What Is the Difference Between Prequalification & Preapproval?

Prequalification

Prequalification is when a lender gives you an informal estimate of how much you can borrow, based on your gross income and debts. You won’t necessarily be approved for that amount, but the quick estimate is helpful when you’re shopping around for a mortgage. Requesting a prequalification letter from your lender can result from a quick conversation over the phone and does not require them to pull your credit report. It’s common for listing agents to require Buyers that are financing to submit a prequalification letter prior to scheduling a showing. This requirement helps weave out Buyers that are “just looking,” and limits showings to prequalified buyers that are already positioned to submit an offer.

How Do You Prequalify?

Lenders use two qualifying ratios to determine how much you can afford. The housing ratio and the debt-to-income ratio. Both ratios help determine how much of your gross income can comfortably go toward mortgage payments. Lenders use both ratios to calculate dollar amounts. The lower of the two amounts is considered your maximum monthly mortgage payment. Once lenders know this, they can estimate the maximum loan amount you can borrow.

Housing Ratio

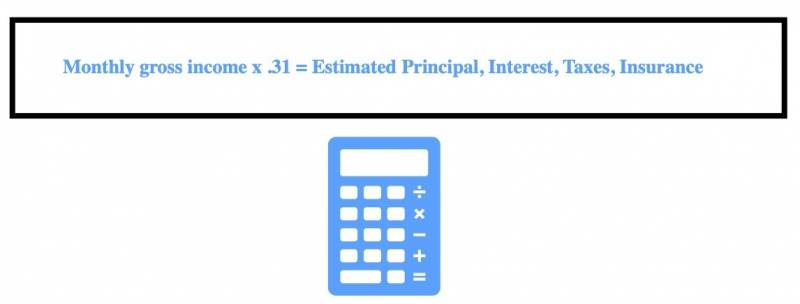

The housing ratio is the maximum percentage of your gross income that you can spend on your mortgage payment. Typically, lenders allow a maximum housing ratio of 31%. Remember that your full mortgage payment consists of principal, interest, taxes, and insurance. Here is a formula to help calculate your monthly payment. This is only a basic estimate of what your payment might be and doesn’t factor in your debts:

Debt-to-income Ratio

The debt-to-income ratio is the percentage of your gross income that you can spend on housing plus debt payments. This ratio varies by loan product, but it’s often in the 41%-43% range. High levels of debt cut into how much you can afford to pay toward your mortgage, which in turn could lower your overall loan amount.

Preapproval

Preapproval comes later when you start seriously looking at homes and have found a specific property that you’re interested in submitting an offer for. A lender agrees to loan you a specific sum based on your actual loan application, as long as you meet certain conditions. Lenders can provide a preapproval letter after reviewing your financials such as tax returns, pay stubs, profit and loss statements, credit report, and debt. A preapproval letter from a lender gives you more negotiating power with sellers because it shows you have the funds to back up your offer.

I encourage my clients to submit a preapproval letter upfront with all financing offers to help them stand out from competing offers. For more information about how to submit a competitive, financing offer contact me.

Example of a Preapproval Letter from Ohana 1st Mortgage

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.