Real Estate is all about preparation, having a strategy/road plan map, and having persistence and lots of patience. One of the most crucial parts of buying a home or condo is understanding the basics of the loan process and your purchasing ability. Understanding the loan process ensures you are happier, calmer, and will give you a better chance of owning your dream home.

Preparation for Getting a Mortgage

A crucial step in buying a property is deciding on a reputable mortgage lender. If you are going to use a mortgage lender and are competing in today’s seller market, it helps to have an excellent cash deposit. This will help you compete if there are multiple offers on one home.

Finding a dependable lender that knows the area, subdivision, and lava zones will ensure your loan process goes smoothly. The best suggestion I can give you about selecting a lender is to ask your real estate agent whom they recommend. Real estate agents work with lenders every day and know who the good and great mortgage lenders are.

Roadmap to Pre-Approval

A question I often get asked is: “What the difference between a pre-qualification letter and a pre-approval?”

A pre-approval letter is when you provide income documentation to the lender, for example, your tax returns. Some good documents to provide are:

- Paystubs (past 30 days)

- W-2s (2 most recent)

- Tax Returns (2 most recent)

- Other financial statements (Checking, Saving, 401K, IRA, Life Insurance, etc.)

- Additional Documents if self-employed

The lender reviews the financial documents and your income. They then determine the amount you are qualified to borrow for a home. A pre-qualification letter is provided without income or financial documentation.

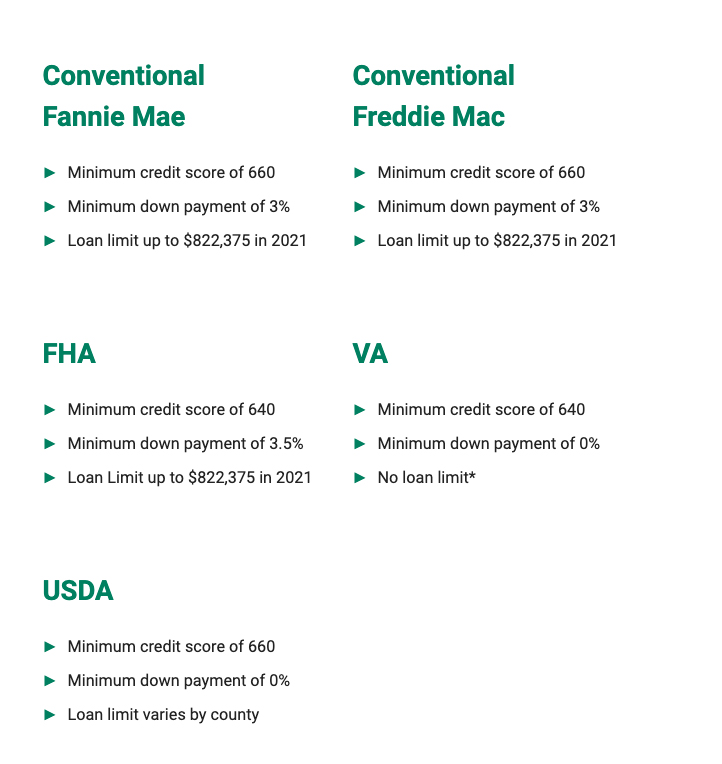

Loan Types & Requirements

Another question I am frequently asked is: “What is the required cash down payment required by the lender?” See below…

This information has been provided with the help of Shinichi Matsumoto, a loan officer with CrossCountry Mortgage here on the Big Island. Shinichi is excellent to work with and very detailed oriented. You can also reach out to him directly with your questions at: [email protected] or 808-365-5900

West Hawaii Real Estate Specialist

Working with a real estate agent who knows the community’s pros and cons will help you feel more confident with your real estate decisions. As a full-time real estate agent, I bring professionalism and honesty to all my clients. I utilize technology and marketing to the fullest while maintaining strong communication. I enjoy helping clients clarify their housing and investment needs with the hope of helping them make their dreams come true. Plus we have fun along the way!

If you are curious about Real Estate on the Big Island or need a great lender to work with, I welcome the opportunity to connect with you.

With aloha,

Leeana

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.