Should You Purchase a Long-Term Rental or Short-Term Rental Property?

Are you considering whether to purchase a short-term or long-term rental property on Maui? Both options allow for pass-through income to pay for what has historically been an appreciating asset while building equity. Both options also give owners a place to vacation on Maui. Check out the pros and cons of each to find out which option is the best fit for you.

Just listed, Kihei Shores #E306 is a 3bed/2bath top floor condo located across the street from the beach in sunny South Kihei.

What’s The Difference?

In Maui County, a short-term rental is a room, apartment, house, condominium, beach house, hotel room, suite, or similar living accommodation rented to a guest for less than 180 consecutive days. Short-term Rental properties must be permitted and licensed. A long-term rental allows tenancy for a minimum of 180 consecutive days, requiring an initial six-month lease that can then be extended month to month.

Owner Stays

Property owners can stay in their long-term rental property less frequently, between six month lease periods. Owners can stay in short-term rental properties on demand by simply blocking their reservation calendar in advance. It’s always a good idea to check on any limitations or fees a property management company may impose for Owner Stays. Hawaii Life Vacations property management does not limit Owner stays, nor do they charge for Owner stays.

Rental Rates

There is a limited supply of long-term rental housing on Maui and increasing demand. The effect of this low supply and high demand results in increasing market rental rates that can help pay for monthly carrying costs and possibly even generate income for a long-term rental property.

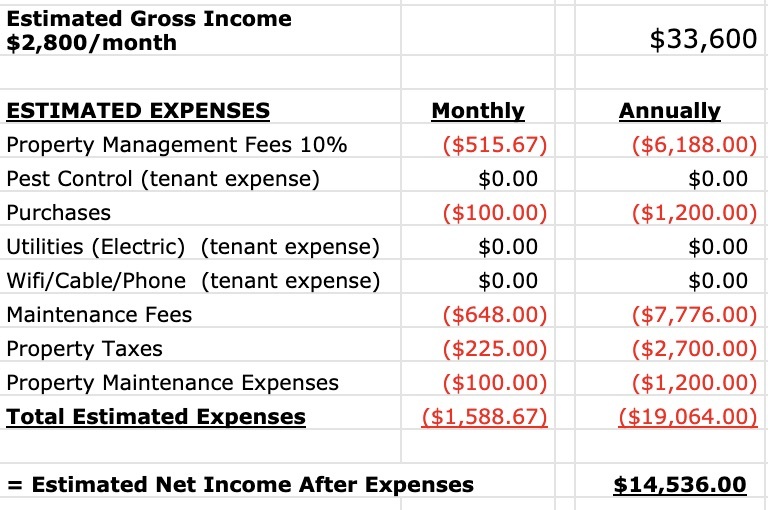

For example, Kihei Shores E306 (MLS #386275), a completely remodeled 3 bed / 2 bath condo in South Kihei, was previously renting for $2,800 per month as a long-term rental. With tenants paying for their own utilities, the property generated just under $15,000 per year after operating expenses, not including principle and interest on a financed purchase.

Operating Expenses

Long-term rental properties have lower operating expenses when tenants are required to pay for their own utilities such as electricity, wifi/cable, trash, and landscaping service. This reduces a property owner’s carrying costs to property taxes, Homeowners Association/Maintenance Fees, and principle and interest on a mortgage if they financed the purchase.

Property Management Fees & Services

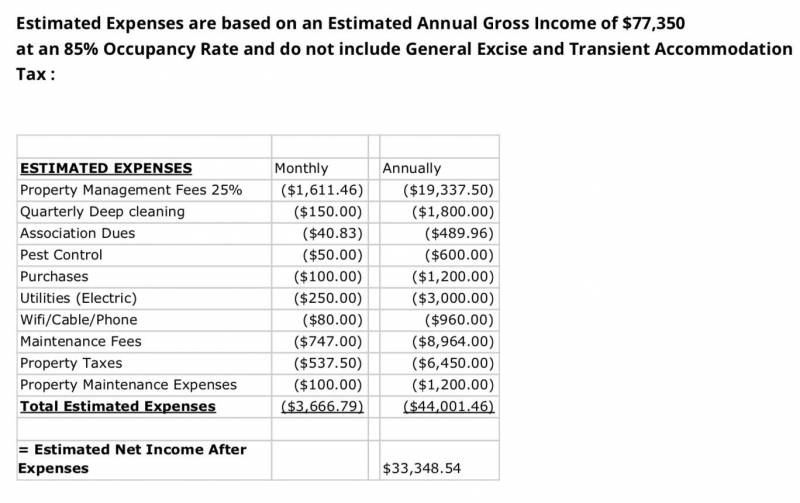

The State of Hawaii requires all rental properties to have a designated on-island contact to manage an investment property and to be available for tenant emergencies. A full-service property management company can market the property, find and screen tenants, create lease agreements and manage insurance requirements, provide transparent accounting, and handle repair and maintenance requests while protecting the owner’s investment. Hawaii Life Vacations is a full-service property management company that charges 10% of the long-term gross monthly rent rate to cover marketing, property management and accounting. Compare this to the short-term rental property management rate of 25% of the short-term rental gross rents. Other property management companies charge up to 35% of gross rents for short-term rental property management, so it’s a good idea to compare services and fees amongst several property management companies.

