Maui Vacation Rentals: The Rotten Egg or the Golden Goose of Affordable Housing in Maui

I am born and raised here on Maui and have lived here the majority of my life; I care deeply for our island home and the people who reside here. With this, I feel it’s paramount to see affordable housing endeavors (ownership and rentals) become much more omnipresent and readily available to our local citizens. The purpose of this post is to help illuminate a number of important and, oftentimes, contentious discussions, that many on Maui are having about Short Term Vacation Rentals and Affordable Housing on Maui.

In full disclosure, I am heavily involved in the personal investment and representation of legal short term vacation rentals in Maui county. My wife and I own a vacation rental property at the Honua Kai Resort, I have represented hundreds of clients on the sale of short term vacation rentals, and my team also runs a portfolio of legal short term vacation rental offerings here in Maui. See Stice Team Hawaii Life Vacations Portfolio here.

Additionally, I also serve on the board of the Maui Vacation Rental Association, the board of the Hawaii Life Charitable Fund, and the Realtor’s Association of Maui Government Affairs Committee where we work with local politicians to foster the stimulation of affordable housing and other important community endeavors. Also, as I mentioned I live on Maui with my family and want to see a more balanced approach to tourism and our island life that we enjoy.

Like many places around the country, Covid-19 has stimulated extreme levels of real estate activity which has caused prices to reach record levels. In Maui County specifically, our average priced house has eclipsed $1M — nicer homes in non-gated communities in Kahului are trading at this price point in a market demographic that is namely full-time residents (not transient like many south and West Maui communities).

I do want to point out that I think the average figure listed above is a bit misleading — I don’t dispute that homes in Maui are becoming progressively more expensive but that the figure north of $1M is heavily driven up by a massive influx of sales in the multi-million dollar price point where there have been unprecedented levels of liquidity at this echelon. Historically, we have seen a much lower volume of sales at this price point.

I have helped many first-time home buyers in my career and I work with many local families trying to purchase properties here. For first-time home buyers, the process has become almost impossible for many to be successful in, especially if you are looking for a house in good working order. Here on Maui the area median income as compiled by HUD varies by region but is typically between $85,000 to $120,000 for much of the island as of this year.

