The fifth draft of the Hawaii County Transient Accommodations Rental (TAR) bill that will require registration of hosted short term vacation rentals on the Big Island is now available for review and comment. Here is a link to download and review this latest version: TAR Proposed Ordinance – version 5.

According to the new proposals, you could rent some of the bedrooms in the home in which you resided, but the second dwelling would need to be a long term rental. MLS 670706.

Background on the Transient Accommodations Rentals (TAR) Proposed Regulations

The summary view is that Hawaiʻi County (the Big Island) was the last of our four counties to implement regulation of transient accommodations. Unhosted short term rentals were regulated in 2018 and at the time the Planning Department indicated that they would address the trickier issues with hosted rentals – which are now colloquially referred to by the popular rental website name as “AirBnbs” – once they had some experience with the regulatory process for unhosted rentals. That time has come.

If you are newly considering a purchase of a Big Island property with hopes of doing short term vacation rentals (or just need to refresh your memory on the proposals) you might want to start your education with these revious posts:

- Hawaii County Council members first draft code amendments for hosted vacation rentals

- Third draft and more information on the Transient Accommodation Rental bill. This post covers most of the substantive changes ahead, including the registration process and the consequences for real property tax assessment of homeowners registering their onsite vacation rentals.

- My take on the fourth draft that came out in July.

For even more background, you might also be interested in my recent post on the countyʻs Draft General Plan 2045. The context of planning for a more diversified and resilient economy for Hawaiʻi Island is important.

Changes in Draft 5 of the Big Island Transient Accommodations Rental (TAR) Proposal on Hosted Rentals

There are substantive changes between the current and previous drafts. In my reading of the changes, they do two things.

First, there are multiple changes that make it easier for resident homeowners who want to offer short term rental accommodations as a supplement to their income to qualify to do so legally under the proposed regulations, especially in the future. Note that many of the provisions that owners of TARs have found objectionable are ones that are restricted by other County or State code or statute sections. For example, building permits for additional farm dwellings on agricultural land require proof that the agricultural activity is sufficient to have a need for worker housing. ʻOhana dwellings on residential lots are, as the name suggests, meant to be used for long term housing for families. Clearly using these dwelling as vacation rentals is in violation of the specific permit requirements under which they were built.

But the latest version makes it otherwise easy for registration of a hosted TAR at any point in the future:

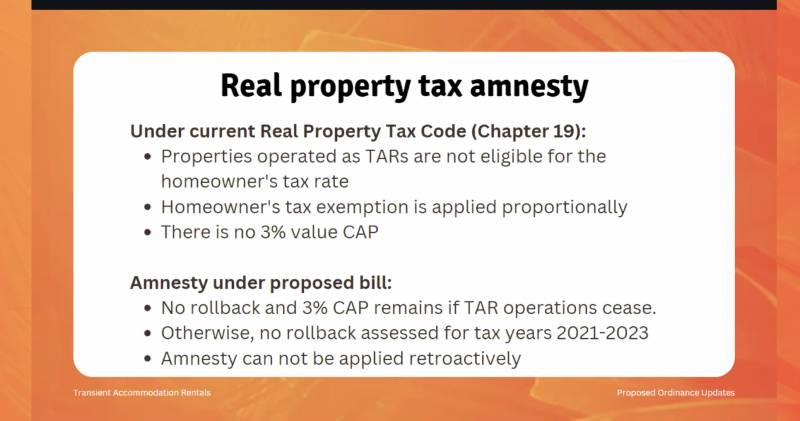

Similarly, many owners of properties with hosted vacation rentals have been benefitting from property tax breaks intended for those owners using their homes strictly for a primary residence, or with an agricultural dedication on the land. Not only will those applying for TAR permits see their property taxes increase in the future, but under the property tax code, they would have been subject to rollback taxes on the years in which they were renting and should have paid higher property taxes. The newest draft of the proposed ordinance gives these owners amnesty.

Second, other sections of the County Code are now going to be under review so that there is less confusion about paths to offering transient accommodations. The pathway that was already in the code for owners of residential properties was to obtain a bed-and-breakfast license. Although previously issued B&B licenses will continue to run with the land, all new permits will be issued under the proposed TAR regulatory process. Updates will also be made to the section of the code regarding ʻohana dwellings.

What to Keep In Mind if You Want to Have A Big Island B&B

Breakfast is the only meal you may service in a hosted TAR – make it a special one!

In this long ago post I mentioned a few considerations if you dream of owning a Big Island B&B (think about your lifestyle AND your business model). Going forward, you will also have costs of registration, the additional property tax burden, and County oversight of your advertising. Make sure your buyerʻs agent is aware of your objectives and can guide you to steer clear of potential pitfalls like unpermitted construction or restrictions mentioned above.

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.