Maintenance & Repairs

Long-term rental properties generally require less maintenance and repairs because single tenancy over a long period of time causes less wear and tear than multiple guests that stay in a short-term rental property every several days. This is reflected in the 10% long term rental property management fee versus the average 25% short-term rental property management fee that Hawaii life Vacations charges.

Property Tax:

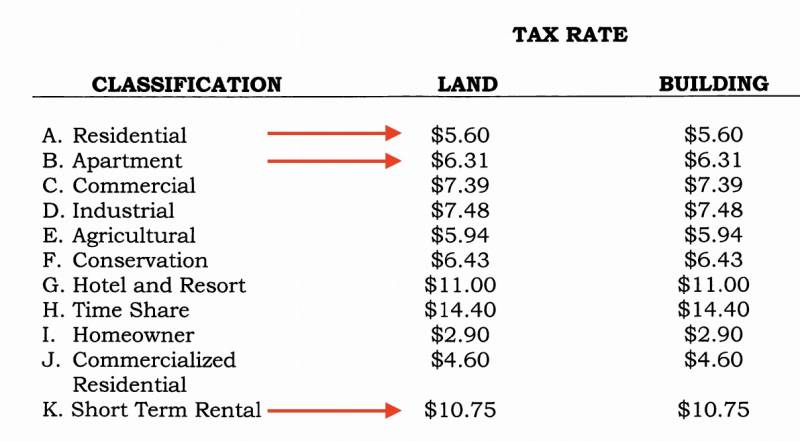

One of the biggest differences between owning a long-term rental versus a short-term rental is the Maui County property tax rates. As of 2019, Long-term rental properties classified as “Residential” have a property tax rate of $5.60 per $1,000 of net taxable assessed valuation. Long-term rental properties classified as “Apartment,” such as many condominiums, have a property tax rate of $6.31. Compare this to properties classified as “short-term rental” that have a tax rate of $10.75 per $1,000 of net taxable assessed valuation. You can find more information about Maui County property tax rates and classifications by clicking here.

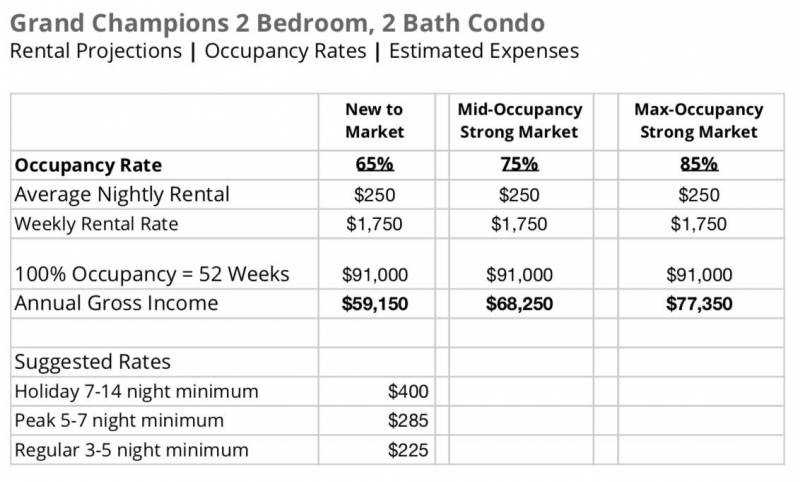

When considering purchasing an investment property on Maui, ask a property management company to provide a breakdown of estimated expenses for you. Hawaii Life Vacations utilizes Key Data, a research software that analyzes rental statistics such as Average Nightly Rates and Occupancy Rates in a specific area or condominium complex on Maui to estimate rental projections. This information enables the property management company to generate estimated pro formas for a specific property that you may be considering to buy.

A breakdown of property expenses such as property management fees, monthly maintenance/Association fees, property taxes, deep cleaning fees, utilities, and repairs/maintenance can help guide you with your purchase.

The Why?

What is most important to you when purchasing an investment property? The bottom line? An existing vacation rental history? Location? A Fixer Upper that you can easily upgrade and then rent? Or maybe it is having a move-in ready destination that you, your friends and family can stay in when you visit Maui? Depending on your motivation, ask a reputable property management company to provide you with rental projections and a list of their services for both long-term and short-term rental property management so you can decide which type of rental property best suits your needs.

Want to Know More?

Contact me for more information about purchasing a short-term or long-term rental on Maui and to find out about Hawaii Life’s full-service property management services.

Mike Ralstin

June 26, 2020

I was curious on your opinion of kihei shores.

Sofia Torres

December 11, 2023

Consider the advantages and disadvantages of each option, including flexibility, stability, cost, location, amenities, and legal considerations.