Vacation Rentals and their effects on Maui Housing and Affordable Housing

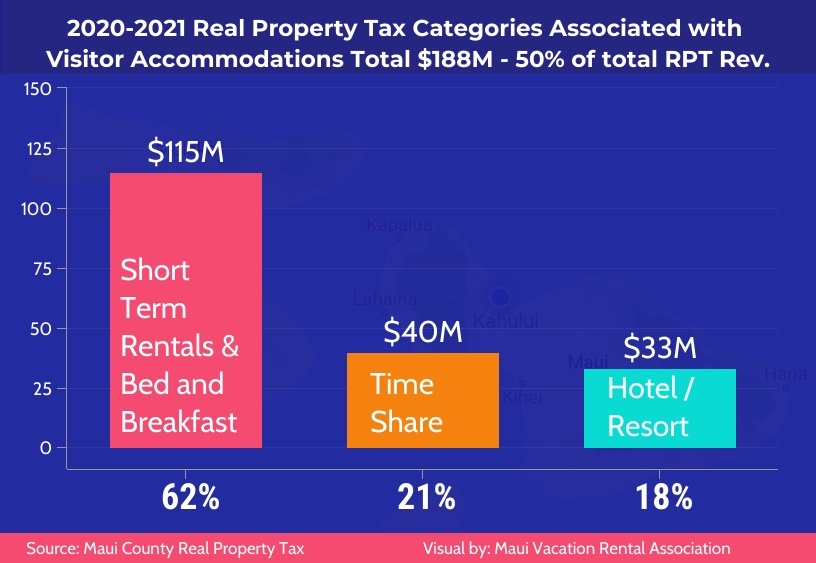

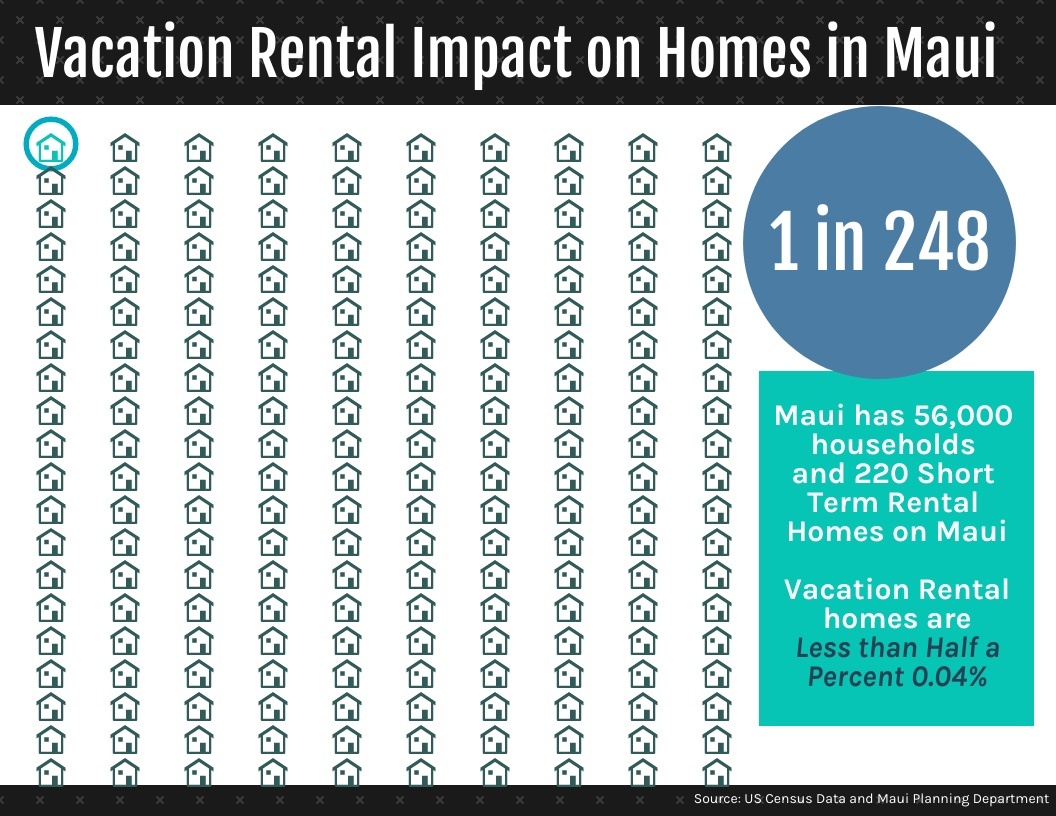

I am disappointed that many vacation rental owners and operators are vilified for “causing” housing to become unaffordable here in Maui County. Because of this, I recently became a board member of the Maui Vacation Rental Association (MVRA.net), not only to better educate myself about the core issues at hand, but also to help share factual information regarding these issues. Currently, the Maui County property tax revenue derived from the vacation rental classification exceeds all of the other classifications combined including but not limited to homeowner, second homes, commercial, Ag, and hotels.

I believe that the majority of the County Council in Maui County have taken a completely unfounded position to curtail vacation rentals under the guise that they inhibit the proliferation of affordable housing. In conjunction with the local community, the MVRA worked diligently to establish our current regulations related to Short Term Rental homes as well as Bed and Breakfast operations. There are already provisions in place for homeowners who reside in close proximity to properties that are in the process of applying for one of these special use permits to state their objections to said operations. Although I support maintaining the status quo related to these ordinances, I have personally provided written testimony objecting to these types of operations which were at one point on the table for homes in close proximity to my own. I feel that we see a lot of nimbyism here in the islands much of which is illogical and not compassionate but this is why we have the process that we do to sort out these issues at a micro and very local level (eg. individual neighborhoods).

I was disappointed to see that the Council recently voted to reduce the caps on each geographic region for short term vacation rentals. Read about this here.

Maui County has consistently taken a position that makes development of housing very unattractive for developers to create, and thus now we are facing an epidemic of many local families having to leave their island home to find housing they can afford. What I don’t quite understand is how the County grants permits to developers who are creating multi-million dollar estates and yet when one of them wants to take on an affordable project, there is massive opposition and the process gets shut down. Much of this has to do with the volume of building and necessary that it takes for affordable housing to be feasible. Nevertheless, massive present-day change is crucial.

Maui County Affordable Housing Plan

On November 9, 2020 the Office of Council Services contracted local nonprofit, Hawaiian Community Assets, to assemble a team that engaged approximately 1,600 community members to identify recommendations and solutions for affordable housing for the County of Maui.

The final plan was presented to the Maui County Council on July 19, 2021.

