I have been blogging regularly about the Transient Accommodation Rentals bill proposed for the Big Island, but the headlines recently have been about the passage by the Hawaiʻi State legislature, and signing by the governor, of a major bill regarding short-term vacation rentals.

Letʻs take a step back to look at how Hawaiʻi regulates vacation rentals on the state level versus what each individual island does as a County (Maui County actually consisting of the islands of Maui, Molokai, and Lanai).

My weimaraner enjoying the sunshine on the lanai of a vacation rental home during a staycation a few years ago.

Refresher: Hierarchy of State, County, and Subdivision or Project Limitations on Real Property Use

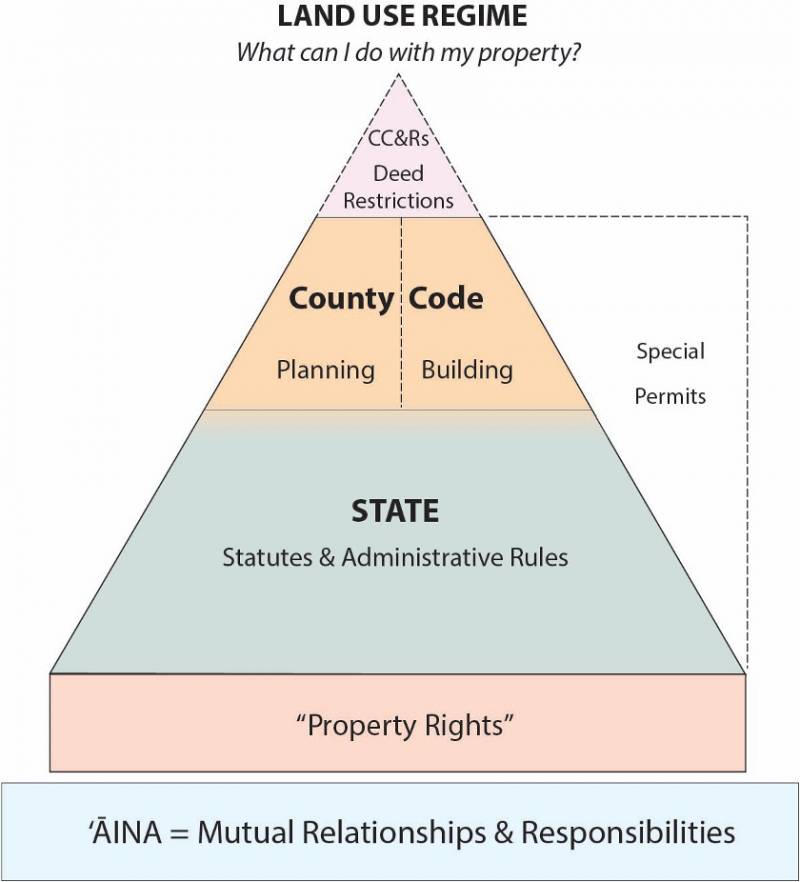

During the public review period of the Hawaiʻi County Draft General Plan 2045, I had so many community members asking me questions that I eventually produced a PowerPoint deck of explanations, and created a graphic to explain how regulations at the Hawaiʻi state level underly county code provisions, which in turn might be further restricted by CC&Rs for a subdivision or condo project. Here is that graphic so we can examine the new Hawaiʻi State vacation rental legislation, the reasons for its passage, and what it does.

What can I do with my property in Hawaiʻi? Here is the land use framework that helps answer that question.

Underlying the legal framework for real property in Hawaiʻi, I put the land itself – but land as ʻāina. In Hawaiʻi when we say ʻāina, land is understood as being literally “that which feeds us.” This previous blog post discusses the distinction between property as a bundle of rights, and ʻāina as a bundle of relationships and responsibilities.

While legally buying a property entitles the owner to a set of rights for usage, those rights are limited by government for considerations of the public good such as health and safety, as well as sometimes by privately agreed deed restrictions, such as subdivision CC&Rs or easements.

In this previous blog post I explain that Hawaiʻi classifies all its lands into one of four districts, and in some cases into subzones, and both statute and administrative rules further restrict what can be done in each of those classifications. For the most part though, land use decisions are then delegated to the counties. In summary, county zoning and code further define and restrict land use, but those ordinances and rules must be consistent with the underlying state district regulations.

At both state and county levels, there are some provisions for permit processes that allow uses outside of what would otherwise be allowed in a State land use district or County zoning. There are also sometimes “non-conforming uses” which is the planning/legal term for being “grandfathered in” when a historical use of a property is inconsistent with current code.

2024 Hawaiʻi Vacation Rental Legislation

Sunset from the Lahaina condo complex where I stayed in early 2023 when on Maui for an event. The need to house residents displaced by the August 2023 fire is one prime impetus to the new state law.

The 2024 short-term vacation rental legislation passed at the State level mainly empowers counties to be more restrictive in where overnight accommodations may be offered to visitors to Hawaiʻi. Senate Bill 2919 was described by its proponents as a response to the crises around affordable housing for local residents and workforce, looking to add to existing long term housing supply by restricting use of more dwellings to long term or owner occupancy, rather than only to building new housing.

Specifically, it amends HRS Section 46-4, in which authority for land use planning is delegated from the state to the counties. The bill also specifically references the legal case against the City and County of Honolulu regarding its passage of an ordinance that increased the allowable short-term rental period from 30 days to 90 days, clarifying that the state intends for the counties to have authority to regulate short-term rentals to visitors, as these are not considered “residential use.”

The bill itself does not make reference to “illegal vacation rentals” as the national and local press coverage does. The Counties already have the ability to enforce closure of illegal rentals, whether short or long term, if they discover them. What the bill does do is make it possible for the Counties to impose stricter regulations, including zoning changes, on legal – meaning registered or permitted – transient accommodations rentals. That term is already defined at the Hawaiʻi State level, as rentals to which an additional tax applies (staying in a hotel you also will see this surcharge on your bill).

While the Maui County mayor has already announced that he intends to use his powers to eliminate thousands of established, previously legal, vacation rentals primarily in apartment buildings, the Big Island Transient Accommodations bill package deals only with hosted rentals, expanding the registration provisions put in place for unhosted rentals in 2018.

Will the state level changes to result in changes to the proposed Big Island vacation rental bills in the short-term? Certainly the County will be looking at the proposals to be sure. As I have often advised in these posts, if you want to buy a property with short-term vacation rental potential, the best strategy is to buy in resort-zoned areas. The County Code defines resort districts as follows: “The V (resort-hotel) district applies to areas to accommodate the needs and desires of visitors, tourists and transient guests.” No problem there.

Mark Hahn

May 9, 2024

I can see the point from both sides as some neighbors don’t want all of the different strangers going back and forth. But on the other hand I wonder how much big money is involved as far as the Hotels and Resorts lobbying for more limits to put more money into their pockets?