest rate reduced to 5%. In the second year, the interest rate slightly increases to 6%. Subsequently, from the third year onwards, the interest rate reverts to the note rate at 7%.

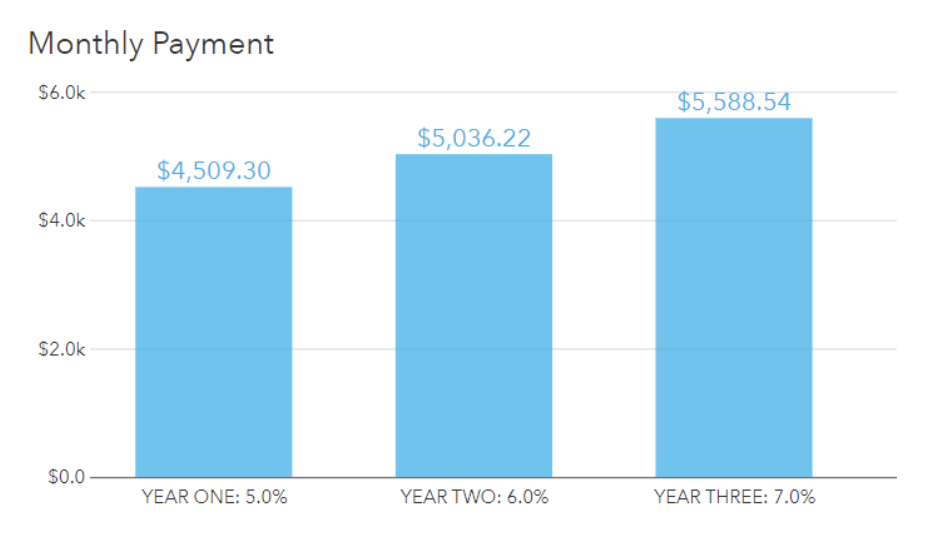

Figure 1: The monthly principal and interest payments of a 2-1 Buydown loan in years 1, 2, and 3. Taxes, insurance, and other monthly payments were not included for simplicity’s sake.

As you can see in Figure 1, the home buyers will save $1,054 each month during the first year of their mortgage. Then, in the second year, the home buyer saves $527 per month on their mortgage. Starting at year three and for the remainder of the loan, the mortgage payment adjusts to reflect the note rate which was originally locked when the home buyer purchased the home.

Advantages for Home Buyers

- Lowers the monthly mortgage payments, allowing the buyer to ease into their payments for the first two years of their home loan.

- Frees up cash flow for home expenses such as furniture, moving expenses, and home improvements.

- Available for FHA, Conventional, and VA loans in Hawai’i, so primary home buyers can benefit regardless of which loan product is best suited for them.

- Unlike Adjustable-Rate Mortgages (ARMs) there will be no payment shock because the fixed payment is known from the beginning and no risk because the payments never change.

- If the buyer refinances before the end of the temporary Buydown term, the remaining balance of the subsidy will be applied to the principal of the loan – so there is no loss of savings to the buyer!

Advantages for Sellers

- Home buyers have an incentive to purchase a home now rather than wait until later.

- A home listing that has been sitting on the market can be revived without ever needing to lower the purchase price.

- The cost to the seller is lower than a Permanent Buydown and has better short-term benefits to the buyer.

- Including the Temporary Buydown in the listing description helps it stand out among homes of similar worth in the area.

Concerns for Buyers

- The Temporary Buydown subsidy can only be funded by the seller or builder of the property, therefore their participation is essential.

- The home buyer must qualify for the loan at the note rate, or highest rate, so this may not be the best option for someone that wants to maximize their purchasing power.

- The Temporary Buydown is not available for USDA loans or investment properties – only primary residences and second homes.

If obtaining the most expensive home you can qualify for is your goal or any other of the reasons above apply to you, please read the Seller Buydown Blog I authored in 2022. The Seller Buydown, also known as a Permanent Buydown, addresses all these concerns and may be a better fit for you.

How Much Does the Temporary Buydown Cost for the Seller?