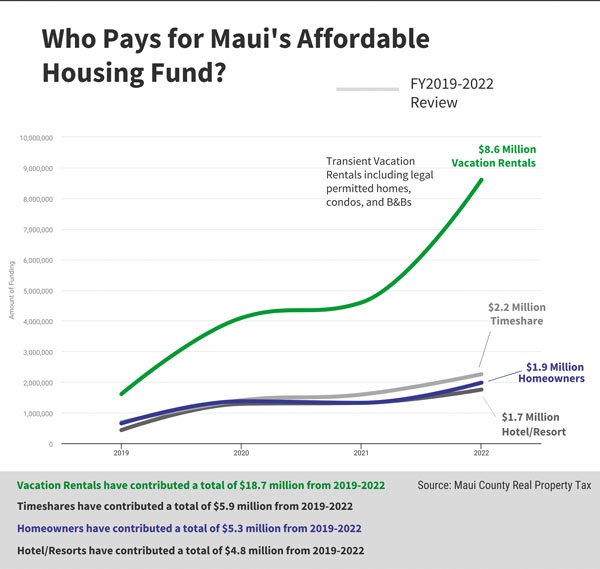

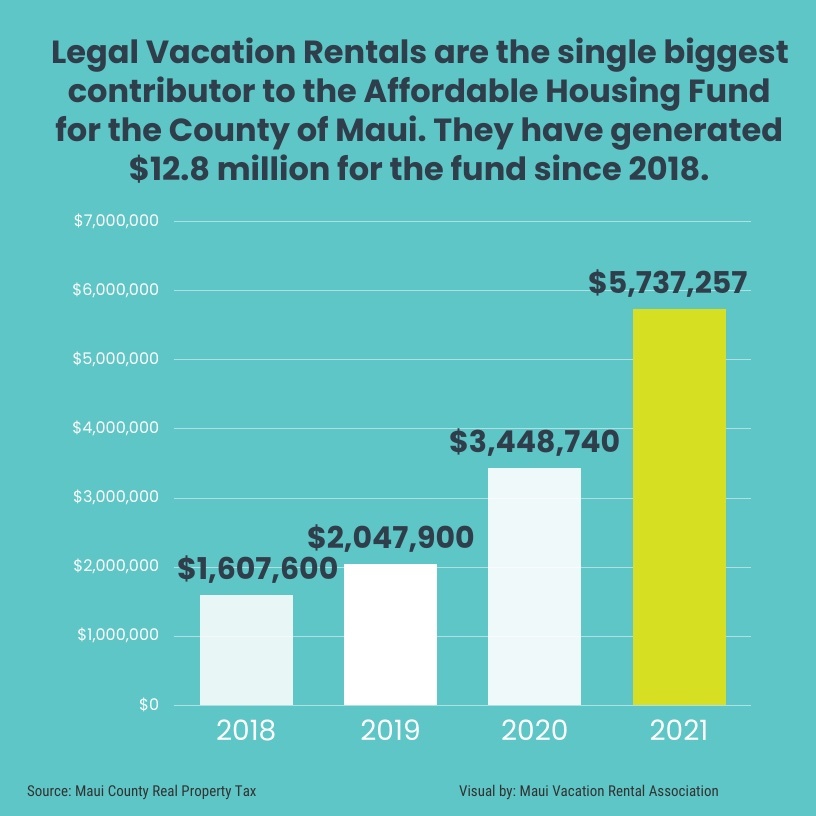

Maui Vacation Rentals – The #1 Financial Supporter of Affordable Housing on Maui

Unlike myself who owns a vacation rental property and lives here on Maui, the vast majority of vacation rental owners do not live here and thus don’t have voting power in our local election process. The short term rental tax classification has seen steady increases in their rates while the hotel rates have dropped drastically namely due to what I believe is a very large unified lobbying power at the state level. Personally, I think it is absolutely ridiculous how little Hotels are paying in property taxes and subsequently contributing to our affordable housing fund.

Our executive director of the MVRA just published the following article in the Maui News in the editorial section: “Vacation Rental Contribute the ost to Maui Affordable Housing Fund.”

While volunteering and serving on the Realtor’s Association of Maui Government Affairs Committee, we adamantly advocate the rights of homeownership. One of our biggest issues that we have been working to help foster is the development of affordable housing. We have been talking about this for 10 years, but smart and affordable growth has been stagnated and we are at epidemic levels of affordability.

