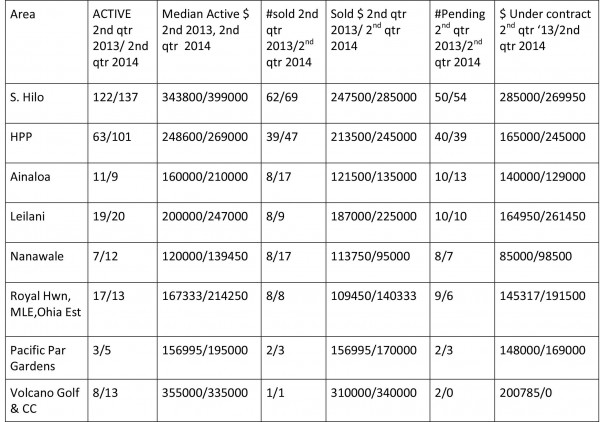

When comparing residential sales during the 2nd quarter 2013 to the quarter that just ended, it’s clear sales numbers and pricing are continuing an upward swing. Only Nanawale Estates had a decline in the median sold amount. The number of listings in Hilo and HPP increased (almost double in HPP), which probably indicates that sellers are more confident about the market. In fact, there is quite a bit of new construction in both areas. New homes sell quickly.

Statistics compiled by Denise Nakanishi from MLS reports

As noted last quarter, sales of homes over $500,000 have picked up significantly. There were 6 closings in Hilo over $500,000 during the 2nd quarter last year. That number increased to 14 this year. There are quite a few pending sales as well.

What I see from the numbers is that sales are very steady. The number of showing requests indicates that the market is very active. Well priced homes, even in the upper tier, will sell. Until recently, I would not have had the confidence to make that statement.

Here’s How to do the Math

There are very important numbers to consider when applying the statistics on the chart to your neighborhood. Calculating supply and demand is key to predicting market direction. For instance, there are 137 active listings in Hilo. This number increases to 191 when pending sales are added back in (pending sales are technically still active). One hundred fifteen homes changed hands during the second quarter, which means there is a theoretical demand for 230 homes this year. This indicates there is more demand than supply. Properly priced homes will sell.

Borrowing Gets a Bit Easier

Lenders continue to offer programs aimed at helping buyers buy. First Hawaiian Bank has a 10% down program for first-time buyers (doesn’t necessarily mean you have never owned a home) without Private Mortgage Insurance. Private Mortgage Insurance adds an additional layer of approval to the loan and additional monthly fees. American Savings has several attractive programs as well. Remember, mortgage brokers are able to place loans with multiple lenders offering attractive programs.

I Can Help You Track Your Neighborhood

Still, applying for a mortgage is not for the faint of heart. Buyers definitely need to come armed with a keen sense of humor and tons of patience. As always, if you don’t see your neighborhood listed, let me know. I’ll be happy to provide a custom report. Keeping up with your neighborhood on a regular basis is very easy. All I need is your address/TMK and you’ll receive periodic factual updates. It’s the simplest way I know to determine if it’s truly a beautiful day in your neighborhood!

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.