Consult with a professional such as an accountant and/or an attorney prior to moving forward with this approach.

Many investors have found peace of mind having the opportunity to “remove their IRA investments from the volatile stock market and put the IRAs to work in a more tangible Property Market.”[i]

There are several types of retirement accounts:

- IRA

- Self-Directed IRA

- 401(k)

- 403(b)

- SEP

- and others

Many retirement custodians do not offer real estate as an investment opportunity within the retirement account. It is customary to have other options such as stocks, bonds, ETFs, mutual funds, etc. It is necessary to work with a custodian that specializes in retirement accounts that own real estate. For the example in this article, the custodian is New Direction Trust Company, with offices in Honolulu, Hawaii, and Louisville, Colorado.

An advantage of having an IRA is it allows the potential for tax deferred growth within the IRA account. As an example, an IRA purchases 100 shares of stock for $90 per share, for a total investment of $9,000. After a period of time, the value of the stock increases to $150 per share, reflecting a total value of $15,000. In the IRA, the $6,000 gain is tax deferred until disbursements are received.

Real Estate Investment Scenario #1

This example shows a hypothetical purchase of a rental property with a purchase price of $548,956. This article will explore the opportunity of purchasing that property within a retirement account.

The property is listed for sale for $567,500.

The property is purchased by an IRA for $548,956.

The name of the owner of the IRA is Joseph N. Maui.

Once Joseph determined the cash flow potential of the subject property, he had his REALTOR draw up a purchase contract. The contract included the name of the Seller, Mary D. Seller, and the Buyer, New Direction IRA, Inc., FBO (for the benefit of) Joseph N. Maui IRA.

The Purchase Contract was checked by Joseph, and on each page, he signed as “Read and Approved.” Then the purchase contract was sent to New Direction Trust Company and was signed by an Authorized Signer of New Direction Trust Company on behalf of the Retirement Account as the Buyer.

The Seller accepted the offer and Title is now in the name of:

New Direction IRA, Inc., FBO Joseph N. Maui IRA.

In the event that the property generates a Net Operating Income of $227,280 for the period of time the property is owned by the IRA, that Net Operating Income is tax deferred until the owner of the IRA receives income or disbursements from the IRA. In addition, if the property is sold at some point in the future, let’s say for a price of approximately $725,000, the profit of approximately 176,044 is not subject to Capital Gains Tax. So the Net Operating Income of $227,280 plus the profit from the sale of approximately $176,044 equals about $403,324 that is able to accumulate in the IRA tax deferred until it is time to receive disbursements. Another option is to take the $403,324 and have the IRA purchase one or two additional properties.

Real Estate Investment Scenario #2

Husband and wife purchase an investment condo for $600,000 with 2 IRAs. There are 2 spouses and 2 IRAs. Each spouse’s IRA invests $300,000 each (50/50) with title as Tenancy in Common.

The rental income is $2,500 per month. Expenses are $1,000 per month for maintenance, taxes, insurance, etc.

Net profit is $1,500 per month, or $18,000 per year Net Operating Income (NOI).

The plan is to hold the property for 5 years, with approximately 5% annual appreciation. Selling in year 5 for $750,000 brings in $150,000 capital Gain with all capital gains taxes deferred. Add to the gain $90,000 NOI over the 5 year period for a total of $240,000 profit that is tax deferred until disbursements are taken. The total of $840,000 divided by the 2 IRA’s equals $420,000 per IRA, minus the original investment of $300,000 equals $120,000 growth in 5 years per IRA.

Another option would be to hold the property indefinitely and have a steady retirement income, raising the rent over time.[ii]

Real Estate Investment Scenario #3

Mary starts work at a new job. She has invested $200,000 in the previous job retirement account, and she rolls this into a new Self Directed IRA (SDIRA) at New Direction Trust Company. Mary is 50 years old and plans to retire in 15 years.

With the $200,000, the new SDIRA invests in a 2 bedroom Fee Simple rental property on Maui.

This property rents for $1,300 per month, and has expenses of $500 per month. Net income is $800 per month, with an annual Net Operating Income of $9,600 per year.

Mary makes annual tax deductible contributions to the IRA in the amount of $7,000 per year. At the end of year 1, Mary has $16,600 that she can reinvest for potential additional growth.

At the end of year 15, Mary has accumulated approximately $249,000 from rental income and tax deductible contributions. Mary decides to hold the first condo and invest in a second condo with the IRA funds from the rent contributions and investments.

Now that she is retired, Mary decides to start taking distributions out of her IRA from the rental income of $1,600 per month.[iii]

THERE ARE RESTRICTIONS TO CONSIDER WHEN PURCHASING

REAL ESTATE IN A RETIREMENT ACCOUNT

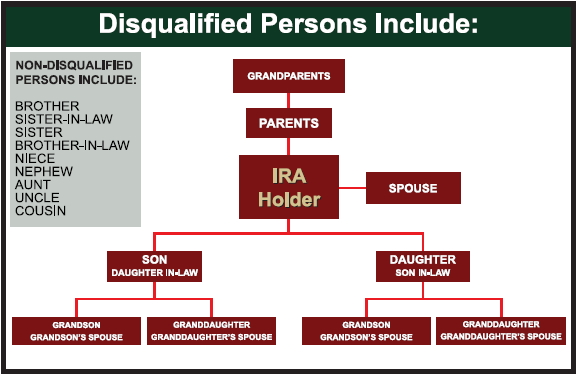

Disqualified Persons and Entities Include:

IRS rules prohibit the IRA from dealing with certain people. Disqualified persons to your plan include:

- You

- Your Spouse

- Your Linear Ascendants (Parents and Grandparents)

- Your Linear Descendants (Children and Grandchildren)

- Your Linear Descendant’s Spouses

- Certain Fiduciaries (CPA’s, Attorneys, Financial Planners, etc.)

