Over the past few years, I have been involved in four real estate deals as a seller in two states outside of Hawaii. The most recent was just a couple of weeks ago. Just to be clear, I was the client and had hired my own local agents to list and sell my properties. Yes, those agents deserve your sympathy as having an out-of-state real estate agent as your client is a bit challenging. This blog was motivated by these challenges.

There are two benefits to my Maui clients that I was recently on the other side of the agent-client relationship. First, it reminded me of what sellers go through during the escrow process, the emotions, the concerns, and the need for updates. It just reinforces all the things I need to do for my clients as I was either grateful when my agent did those things or cranky when they didn’t do those things.

The other benefit is it reminded me how the closing process is so different from state to state. As a Real Estate Broker Licensed in Hawaii, Roy Vandoorn RB-21017, I am totally comfortable with the Hawaii process. When I have first time home buyers or sellers, it is easy to guide them through the process, as they don’t have any previous experiences or expectations. Just as I got frustrated by the difference between what I used to in Hawaii versus that standard operating procedures in those other states, I have seen my out of state clients struggle with the differences, especially by buyer clients. The purpose of this BLOG is to review the process as it is done here in Hawaii after you have gotten an agreed to purchase contract through the closing of the transaction.

Before I go into the details, I would like to thank and acknowledge Reta Chin, AVP, Strategic Business Development, Sales Support with Fidelity National Title & Escrow of Hawaii, based here on Maui, for reviewing this BLOG to ensure all the information is correct.

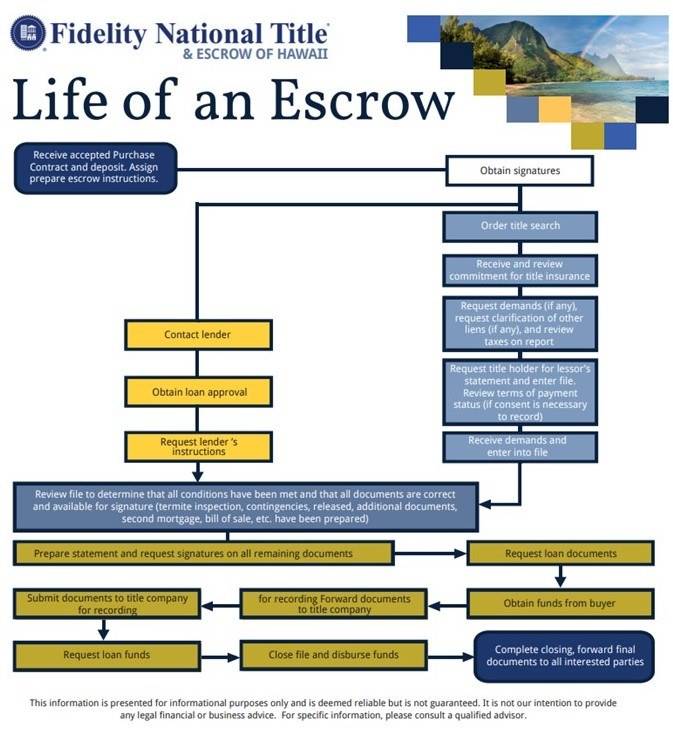

Reta provided me with the following flowchart.

Once the buyer and seller agree to the terms and conditions in the purchase contract, all parties must sign the contract, addenda, and final counter. Once the last signature is obtained, there is an agreed to contract, and the day of the last signature is the “Acceptance Date” upon which most contingencies are based. A few contingencies are written, X days before closing, but most are written as Y days after acceptance.

At this point, escrow is opened upon receipt of the signed purchased agreement by both parties and when the buyer’s initial deposit is received. Typically, the buyer chooses the escrow company and escrow officer. There are some cases where the seller will request a certain escrow company and escrow officer, especially, if that company had done title research and/or assistance prior to when the property was placed on the market. For some of you reading this BLOG, this is already very different than how things are done in your home state. In some states, there is no escrow company or escrow officer, but rather a law firm and an attorney. Having experienced both models as a client, I am personally much more comfortable with having an escrow officer involved because working with a law firm felt like a barrier to communications. Having years of experience working with a seasoned escrow officer who can communicate any/all title or escrow issues throughout the process makes such a difference vs. having limited discussions with a representative of a law firm. Okay, guilty, the escrow company model is what I am more familiar with and hence more comfortable with. If your previous experience is in states with the attorney model, you will most likely see a very different approach with your Hawaii real estate transaction.

Yes, there is still an attorney involved in drafting the deed and possibility some other documents, however, the escrow officer is the only person that typically interfaces with the attorney.