It is my opinion that Maui County needs to develop new housing (homes, apartments, mini-homes), continue to develop programs for affordable housing, and to work with developers to ensure that these types of properties are built in a timely yet responsible fashion and that they are kept affordable in perpetuity. I don’t believe that baselessly attacking the vacation rental industry is just or will have any positive effect on homeownership costs in Maui County. The vast majority of Residential homes in Maui County that are legal short term rentals through either a special use permit, a STR license, or a B&B license are higher-end properties that would never be affordable anyway.

New Maui County TVR Phase Out Bill

There is now a new piece of legislation on the table that some current Maui Council members have made about going after a select group of vacation rental condos were initially covered by the Minatoya Opinion and have now been codified into law is also a poorly thought out approach. Many of these condos are aging, are located on or very close to the shoreline (sea level rise), and have very high HOA fees that substantially increase the cost of ownership. How is a local family going to pay $800-1,500 per month in HOA fees for a one or two-bedroom condo on the ocean?

I will touch on this legislation specifically in a later post and illuminate why I think it is bad idea.

It is my opinion that Maui County needs to experience healthy and responsible growth. I personally lived outside of Waikiki on Oahu and that frankly was just overwhelming and is not the kind of growth I would like to see here. I will touch in on a later blog post about responsible development that I would like to see in Maui. Here is a bit more on that front. I encourage you to see and become educated on what Hawaii Community Assets has been doing for our communities. This 501c non-profit group was commissioned by the County of Maui to provide a comprehensive housing study. I believe that they have done a tremendous job with their work and I find it absolutely appalling that the Maui County Council has utterly disregarded their recommendations.

I believe that Maui County needs to streamline the building process onto existing housing, making houses larger or building additional structures as permitted by code.

Additionally, Alaula Builders is currently in the process of developing two different workforce affordable housing projects in Maui right now and I like a lot of things about their vision and the way that they design their properties. I encourage you to see what they are up to here.

Here is a non-profit site that has a lot of great information.

Solutions for Improvement – Maui Property Tax System Needs Tuning Up

Personally, I think that property taxes for primary residences in Maui County are too low and that we should discuss raising them. For those whose property qualifies for the homeowner rate (more than half the year residency and files a state tax return), they are paying the lowest property taxes in all of the US. This same classification and rate in comparison to other counties around the state is a fraction of what other Hawaii citizens are paying. Additionally, I think the county of Maui needs to modify the tiered value system for the homeowner and non-owner occupied classes as well as improve the property assessment tools for property valuations. For example, our home in Kaanapali Coffee Farms which was built in 2018 has a substantially higher assessed value than other older homes in the very same community that have a very similar market value. This is a complete flaw in the system that is leaving a lot of tax revenue on the table.

The current tiers are currently way out of touch with market values with the upper echelon being $1.5M — how does this make sense when your average home is now $1.5M?

I would like to see additional tiers at $3M, $5M, $10M, $15M, and $20M+ and I think this would make a lot of sense and have a positive effect on our island as a whole. Almost anyone who is purchasing a $3M+ home in Maui has at least a couple of homes elsewhere, is often quite wealthy, and can afford to pay higher property taxes here.

I also think that the County needs to do away with Ag classifications for “Gentlemen’s estates,” where growing some palm trees and having a goat allows wealthy homeowners to experience low property taxes while also placing them with a burden for the development of their properties by mandating an Ag Plan on these properties. The majority of these owners really don’t have any interest in doing real Ag. Let’s just change the zoning on many of these lots to Rural as homeowners in high-end communities like Plantation Estates in Kapalua, many of them want to do anyway. This will cut down on all of the administrative efforts to establish an Ag Plan and also substantially raise the tax base for these properties. If an owner is genuinely doing legitimate Ag then they should benefit from this after they go through the necessary steps.

Also, I am going to harp again on Gentlemen’s Ag in the same subdivision that I live in. Why is Kaanapali Land Management paying only hundreds of dollars per year on parcels that are zoned Ag but also have the entitlements to be developed as Gentlemen’s Estates where market values in phase I of Kaanapali Coffee Farms are between $1-1.3M for 5 acre lots?

We have a massive amount of fallow Ag land on Maui, there is no need to erroneously classify properties as Ag — this doesn’t help our local farmers. I contend that it exacerbates the issue and weakens their already very challenging position.

