Latest News on Hawaiʻi Island Short-Term Rental Regulations

In November 2022, two members of the Hawaiʻi County Council presented a draft bill to the public for comment (here is a link to my report on that initial presentation). The bill is now on its third draft, and the two council members hosted another ZOOM call with about 500 members of the public on Friday January 20th. While much remains the same, they have listened to feedback and modified a number of proposals to make it easier for homeowners to register hosted Transient Accommodation Rentals (the new terminology for what had been called Short-Term Vacation Rentals).

Here is a summary of the latest iteration of the Transient Accommodations Rental (TAR) Code amendments. There is now a website you can view with a lot more information: Hawaii County TAR.

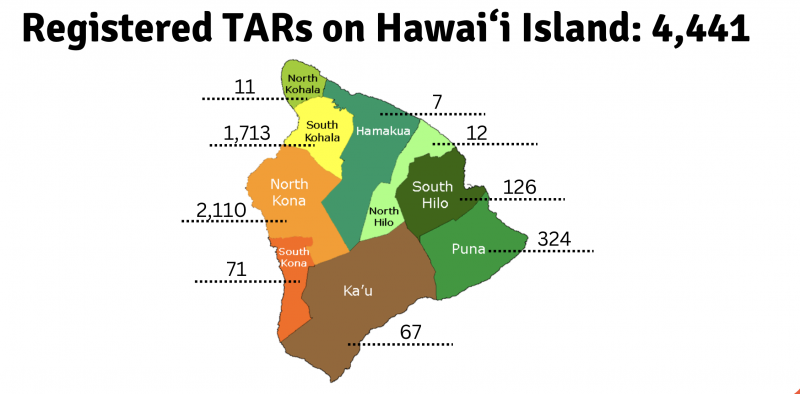

This slide from the January 20 TAR presentation shows the location of the currently registered Transient Accommodations Rentals on Hawaiʻi Island

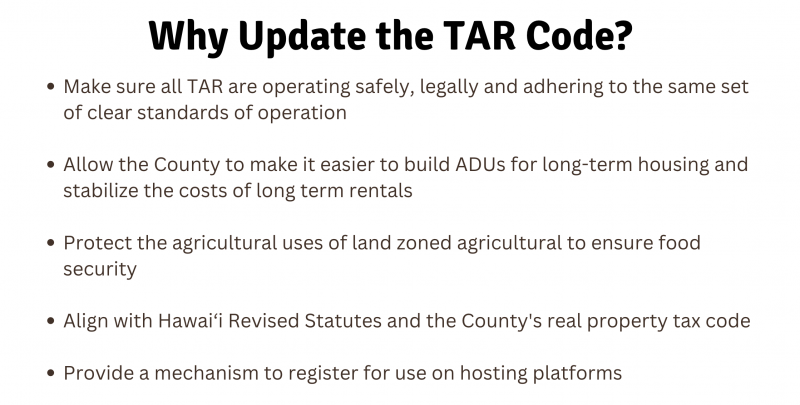

Recap on Why Hawaiʻi County is Proposing to Register Hosted Transient Accommodations

If you have been reading my posts, and those of my colleagues on other islands, Hawaiʻi Island (the Big Island) is actually the last of the islands to address the issue of hosted, as opposed to unhosted, vacation rentals which have been required to obtain a license since 2018. The shift in terminology is to be consistent with Hawaii State statutes as well as with other islands who are in conformance with the state use of “transient accommodations rentals.”

This slide clarified the larger purposes which the new regulations are intended to address:

Progress in the Third Draft of Proposed TAR Registration Regulations

Here are some of the positive changes I saw in this round, addressing comments received in the past two months. My sense is that the County is trying to be sympathetic to resident homeowners for whom hosting paying guests is an important source of income to keep them in their homes — local families and retirees, for example.

- Clarification of the definition of “transient” as being under 180 days (consistent with state law), and categories of renters who are exempt from the definition regardless of length of stay such as traveling medical personnel employed at a Hawaiʻi facility, military personnel, and full-time students.

- Clarification of what a “hosted” rental can be. If the homeowner resides on the property, they may rent bedrooms, guest houses, and ʻohana dwellings. Registration for these may occur now or in the future. If there is a resident operator other than the homeowner, and the home is not in an allowed zoning, they must apply for a non-conforming use certificate.