The buyer typically delivers their deposit to escrow, either in the form of a check or a wire transfer, depending upon where the buyer is located. At Hawaii Life and many other Hawaii-based real estate brokerages, agents do not take the deposit check from the client anymore, rather all monies go directly from the client to escrow. This direct path is a safer way to do business. If anything were to happen to the real estate agent between receiving the deposit check and delivering it to escrow, the entire deal could be lost. As a side note, any time you are working with a real estate agent, especially when you are under contract, be sure to find out who your agent’s backup is in the event that you can’t get a hold of your agent. Typically, this is the agent’s Broker (think supervisor in the real world). A Maui agent I know had a medical situation arise, where his survival was in question. This agent’s Broker took over his open transaction and ensured that it closed on time for the agent’s buyer. For me, that is another advantage of working with a company like Hawaii Life where we have the resources in place to ensure your deal closes even if something were to happen to your agent. Another person who plays a crucial role in such an event is the escrow officer. Escrow companies are a neutral third party, and escrow officers take instruction from the principals of the transactions. In the event that one of the agents is no longer able to perform their duties, the escrow officer can assist in the communication process of who will take over to get the transaction closed.

As the flowchart shows, if there is a mortgage involved in the deal, the process around getting and finalizing the loan is done in parallel with the escrow process. This is one example where there needs to be a good cooperative relationship with excellent communication between the mortgage broker, the escrow officer, and the buyer’s agent. A discussion of the entire loan process is left for another day.

Upon opening escrow, the escrow officer will order the preliminary title report. This triggers a title search. What is a “Title Search”? “A review of all recorded documents affecting a specific piece of property to determine the present condition of the title.” This definition was stolen from the Fidelity website with Reta’s permission of course. At this point, we should actually define title. The Hawaii Association of REALTORs has a standard form entitled, Plain Language Addendum. I would recommend that you ask your agent for this form when you either list or write up an offer for a property. This is a great resource and defines a lot of the terms your agent will use. The definition of title in this form is: “Right of ownership to the Property.” Evidence of ownership is typically thought a deed that in Hawaii is recorded with the State Bureau of Conveyance. Many of you are saying, not at the county? No, in Hawaii it is at the state level. The output of the title search is the preliminary title report, which is “A report showing the condition of title before a sale or loan transaction. After completion of the transaction, a title insurance policy is issued.” (Source: Fidelity Web Site). This report will include any recorded document that impacts the property, including easements, liens, encroachment agreements, association documents, and, most importantly will determine if the person(s) selling the property have the right to sell the property. Based on this report, the title company will determine if they will issue a title insurance policy. Title Insurance is “Insurance against loss resulting from defects of title to a specifically described parcel of real property. Defects may run to the fee (chain of title) or to encumbrance.” (Source: Fidelity Web Site). As a buyer, it is extremely important that you review the preliminary title report carefully. Many escrow companies will provide you a preliminary title report with hyper-links to the actually documents, so you can review all the documents yourself. If you have serious concerns about the preliminary title report or the associated documents, this would then be a good time to consult your own real estate attorney.

As you know, Hawaii is an island state. With no disrespect to Lana’i, Moloka’i, and Nihue, there are four main islands, Kaua’i, Oahu, Maui, and Hawaii (aka The Big Island). As previously mentioned, all documents need to be recorded at the Bureau of Conveyances in Honolulu (Oahu). This makes it impossible to sign documents on the closing date. This is a significant difference between Hawaii and some other states. Documents will typically be signed 3 to 5 days prior to closing, and all funds must be received by escrow at least 3 to 5 days prior to closing. I have had clients, where this was explained to them multiple times, including when they made their initial offer that just could not understand why after they signed the closing documents and had given escrow their money that they had to wait 5 days before they could take possession. I kept hearing, every other time I bought real estate, I got the keys when I signed. I said, in Hawaii? They said, no in other states. Since we had discussed this multiple times previously, I just said, “Welcome to Hawaii.”

What is really interesting about this process is that for all practical purposes, about 48 hours prior to the recording date (closing date on the purchase contract), the transaction is impossible to stop. Once the file and documents have been brought down to the Bureau of Conveyances, the day prior to recording, there is no pulling the file. It would be set to record the following day. Hence, the reason that everything needs to be finalized 3 to 5 days prior to the actual closing date.

One super nice thing about the Hawaii process is on the morning of recording, or closing, at 8:01 am or thereabout, escrow will contact both the buyer’s and seller’s agents that everything has been recorded. In my last two transactions outside of Hawaii transactions, I had to wait all day to get word that everything was done. I must say, I am not a good waiter, unless I am holding a fishing pole. Having to wait all day, wondering if the buyers showed up to sign, I found to be very frustrating.

If you are someone that is comfortable with real estate transactions in a state other than Hawaii, here are the takeaways to remember. Hawaii is an escrow state. Hawaii is an island state. Signed documents and funds must be to escrow 3 to 5 days prior to closing. On the closing date, if you are the buyer, you should be able to receive the keys before noon.

Again, Mahalo (thank you) to Reta Chin with Fidelity National Title and Escrow for her assistance.

Jerry Godfrey

December 22, 2020

As I’m closing my first transaction in HI next month I found this very helpful indeed.