Maui County also made the unwise decision last year to tax anyone who owned a property that had underlying zoning to allow for Vacation Rentals as a complex but was not using it as a vacation rental (not renting the property) at the short term rental rate rather than the Non-owner occupied (second home rate). Not only is this not fair in principle I think it also caused a number of people to either start renting their property out or to sell it to someone who would rent it out. Perhaps this was their intention, but based on other decisions I have seen the council make, I don’t think this was the case.

Reducing the caps will lead to more sales and higher prices. The average price is distorted by a higher volume of more lucrative sales than we have ever seen before.

The politicians want to cater their approach to their voting body but it is my opinion that much of the general public and the politicians need to become better educated on the logical, economic, and lifestyle facets of this decision making.

Airport Beach in North Kaanapali in August of 2020, Covid-19 was a game-changer for our island home.

Hotel Property Taxes and GET/TAT

I believe the hotel industry in Maui County is robbing the island in plain sight with an extremely disproportionate share in contribution for property taxes. Really, why are the hotels contributing so little as a whole when compared to the vacation rentals? The property tax rate for hotels is very close to vacation rentals, but whereas the assessed values for almost every single other category have gone up, hotel property assessments (tax base) have done down drastically. I think this is a clear effort to bail out hotels during Covid and passing the burden to others to carry.

Unfortunately, only 23% of the GET and TAT earned dollars here in Maui are actually returned back to Maui. I have a feeling that the vast majority of it goes to Oahu to fund “black hole” type projects like the Honolulu Rail. There was just recently a bill that was passed to allow the individual counties in the state to enact an additional TAT Surcharge. As of Nov.1, all new short term transient reservations in Maui County will be subject to an additional 3% tax.

A Movement Towards Responsible Tourism

Although I am personally heavily vested in the business of tourism, I do strongly believe that it needs to be managed much better by Maui County as a state as a whole. With visitors not being on island for 9 months out of the year last year, it was a moment of clarity and appreciation for our citizens to enjoy the natural beauty of our islands. Seeing nearly empty beaches, flourishing wildlife, and no traffic was a stark contrast to what we are accustomed to in daily life. I for one am open to discussing ideas on how we can lawfully limit the number of visitors coming into our state and to help develop long-standing programs that will better educate our transient visitors about the delicacies and way of life that we want to see here. With this, I think it is also important for local Maui people to properly care for the land (there are a few very bad apples on this front) and to treat people respectfully provided that the respect is offered on the front end as well.

Thank you for taking the time to read this post. I hope you enjoyed and found value in this article, please feel free to leave me a public comment or reach out to me directly if I can be of service to you. Let’s discuss with Aloha — I encourage you to share your comments publicly here on this blog post but please keep your commentary pono.

Jeremy Stice R(B) at Your Service

As the director of Hawaii Life’s West Maui Vacation Rental portfolio and one of Hawaii Life’s top-selling Brokers, my team and I are here at your service. I was born and raised here in Maui, am a third-generation Realtor, and my wife and I have called West Maui home for the last 10 years and enjoy sharing our passion for it with all who are interested. I make a commitment to pick up my cell phone as best as I can, return voicemails, text messages, and email in a timely fashion. I also work 7 days a week so feel free to call me anytime you need me. However, if I am busy at the time, I will get back to you shortly. I am here at your service, I look forward to sharing my passion and expertise with you. Want to follow my blog via email updates? Please enter it below. This will not be used for any other reason than automatic blog updates that I post. Subscribe to the Jeremy Stice Blog Roll Here

You might also be interested in these past articles:

- Key Amenities of a Succesful Hawaii Vacation Rental Property

- Sapphires to Diamonds – Ranking Maui’s Top Luxury Vacation Rental Properties

- New Hawaii Vacation Rental Loan Program with 20% Down Payment

- 3 Ways to rent and optimize your Hawaii Vacation Rental Property

- How to properly prepare for owning a Hawaii Vacation Rental Property

- 5 Ways to Protect your Hawaii Vacation Rental Investment Property

- Invest in a Hawaii Vacation Rental Property with as Little as 20% Down

- Maui County Publishes Maui County Short-Term Vacation Rental List

- Purchasing a Maui Vacation Rental? 3 Reasons to Call Us First!

- Maui Realtor Interviewing for Your Services Today

- Earn a Part Job in Hawaii by Purchasing a Vacation Rental Property

- Toolkit For Purchasing a Hawaii Vacation Rental Property

- How Technology Facilitates Maui Property Sales via the Internet

- Invest in Maui Property via an Internet Purchase with Jeremy Stice & Hawaii Life

Beth Thoma Robinson, R(B)

October 13, 2021

Definitely a complex issue…thank you for the passion and intelligence you bring to making progress on the Affordable Housing dilemma on Maui. We are going through similar issues on Hawaii Island and as you point out the institutional barriers are the biggest hurdles…the impact of vacation rentals is almost nil as a contributing factor.

