Whether you’re a new homeowner excitedly stepping into your first property or a seasoned homeowner with decades of cherished memories, the question of your home’s value often looms in your mind.

It’s a curiosity shared by many, and in this blog post, we’ll explore the various ways you can determine the value of your home. Whether you’re considering selling, refinancing, or just want to satisfy your curiosity, understanding the worth of your home is a valuable piece of knowledge.

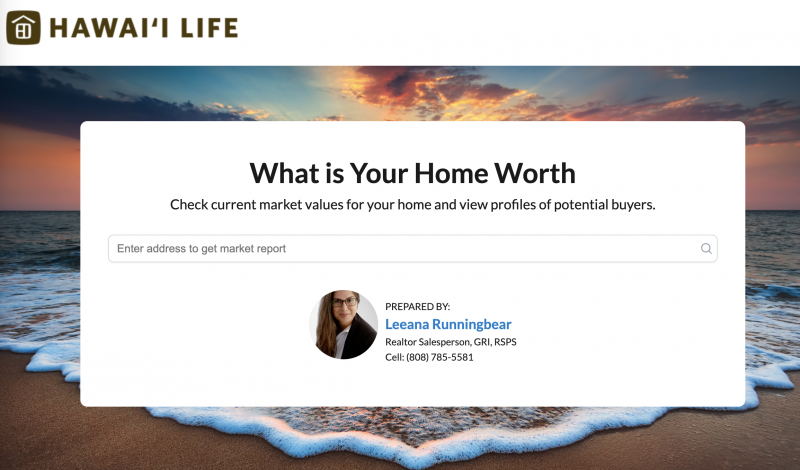

1. The Power of Online Valuation Tools

In the digital age, a plethora of online tools and websites offer free home value estimates. Platforms like Zillow, Redfin, and Realtor.com provide easy-to-use calculators that provide ballpark figures based on publicly available data. While these tools can be a great starting point, they often lack the local context and personalized assessment a real estate professional can provide. Try our New Hawaii Life Evaluation Tool!

2. Consult a Real Estate Agent

One of the most accurate ways to determine your home’s value is by consulting a local real estate agent. They possess in-depth knowledge of the local market, recent sales, and the specific factors that influence property values in your area. Real estate agents can provide a Comparative Market Analysis (CMA), which compares your property to recently sold homes with similar characteristics.

3. Consider a Professional Appraisal

A professional appraisal may be the way to go if you’re looking for a precise value, especially for refinancing or legal purposes. Licensed appraisers assess your home’s value by thoroughly examining the property, including its condition, features, and recent comparable sales in your area.

4. Local Real Estate Sales Data

Keep an eye on the sale prices of homes in your neighborhood or similar areas. This can provide valuable insights into the current market conditions and give you a rough estimate of your home’s value. Your local assessor’s office and county records may also have information on recent property sales.

5. Home Improvements and Updates

Consider the improvements and updates you’ve made to your home since your purchase. Renovations, additions, and upgrades can significantly impact your property’s value. Document these changes and their associated costs to provide a clearer picture of your home’s worth.

6. Track Market Trends

Stay informed about broader real estate market trends, including interest rates, economic conditions, and housing supply and demand in your area. These factors can indirectly affect your home’s value.

7. Understand the Purpose

Consider why you want to know your home’s value. Are you planning to sell, refinance, or simply curious? Understanding the purpose behind your valuation can help you choose the most appropriate method.

Determining the value of your home can be an exciting and informative process. Whether you’re exploring potential selling options, refinancing, or just satisfying your curiosity, various methods are available to help you estimate your home’s worth.

While online tools offer convenience, consulting with a local real estate agent or obtaining a professional appraisal can provide a more accurate assessment tailored to your circumstances. In any case, understanding your home’s value is valuable knowledge that can guide your future financial decisions.

With Aloha,

Leeana

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.