VA Home Loan Myths & Facts

Am I VA Eligible?

- VA loans are not only for veterans. Active Duty members and Guard/Reserve members with at least 90 days of active duty (since 8/2/1990) are also eligible.

- For Guard/Reserve members (prior to 8/2/1990), 6 credible years of service or at least 90 days of non-training active-duty service will make you eligible.

- It is best to check with a loan officer who can get you the certificate of eligibility (COE) from the VA. This will

ENSURE your VA loan eligibility. If you need a referral to a trusted VA lender please reach out to me!

Do I have to pay Mortgage Insurance (PMI)?

- Mortgage Insurance is not required for a VA loan, even with 100% financing.

- PMI is prohibited for a VA loan, regardless of the borrower’s credit score, debt-to-income ratio or payment history.

Do I have to pay a VA Funding Fee (FF)?

- Because the VA doesn’t collect PMI, it needs to cover the cost of insuring VA loans in another way. Therefore, the VA charges a funding fee at closing.

- The VA funding fee will be dependent on first use or consecutive use and % of down payment. Luckily, most lenders allow the borrower to roll it into the loan, meaning there is no need to pay for the funding fee at closing.

- For 100% financing, the first-time user will be charged 2.3% of the loan amount and consecutive use will require a 3.6% charge. In either case, a down payment of between 5% to 10% will reduce the charge to 1.65%. A down payment of 10% or more will decrease the charge to 1.4%.

Can I get a Funding Fee Waiver?

- The Funding Fee will be waived if:

- You are a Purple Heart recipient

- If you receive or are confirmed to receive VA disability benefit

- You are a surviving spouse. If your spouse died from a service-connected disability or if your spouse died during active military service

- You receive retirement pay instead of VA disability compensation

Can you pay off a VA loan early without pre-payment penalties?

- VA loans have NO prepayment penalties. You can pay off your VA mortgage early or make additional payments without worry of being penalized financially. Below are some examples of how prepaying your loan can save you a ton of money:

- Making one extra mortgage payment each year would reduce the life of your loan significantly. If one extra payment all at once is too much the most economical on your bank account is to pay about 8% extra each month. For instance, by paying $1296 each month on a $1200 mortgage payment, you’ll have paid the equivalent of an extra payment by the end of the year.

- If you have a $400,000 mortgage with a 30-year term and pay 4% interest, one extra payment each year can reduce your mortgage by 4 years and save you more than $40,000 in interest.

Can I have more than one VA loan & can I use it more than once?

- Most people think that because they already purchased a home with their VA loan that they cannot use it again until the home is resold. Thankfully, this is not true. Here in Hawaii the County limit is $800,000. This means that if the home that you already purchased in another state using a VA loan has a loan balance of $200,000 then you still have $600,000 of your VA loan to use to purchase a second home.

- If you would like to purchase a home that cost more than what you have left to use ($600,000 in this case), you will generally need to pay a 25% down payment on the difference. So, if the home you want is $400,000 more than the eligibility you have left you would need a $100,000 down payment.

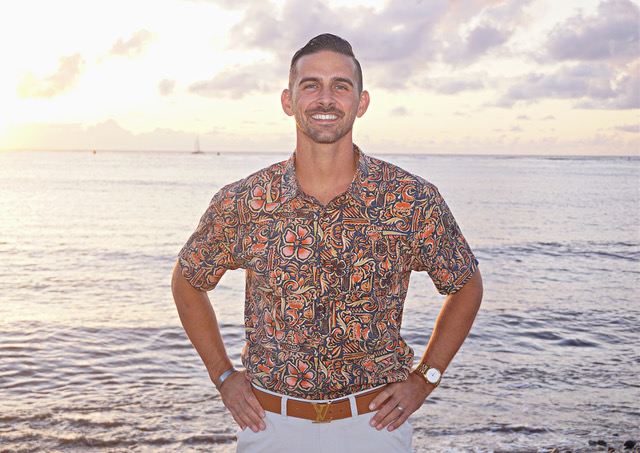

The home buying process is demanding enough for most people, so hopefully this bit of VA loan education will help to alleviate unnecessary confusion. It is true that any real estate agent and mortgage lender/broker can help you to purchase a home. Remember, an agent familiar with the VA loan process and military is ideal when starting the home searching process. If you would like to work with a real estate broker that has an amazing team of VA lenders, has personally PCS’d 6 times, and has personally used a VA loan then look no further! I have had the privilege of helping more than 70 VA families buy homes over the past four years. I hope that you will trust me to help yours!

MAHALO!

Joe Hanley with Hawaii Life Real Estate Brokers

Military Relocation Professional

(808) 861-6783 or [email protected]

www.joehanleyrealtor.com

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.