The real estate market has abruptly changed…and is still changing. During Covid my wife and I refinanced our mortgages, and now enjoy 2.65% on our owner-occupied home. We settled around 1% higher with our investment property mortgages. Today, 6+% seems to be more the norm, and “projecting 6.5% to 8% throughout the remainder of the year” (Forbes Advisor, Andrea Riquier, September 30, 2022).

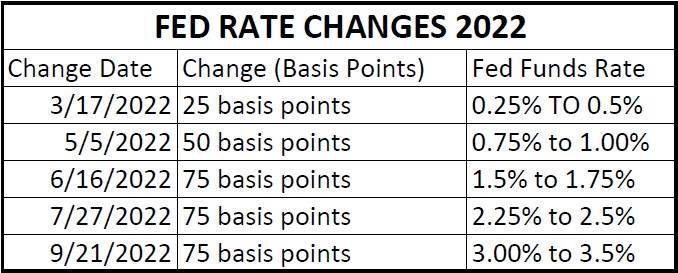

So what happened? Inflation started taking off, and the Federal Open Market Committee, commonly referred to as FOMC, or, “The Fed,” decided to raise interest rates in an attempt to curb inflation.

Some Background

In theory, people deposit money in banks in various types of savings accounts. The banks profit by lending the money deposited in the bank. Certain regulations require that the banks retain a certain reserve, therefore the bank cannot lend all of the money people deposit in their savings accounts. In order to lend more money the banks need to borrow the additional money to lend out.

With interest rates being so low, very few people put their money into savings accounts bearing 0.01% interest. Instead, many transitioned to the stock market, real estate and other investments. Therefore, the banks have been borrowing a lot of money to lend out as home mortgages

Towards the beginning of 2022, the Fed started raising the interest rates that is charged to the banks in an attempt to reduce inflation. Now we are seeing the resulting rise in home mortgage interest rates as a result. The banks are charged more, so the banks need to charge more. Of course, banks lend to corporations, etc. as well, so the cost of doing business everywhere started rising.

Now that the interest rate on home mortgages is continuing to rise, fewer buyers are qualified to borrow the necessary funds to purchase a home.

An Example

- A 30-year mortgage for $500,000 at 3% interest has a principal and interest payment of $2,108 per month.

- A 30-year mortgage for $500,000 at 6% interest has a principal and interest payment of $2,998 per month.

This example shows mortgage payments increasing by almost $900 per month, so many buyers have been forced to wait to purchase a home.

This results in fewer buyers, especially in the $750,000 to $1,500,000 price range.

Fewer Buyers result in fewer closed transactions.

Fewer closed transactions result in more property inventory on the market.

More property inventory can result in lower prices, based on the law of Supply and Demand.

As you can see from the following graphs, we may be seeing a shift in our local market.

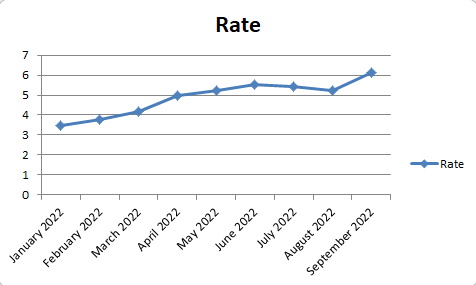

1. Mortgage Interest Rates Begin Rising (Source)

Interest rates rose from 3.45% in January 2022 to 6.11% in September 2022.

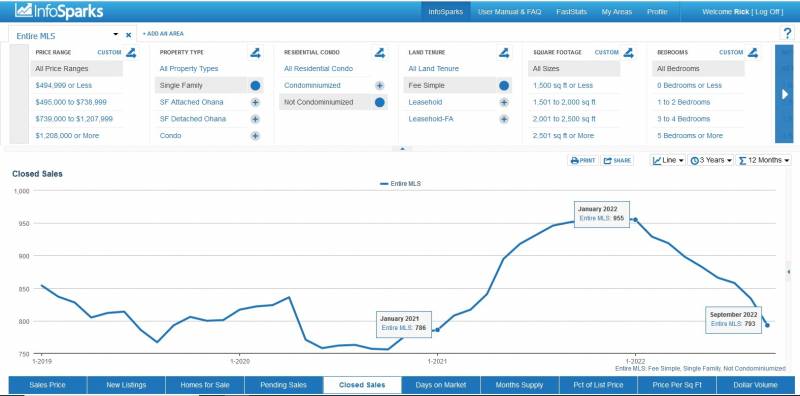

2. Higher Interest Rates Result in Fewer Buyers and Fewer Closed Transactions

The month of January 2021 ended with 786 closed sales. This increased in one year to 955 closed sales in January 2022, an increase of 21.5% of closed sales. By September 2022, the number of closed sales decreased to 793, a reduction of nearly 17% in 8 months.

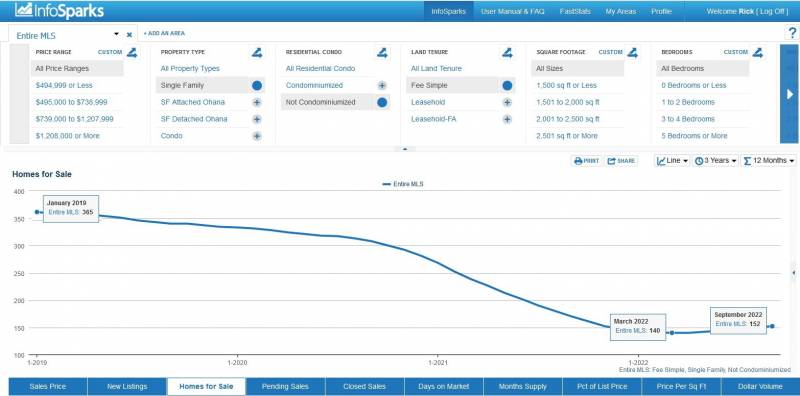

3. Fewer Closed Transactions Results in Higher Inventory of Homes For Sale

Beginning in January 2019, the number of homes available for sale decreased steadily from 365 to 140 in March of 2022, a reduction of just over 61%. From March 2022 until September 2022 the number of homes available for sale started rising from 140 to 152, a rise in inventory of just over 8.5% in 6 months. Fewer closed sales resulted in more homes being on the market.

4. More Homes on The Market Results in Lower Prices

Prices began increasing in November, 2020, starting with an average price of $1,003,041. We see a peak in the average price in May of 2022 at $1,720,769. This is an increase of $717,728, approximately 71.56% in 22 months. Then we see what could be the beginning of a downturn in the average price of single-family homes, with an average price reduction to $1,599,488, a reduction of 7% in 6 months. When the number of homes available for sale increases, that means supply is increasing and prices tend to drop. If this trend continues, we may experience a loss of value in our homes. We can see from these graphs what could be the beginning of a downward trend in home prices.

In summary, we see higher interest rates, fewer buyers, more inventory on the market, and prices dropping with properties being on the market longer.

If you are considering selling your home or investment property, NOW MAY BE THE PERFECT TIME TO CONSIDER SELLING YOUR HOME!

It is almost impossible to gauge the market with enough precision to sell at the absolute peak. It is important to be able to identify trends that could indicate direction of the market and to be able to sell as close to the peak in the market as possible.

If you are considering selling your real estate here on Maui, I am confident that I am able to provide the highest level of professional service to you in the marketing and selling of your property.

Please feel free to contact me to discuss your real estate needs!

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.