- The proposed fee schedule is being looked at to make it more progressive. That means that rather than a flat rate schedule for all rentals, the amount might be tied to the value of the rental unit so that luxury accommodations would pay a higher rate than very modest ones.

- There is a pathway for properties that do not have building permits to apply and have a conditional registration for up to one year while the homeowner obtains “as built” permits.

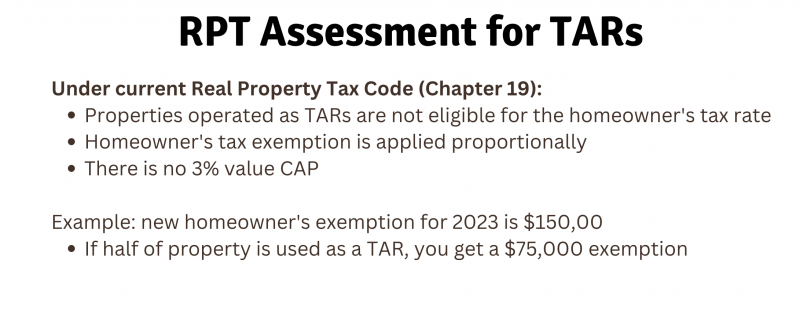

Another consideration which was brought to the attention of listeners for transparency is that if a homeowner currently is claiming a resident homeowner rate and deduction which reduces their property taxes, registering a hosted vacation rental will likely have the effect of increasing their property taxes. This is not a change, just a consequence.

Can You Have a Hosted TAR on Agricultural Zoned Land?

You may recall that a group of property owners challenged the Countyʻs unhosted short-term rental legislation over denying non-conforming use certificates if their post-1979 properties were on land zoned for agriculture by the County and designated as such by the State.

A sample of current vacation rental listings near Hawi, Hawaii.

Living in North Kohala where most of the land is zoned agricultural, the question of whether hosted short-term rentals are allowed on agricultural properties is a key one. The slide at the top of this post shows there are only 11 unhosted vacation rentals licensed under the 2018 law. A quick search near Hawi on any of the rental sites reveals there are dozens of hosted rentals in operation. A second dwelling on ag land since 1996 would likely have been permitted as an additional farm worker dwelling and would have a recorded agreement on the associated income-generating ag activity. In other words, these are for workers, not for tourists, in conformance with state agricultural district statutes. The clarification offered by the Deputy Director is that bedrooms in the homeownerʻs dwelling or a detached bedroom “pod” could be registered as a TAR, regardless of zoning.

Give Your Opinion on Hawaii County Transient Accommodations Rentals Proposals

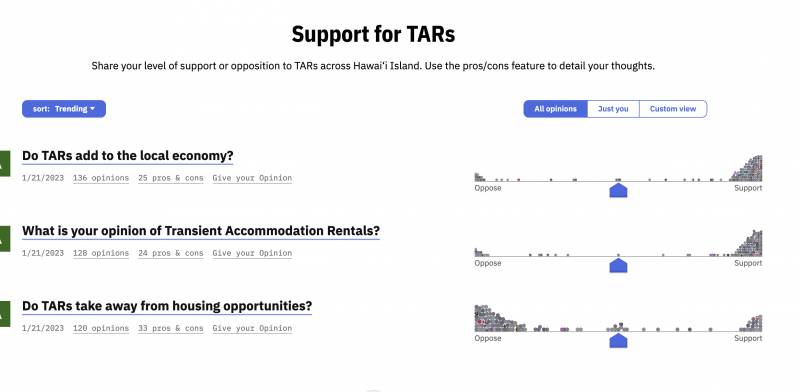

The consider.it software allows for robust community input and a visual representation of opinion trends

I wrote in 2020 about the ʻĀina Aloha Economic Futures project which used consider.it software to gather opinions on proposals submitted on topics from tourism, to education, to affordable housing. The same software is being used by Hawaiʻi County for the public to rate and give specific feedback on proposals. Here is the link to participate: Hawaii County TAR Considerit.

If this is an important matter for you, be sure to participate while these regulations are still in draft stage.

Next steps will be the introduction of the proposals to the County Council for consideration, likely by March.

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.