Hawaii state and county governments are beginning to address the impacts of Covid-19 for their tax revenues and budgets. One of the proposals currently before the Hawaii County (Big Island) Council is the creation of a new property tax designation that would allow for a higher tax rate to be assessed on “luxury” properties.

This Puakea Bay Ranch home for sale has an assessed value of over $2 million and a non-resident owner would be subject to the proposed higher property tax rate.

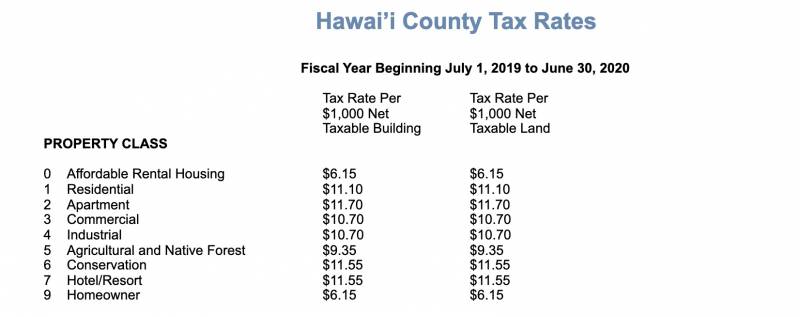

Current Fiscal Year Hawaii County Tax Rates

The tax year for Hawaii County begins on July 1 of each year, and while the rates generally increase from year to year, the new proposal will actually create an entirely new class of residential property.

Source: Hawaii County Real Property Tax Office website

The proposed Hawaii County Bill 168 defines residential tier two property as follows:

- net assessed value of $2 million or more; and

- no homeowner tax exemption (meaning, the owner does not reside in the property as a resident of the state and county of Hawaii); and

- applies to single family homes, condominiums and vacant land;

- as long as the property is “classified as residential in consideration of the highest and best use of the land.”

The last criterion means that, for example, a property for which conservation is the highest and best use would not be subject to the higher tier two property tax regardless of its assessed value.

If you live full time in the luxury property, it will not fall in the new property tax class, no matter how luxurious

Implications of the Proposed Luxury Property Tax Tier in Hawaii County

If you are considering buying luxury property on Hawaii Island, how will the proposed residential property tax affect your second home or investment property?

The bill only creates the new property tax category. Even if it passes, the County would still need to assign a rate for each year. Under Mayor Harry Kimʻs proposed budget, luxury property owners would pay a rate of $14.60 per thousand in value on all value over $2 million, compared to the current tax rate of $11.10 per thousand.

In other words, there would be no increase in the tax rate on the first $2 million in value, and then a surcharge would be applied to the value of $ 2 million. If your property was assessed at $3 million, your current annual property taxes would be $33,300; under the new tier they would increase to $36,800. An increase of $3,500/year or less than $300/month. If it was decided to impose the higher rate on the entire assessed value, the increase would be $10,500 in this example.

Most Big Island listings over $2 million subject to the property tax increase will be in one of the Kohala Coast resorts.

Currently only 935 of the 140,000 properties on the Big Island have assessed values over $2,000,000 without a homeowner exemption. Those properties are almost entirely on the west side, mainly in the Kohala Coast resorts. The idea behind a progressive tax structure is that most of the property owners in the higher category would have little problem affording the increase. However, there are some communities like oceanfront Puako where properties that have been in the same family for generations might have increased in value, making it difficult for the family to afford property taxes if they do not live in the property.

Not all properties listed for over $2 million will have an assessed valuation that high. But if you are considering buying a property in the over $2,000,000 market on Hawaii Island, keep in mind that even if the current assessed valuation is below the $2 million threshold, it is likely to be “marked to market” once it trades at a higher value. Your real estate agent can help you research the implications of the new luxury property tax tier, should the Hawaii County bill pass.

Lisa Velasquez

May 21, 2020

I believe this has passed the first hearing in the council and there will be one more vote before it goes to Mayor Kim. Stay tuned.