Tushar Sarnobat

October 14, 2021

Very well written, unbiased article. Looking forward to read and know more about Maui Life

– wannabe Maui resident

Marcel

October 14, 2021

Very good article Jeremy. I agree with so much of what you said. Vacation rental property owners carry the blame of ‘taking viable long term rentals’ out of the market and making it unaffordable and difficult for locals to find housing. While this is partly true, I believe with the limits that Maui council have put on the numbers of STR, the onus now lies with builders of new housing and owners of other properties being willing to rent long term.

But, I think the Maui County council was trying to ensure that any home on the list of Vacation Rentals was being used as such or lose its’ designation. The homeowner, if they didn’t want to ever use the home/condo as a STR in the future, could always apply to have it changed to a lower ‘second home’ tax rate . Instead, they used it as a STR which helped cover the higher tax costs or sold it to someone who would appreciate the ‘value’ that the designation would carry. No harm, no foul.

At the same time, if there is a secondary accommodation in the home, it could be used as long term rental in the open market once the home was removed from STR.

John E Sink

October 14, 2021

money in Maui and Hawaii is from mainland , China ,and Japan.

Mary Donlevy

October 15, 2021

Very thoughtful and well researched article. The thing I really cannot understand is how a local will be able to afford the high AOAO fees of the STR condominiums. Also, most were not built with enough storage for a family or even a full time couple. And parking is at a premium so I cannot see locals being enticed to buy these units.

LindaM

October 20, 2021

This is a very helpful and well-written article; thank you for that. I have owned a Minatoya List condo for 20 years, the first 10 as ‘second home’ but as property taxes grew high, ten years ago, we put it into STR in the months we are not there. I really appreciated that your article noted that remote owners such as myself, who love Maui and care about its future, have no voting rights or ability to influence events.

If the Minatoya List condo properties are actually restricted by County and lose their ability for STR, their property values would crash. There would be no market for them. As noted, they are not suitable local housing and would not solve any housing issues. Many are financed by local banks. Has anyone considered carefully this aspect?

I for one am going to write my mortgage bank, First Bank of Hawaii, and ask them to lobby against any change. Otherwise, the value they think they are holding will just evaporate.

I wonder, even now, if buyers are able to find financing, with this hanging over that market?

Ron

December 26, 2021

Let’s make Maui’s dreams come true. I no longer visit Maui. After coming for over 40 years. Vacation rentals are a “RIP OFF” Tourists keep the economy moving. We are the goose that lays the golden eggs. The government SCREWS the tourist. HIGH TAXES – DRIVE ON THE ROAD DAILY TAX. I use to pay a fair though high daily rental

Vacation rentals are now recently SCREWING tourists with OUTRAGEOUS RATES. Tourists join me and find other destinations. UNLESS Maui regains it’s sanity. BOYCOT MAUI. BRING PRICES DOWN TO EARTH.

Kelly

June 5, 2022

Thank you for the fantastic article. I first visited Maui 40 years ago when a vacation rental property was not viewed as a major point of contention for Mauians not having access to affordable housing. I don’t recall there being the view that less vacation rentals would equate to more housing opportunities for locals. Most families want to live in single family homes; not the typical, modest or minimal square footage of a condo with outrageous HOA fees (a chronic problem in Maui). I gained this insight from years of visiting extended family who lived, and still live in Maui.

Unfortunately there has been far too little development of single family housing in Maui. I remember the excitement when the newer Wailuku Heights developments started offering lots/homes for sale in the 80s and 90s. Although that area was still out of reach for many Mauians, it provided move up opportunities that then created resales for first time homebuyers. If there has not been another Wailuku Heights expansion, I fail to see how the inventory of STRs could be the cause of that. Maui needs to solve its affordable housing problem… period.

And while I totally understand the concern about overtourism, Maui needs to strike a balance. Without tourism, Maui would lose 40% of its income. Affordable housing and STRs need to co-exist. They are mutually exclusive. Neither is a detriment to the other. They just are.

As for your revelation about the lower taxation rate on hotels, appalling is right. There is absolutely no equity in that disparate approach.

Thanks again.