As I reported six months ago, in 2020 the Hawaii County Council implemented a new property tax designation that assesses a surcharge on luxury properties. While this affected only an estimated 935 properties out of some 140,000 Big Island homes, they were concentrated on the west side of the island, primarily within or near the Kona and Kohala Coast Resorts where I do most of my business.

The funds raised are a proverbial drop in the bucket in the context of the County Budget, but the idea was a popular one with island voters, very few of whom would be affected. At the time, one in three residents was unemployed, and yet the number of out-of-town license plates on expensive vehicles driving our roads seemed to be growing exponentially — both pandemic-related phenomena.

As the 2021 County Council opens, one of the first bills introduced is attempting to correct for the effects that fall under the Law of Unintended Consequences…although if the council members had been listening carefully the negative consequence might not have been so unforeseen. I volunteer on the development committee for my beloved Kahilu Theatre, and learned late last year that some of our faithful donors had cut back their giving to Hawaii Island organizations in response to the property tax increases.

My debut running a live fundraising auction prior to a Kahilu Gold concert at a Mauna Lani luxury residence in early 2020.

Bill 18 would give luxury home owners an option: pay the amount of the tax surcharge as property taxes, or donate it directly to County-sponsored initiatives addressing homelessness, or to federally recognized 501(c)(3) non-profit organizations that benefit Hawaii County residents.

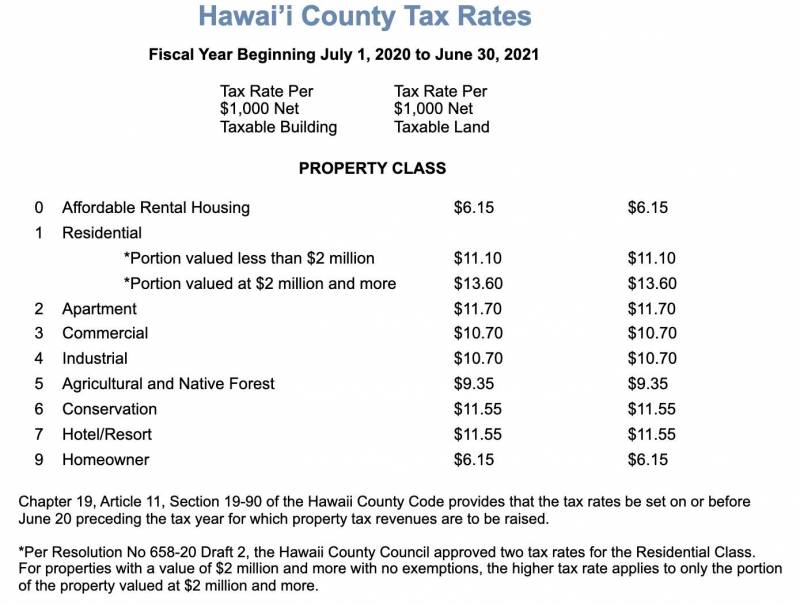

Current Effect of the 2020-2021 Hawaii County Property Tax Structure

The property tax year for Hawaii County (the “Big Island”) begins on July 1, and the luxury residential surcharge was built into tax bills starting July 1, 2020 as follows:

Note that unlike your federal income tax brackets, moving into the next bracket does not increase the tax rate applicable to your entire assessed valuation. Rather, the portion valued at $2 million or more is taxed at an additional $2.50/$1,000 value.

Just out of curiosity I searched for all active residential (not condo) listings with an assessed value of $2 million or more. There are currently 57 such listings with asking prices from $2,450,000 for a residence on 10 acres at Puakea Bay Ranch to $24,000,000 for a 7,608 sq ft home at Kukio.

|

Letʻs take an example at around the median list price and see what effect the new property tax structure would have on the seller and buyerʻs tax bill. If the County assessed the property at sales price of $6.4 million, the new property tax rates imply an annual bill of $83,400 versus $74,880 under the old structure. The difference of $8,520 could be donated to a non-profit rather than paid as property tax.

Surfer walking past anchialine ponds towards the ocean, viewed from poolside at Naupaka Place home for sale $6,795,000

Would homeowners actually remember to instruct their accountants to make the appropriate submissions to designate a portion of their charitable contributions as their offset to property taxes? Would it result in an actual increase in donations to local organizations rather than just a reduction in the amount the County collects, given that many of these homeowners already give generously to Hawaii Island organizations?

The economist I once was will enjoy seeing the data on the off chance this bill actually passes.

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.