- Businesses or Entities Owned or Controlled by Any of the Aforementioned Individuals

- Retirement Plans Held by Disqualified Persons

Prohibited Transactions

The following actions are considered prohibited transactions and could result in the distribution of this asset from your plan. (When you take a distribution from a retirement plan, taxes, penalties, and interest charges may be imposed). Prohibited transactions apply to all disqualified persons to your plan.

- Purchase, sell, or exchange assets with the account

- Yield a commission/fee for the purchase, sale, or exchange of assets

- Rent, occupy, or otherwise use property owned by the account

- Personally execute renovations/repairs on property owned by the account

- Retain account earnings on a personal basis

- Cover account expenses with personal, non-account funds

- Use of your IRA’s assets as collateral for a personal loan

- Use of your IRA’s assets to guarantee credit for a loan on the property

- Buying or selling a property/asset from the place from/to a disqualified person

All expenses for the property are the IRA’s responsibility. Never pay any bills with personal funds. Such payments may be considered prohibited transactions, which could jeopardize the tax-advantaged status of your IRA.[i]

Managing Property Income

There are three ways to manage your property income.

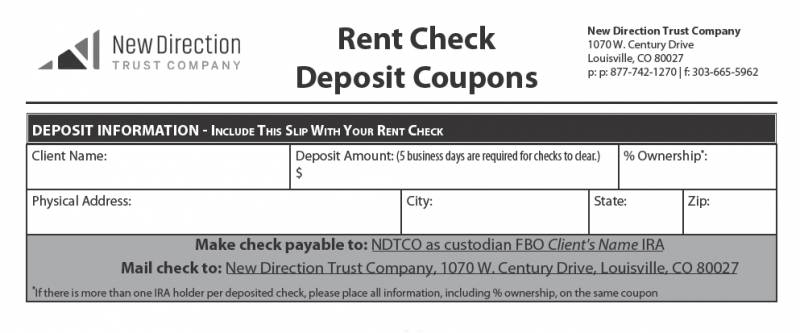

- Submit the tenant’s rent checks to New Direction Trust Company accompanied by a completed deposit coupon.*

* New Direction Trust Company does not notify the IRA holder if a rent payment is not received. PLEASE NOTE: New Direction Trust Company DOES NOT FUNCTION AS YOUR PROPERTY MANAGER.

All income from the property belongs to the Retirement Account. Instruct renters (unless a property manager is depositing these checks to their trust account) to make their rent checks payable to the Retirement Account as follows: NDTCO as custodian FBO Client’s Name IRA.

Income checks cannot be deposited into your Retirement Account that are made payable to you personally. Any such checks will be returned to the renter with correct payee instructions.

- Have the tenant make rent payments online via ACH (eCheck) at mydirection.com by clicking the “Make Payment Now” button.

- Set up automatic rent payments with the tenant using the “Authorization Agreement for Direct Withdrawals” form.

- Hire a property manager of your choice to receive rents and keep records of such.

Managing Property Expenses

There are a couple of ways to manage your property expenses.

- Use the myDirection Online Bill Pay. Request a check to be made out to the utility or property tax, etc. and have it mailed to you (or your manager) and send it in with the invoice that you received.

- Use the Recurring Payment Authorization Letter for HOA dues.

All bills should be set up as “Client Last Name, First Name, IRA c/o New Direction Trust Company.”

Lease Agreements

All agreements that need to be signed require your “Read and Approved” signature in the margins and forwarded to New Direction Trust Company. An authorized signer will sign as the owner on behalf of the IRA.

This article is meant to be an overview of the process of purchasing real estate with a retirement account. Please feel free to contact me to discuss this option further.

ALWAYS CONSULT WITH A PROFESSIONAL SUCH AS AN ACCOUNTANT AND/OR AN ATTORNEY PRIOR TO MOVING FORWARD WITH THIS APPROACH.

For more information regarding Real Estate on Maui, please feel free to contact me!

![]()

Rick

Rick Wyffels, Realtor-Broker, RB-21621

MS, (Master of Science)

RSPS (Resort and Second-Home Property Specialist)

ABR (Accredited Buyer’s Representative)

808-495-6092

RickWyffels@HawaiiLife.com

References

[i] Real Estate Owner’s Guide_2019, Page 11, New Direction Trust Company

[ii] https://www.ndtco.com/home

[iii] New Direction IRA Power Point Presentation “Self-Directed IRAs and more…”

John Dunham

December 1, 2022

Aloha Rick, great article! I have a question regarding the expenses for the real estate that is purchased by an IRA. Are the expenses deductible expenses, such as maintenance, condo/association, dues, real estate, taxes, etc. also can the IRA depreciate the real property?