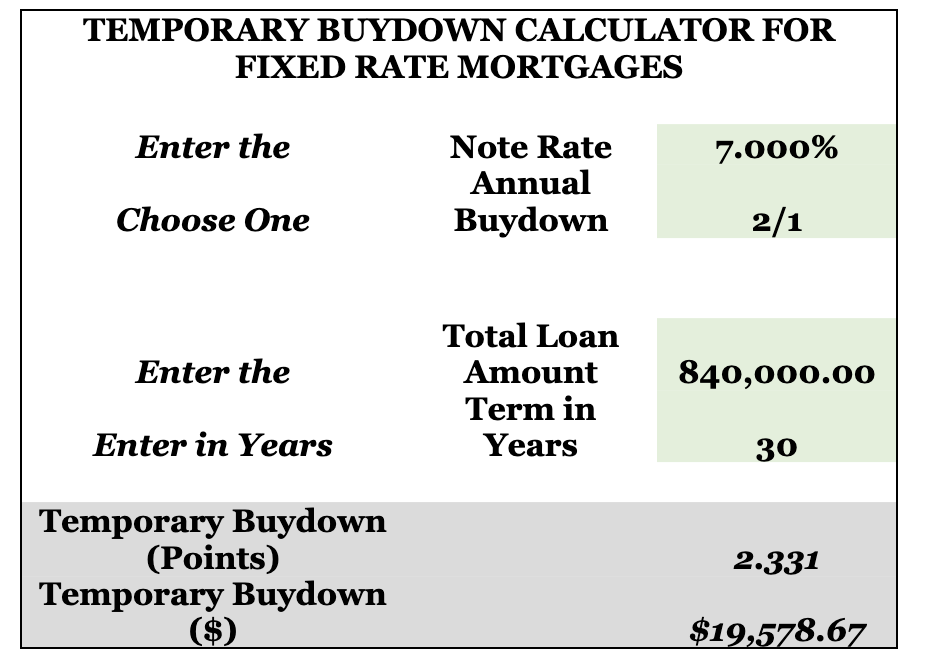

For a Temporary Buydown, the seller typically needs to contribute somewhere in the area of 250 basis points in closing credit, or in lay terms about 2.5% of the home buyer’s loan amount (not the purchase price)! According to Figure 5 below, in this example the seller would need to contribute 233 basis points, or just under $20,000. Correspondingly, it costs the seller the same amount and often even less than a 2% to 5% price reduction on the property. This is generally a win-win strategy for both parties involved in the transaction.

Figure 5: Calculation of the cost to the Seller to provide a Temporary Buydown subsidy for a buyer purchasing a home for $1,050,000 with a 20% down payment.

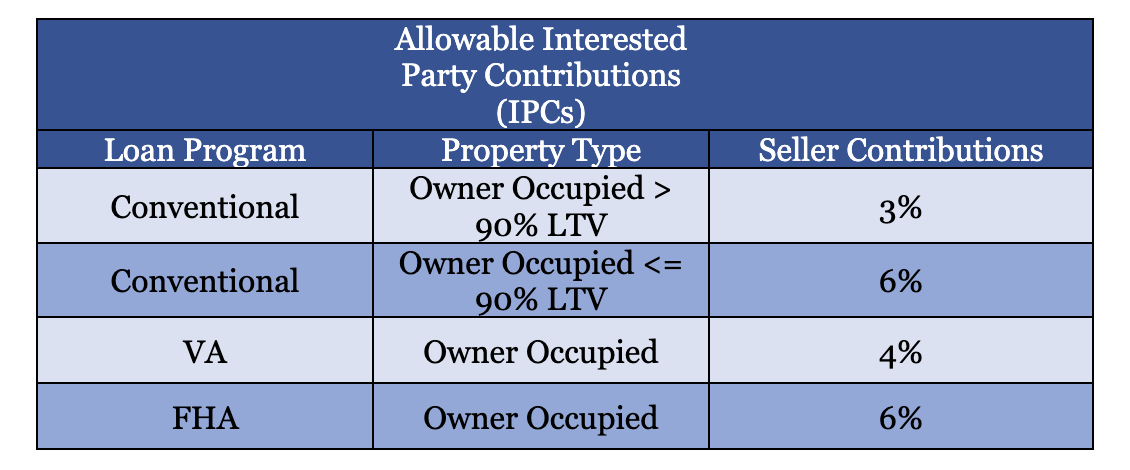

Rules Regarding Seller Contributions

There are different rules and regulations for every loan program. Interested party contributions (seller/realtor/builder) are limited to a percentage of the purchase price. This percentage includes all contributions combined, including rate Buydowns, single premium mortgage insurance, and concessions for repairs or closing costs. Please remember to be aware of these limits before stacking multiple credits into the contract.

How to Move Forward With a 2-1 Buydown Loan

In conclusion, a Temporary Buydown can be a mutually beneficial strategy for both buyers and sellers. It can save buyers money in the short term and make sellers’ listings more attractive. If you’re considering this option, feel free to reach out to me, John Stengel, your local mortgage expert, for a total savings analysis tailored specifically to your wants and needs.

We can talk about your goals for homeownership, and I can explain your options in greater detail. When you’re making such a significant financial decision, it’s crucial to have confidence in your mortgage advisor, so let’s work together to find the best solution for you!

Bonus Tips!

- There is a possibility that you can “double-dip” by permanently buying down the note rate and getting a Temporary Buydown subsidy from the seller, therefore leading to a signficantly reduced interest rate. This is available on a case-by-case basis, so reach out directly to me to see if you qualify.

- Although the 2-year Buydown term is most popularly used, Temporary Buydowns can be used with shorter terms as well. A 1-0 Buydown reduces the interest rate 1% for one year, making it a more affordable option for sellers to finance.

- Specific language is required on a purchase contract to indicate a Temporary Buydown is being utilized. If you are a realtor, or are a buyer who wants your realtor to negotiate a Temporary Buydown, then please reach out directly to me to get accurate contractual wording.

Helping You Harness the Power of 2-1 Buydowns

For further reading, check out the first installment of my series on Buydowns, The Seller Buydown. You can also reach out to me, John Stengel, directly by phone at (808) 490-8343, by email at john.stengel@elementmortgage.com, or by sending me a direct message on Instagram or Facebook @johntheloanranger. I’m a mortgage consultant at Element Mortgage, Hawai’i Life’s preferred lender, and I’m here to help!

With Aloha,

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.