Recently I closed a transaction where the Buyer was able to secure seller financing for vacant land on Maui. Sounds pretty straightforward in concept, but very recently the whole process was threatened by legislation designed to protect consumers. (For a great thorough read on how that went down – check out Tim Stice’s Blog Article). Suffice it to say that with the signing of Act 225-15, seller financing is once again a legal possibility for Buyers and Sellers.

Why Seller Financing?

In some cases, well qualified borrowers may not look good to a bank. Take, for example, a real estate investor whose primary source of income is capital gains from buying and selling property. Lenders will typically not include “gains” as income. So this borrower will be considered high risk. Similarly, a Seller who doesn’t need to cash out entirely will likely find the interest rate on seller financing appealing. (Certainly a 5% rate of return is better than many investments.)

So How Does it Work?

Historically in Hawaii, many deals were struck via an “Agreement of Sale,” which is a document recorded at the Bureau of Conveyances at closing that outlines a payment structure (typically monthly) and a timeline for the payback. At the conclusion of the payments stipulated in the agreement, title transfers to the Buyer.

Today we typically opt for a “Purchase Money Mortgage,” which is a Mortgage and Note very similar to what you would have with a large bank or mortgage lender. In this case, the Mortgagor is the Buyer and the Mortgagee is the Seller. Here’s a typical timeline on the process:

- 1st step: Agreement on terms between Buyer and Seller via the Purchase Money Mortgage Addendum

- 2nd step: Escrow hires an attorney to draw up the Mortgage and Note

- 3rd step: Close Escrow! Easy.

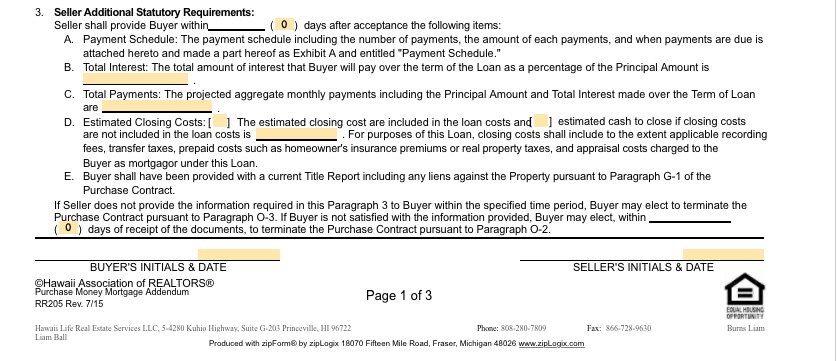

Revisions to the Purchase Money Mortgage Addendum

In order to comply with the new regulations outlined in the SAFE act (and amendments) the Hawaii Association of Realtors has revised the Purchase Money Mortgage Addendum (hereafter referred to as the PMM Addendum) adding language for compliance. Below is a sample of the Statutory additions to the PMM Addendum which are mostly Consumer Protections. This link will take you to a blank PMM Addendum.

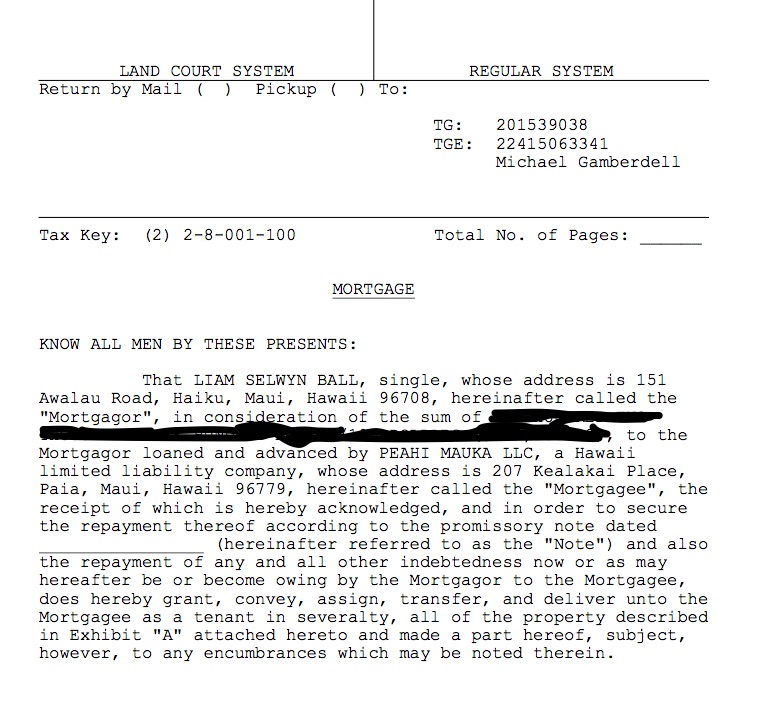

Mortgage and Note Drawn up by an Attorney

In this case, the well esteemed local firm of Mancini, Welch, and Geiger LLC was hired to draw up the Mortgage and Note. Here’s a sample of the Mortgage Document:

Step 3: Closing! – Get Planting, or Get Building!

I’m happy to say that the lucky Buyer who benefited from Seller Financing in this story is ME! Cheers from Burns Road!

– Liam S. Ball, R(B)

808.280.7809

liamball@hawaiilife.com

Julie Keller, RS

December 21, 2015

Great Info, thanks Liam!

Julie Keller, RS

December 21, 2015

Great Info, thanks Liam!

Liam

December 22, 2015

Thanks Julie! Glad I pulled it off for myself as my own client! Ha.

Liam

December 22, 2015

Thanks Julie! Glad I pulled it off for myself as my own client! Ha.