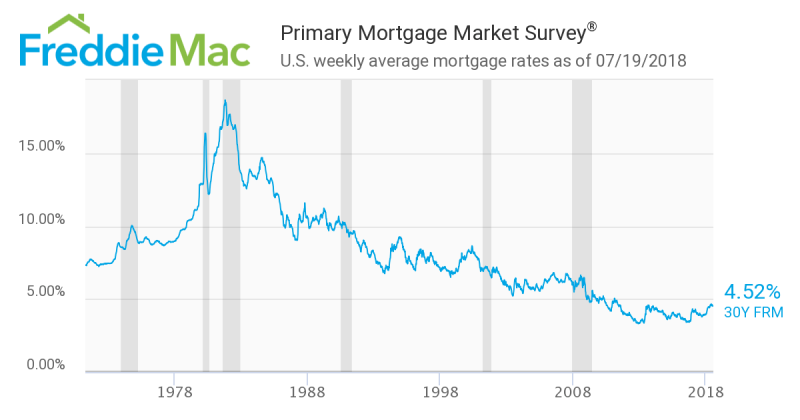

This 40 year graph of mortgage rates recently came across my desk and it prompted me to share a few thoughts about how the current mortgage rate might be trending and what it might mean for you as a potential buyer of real estate in Hawaii.

I remember the high inflationary times of the early ’80s and this graph reminded me that we have been experiencing an unprecedented and exceptional period of low mortgage interest rates. But, can we expect it to continue?

A helpful article by J.B. Maverick on the website Investopedia about the factors that affect mortgage rates can be found here. This blog post is my summary of the Maverick article plus my own research of the latest data and figures.

There are a variety of factors which influence mortgage rates: the overall housing market, economic growth, inflation, and the Federal Reserve Bank monetary policies.

The Overall Housing Market and the Economy

The overall housing market and the general economy affect mortgage rates in several ways. In a period of high economic growth, higher consumer spending includes more people purchasing real estate. More demand for mortgages will push mortgage rates higher because lenders only have so much money available to lend. A sluggish economy or a lack of supply of homes on the market can create less demand for mortgages and can push mortgage rates lower. Housing observers have seen an interesting new trend of more home renters and fewer buyers. This trend could keep mortgage demands lower and add to the pressure to keep mortgage rates low.

Inflation

Inflation is another important factor for mortgage lenders. Inflation erodes the purchasing power of dollars over time. Mortgage rates on a loan have to overcome the erosion of purchasing power through inflation to ensure that the lender sees a profit, so higher inflation will mean a rise in mortgage interest rates. And in fact, inflation has been rising over the past 2 ½ years.

“Historic Inflation United States – CPI Inflation.”

The Bond Market and the Federal Reserve

If you’re trying to forecast what 30-year fixed-rate mortgage interest rates will do in the future, you should watch the yield on the U.S. Treasury 10-year bond and follow what the market is saying about Federal Reserve monetary policy.

The general trend in the bond market also has an effect on mortgage rates. Mortgage backed securities have to be poised to attract buyers and must be competitive within the overall bond market.

The Federal Reserve Bank does not set mortgage rates, but their monetary policies are one of the most important factors influencing mortgage rates. The Fed has clearly and openly stated their intent to gradually keep raising interest rates, yet investors are behaving as if they don’t believe that the Fed will continue to raise rates for much longer.

You, the Buyer

So, what does this mean for you in terms of mortgage interest rates? Well, as always, every individual has their own unique situation and needs, but generally speaking, the 30 year mortgage interest rate has been dancing around 4% for the last 9 years and is a bit above 4.5% now. Certain indicators suggest rates will be rising, and a few general trends might help hold mortgage rates lower. I think that if you are looking to purchase using a mortgage, trying to time the rates to obtain a couple of fractions of a percentage point in your favor is probably ill-advised. The time to purchase is when you have found the property that suits you.

Contact me today to help you find your perfect place.

Sources:

Maverick, J.B. “The Most Important Factors That Affect Mortgage Rates.” Investopedia, Investopedia, 6 June 2018, www.investopedia.com/mortgage/mortgage-rates/factors-affect-mortgage-rates/.

Coppola, Frances. “The Flattening Treasury Yield Curve Indicates Trouble Ahead.” Forbes, Forbes Magazine, 19 July 2018, http://www.forbes.com/sites/ francescoppola/2018/07/19/ the-flattening-treasury-yield-curve-indicates-trouble-ahead

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.