Hawaii County Transient Accommodation Rental Bill in 4th Draft

If this is the first post you are reading about proposed Hawaii County regulation of Transient Accommodation Rentals (TAR), or hosted short-term vacation rentals, you might want to start your education with these two previous posts:

- Hawaii County Council members first draft code amendments for hosted vacation rentals

- Third draft and more information on the Transient Accommodation Rental bill. This post covers most of the substantive changes ahead, including the registration process and the consequences for real property tax assessment of homeowners registering their onsite vacation rentals.

While many owners have joined forces in opposition, as have our island Realtor associations, some version of regulation of hosted rentals is inevitable. State statute has restrictions on these rentals, which Hawaiʻi County (the Big Island) has not monitored nor policed in the past. Sentiment towards short-term rentals in residential neighborhoods and agricultural areas has changed from leniency to alarm across Hawaiʻi, as non-resort lodging proliferated with the advent of platforms such as Airbnb and vrbo.com. Hawaiʻi County is the last of the countyʻs to pass code changes (for other county information, our Hawaiʻi Life website has plenty of relevant articles).

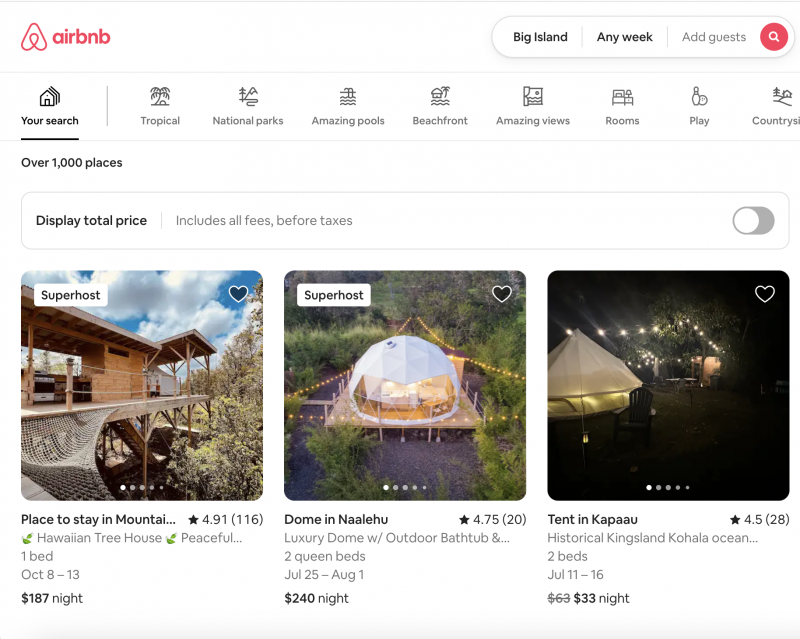

Airbnb shows over 1,000 hosts on the Big Island. How many will qualify to register under pending changes?

Whatʻs Changed in the Fourth Draft of the Big Island Transient Accommodation Rental Bill

The third draft was published in January 2023; after five months of gathering feedback, consulting with attorneys for the County, and comparing with relevant Hawaiʻi State statutes, the fourth draft has some changes that merely tighten up language, as well as a few changes in substance.

Although both the third and fourth drafts have certain changes from the original bill that attempt to make the schedule of fees more progressive, once registration begins the costs of running a hosted vacation rental on the Big Island will increase. Here is a list of the new costs:

- Initial registration fee. Currently $500 for hosted (versus $1000 for new unhosted rental properties)

- Annual renewal fee. This is now a tiered structure based on the number of bedrooms rented and assessed property value. In other words, the assumption is that smaller, less valuable properties are charging less and the annual renewal fee is tiered to not unfairly burden them. The proposed annual fee is only $50 for a property valued under $500,000 but $150 for a property valued over $1,000,000.

- Non-conforming use certificate. If the property that has been operating as a hosted vacation rental is not in one of the zoning districts where it is allowable, it can potentially be “grandfathered in” by applying for a non-conforming use certificate. It costs $250 to apply and $250/year to renew, in the current bill.

- Foregone property tax benefits available to homeowners. If a property in Hawaiʻi County is your principal residence (meaning you occupy it as your “true, fixed and permanent home” and you file a Hawaiʻi state income tax return declaring residency here), you would normally benefit on property taxes in two ways. One is in the rate, and the other is the assessed value to which the rate is applied. Per the Property Tax website the residential rate is currently $11.50/$1,000 in assessed value for up to $2 million in value; the homeowner rate is only $6.15/$1,000. In addition, homeowners qualify for a exemption (reduction against assessed value), amount depending on homeownerʻs age. The Property Tax Division rules, as laid out in this draft, specify that if any portion of the home is rented, the homeowner rate does not apply. The exemption can be taken in proportion to the portion of the home occupied for use as the principal residence. This could be an additional cost to the homeowner of thousands of dollars a year.

To download a copy of the latest version, go to HawaiiCountyTar.com.

Tips for Prospective Buyers Hoping to Operate a Vacation Rental in their Big Island Home

While it is not certain whether the current specifics of the proposed regulations will be the final ones, there are some takeaways if you are currently in the market for a new home on the Big Island and part of your plan is to rent a room or guest quarters or an ʻohana unit for visitors on a short term basis. Here are the top four considerations I recommend to my buyers:

- Pick a home that has final building permits and a septic or sewer for wastewater. Although the current version of the bill has changed language from requiring final permits to requiring an affidavit on health, safety and code, better to be safe than sorry. Renting might also require that you change from cesspool to septic sooner than otherwise required – and thatʻs a whole other level of expense.

- Make sure you have adequate off-street parking. You will have to submit a site plan with your permit application.

- Make sure your intended rental does not violate state law or county code on agricultural district farm dwellings. The draft regulations say if the home or unit was built with a restriction that its use be related to agricultural activity, it will not qualify for a TAR permit.

- Run the profit and loss numbers. While this might seem like an attractive source of income, there are costs. Research rental rates on one of the platforms and then calculate your costs of registration and property tax consequences.

Stay tuned for more on this important topic. And please consider a long-term rental for that second dwelling on your property. Our communities need them desperately, property tax implications are better, and you might just make your first friends in the neighborhood!

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.