13 Compelling Facts Regarding Legal Short-Term Vacation Rental Properties on Maui

There has been an onslaught of recent media regarding Maui’s Mayor proposing to phase out vacation rental properties in the apartment zoned districts here on Maui. I am very pleased to see that we are now seeing many more factually based aspects to this complex challenge being shared about housing that Maui and many other places around the world are facing. Most recently, I was quoted along with one of my dear friends and hardest working people I know, Leo Szakacs-Kekona, who owns a local cleaning company recently had the opportunity to share a few of our thoughts in a recent Civil Beat article. Maui Council Budgets $300,000 To Study Impacts Of Eliminating 7,000 Vacation Rentals.

Born and raised here on Maui and living full time most of my life, I have always been a huge advocate of affordable housing here on Maui as it is vital for our local people to have places that they can own and/or rent at reasonable rates for their families. I believe that the proposed legislation will yank the rug from underneath many of us and will make the situation far worse. I 100% support more housing but this is not the way to do it.

There are some serious misconceptions among many that the effects of eliminating legal vacation rentals exist in a vacuum, i.e., we just eliminate the use, and everything after that is just fine. That is clearly not the case of what would likely happen.

In this post, I do my best to help illuminate some of the positive core components of the Maui Vacation Rental industry. While doing this, I 100% acknowledge that it is far from a perfect economic industry and that tourism plays a significant impact on all of those who choose to call Maui home.

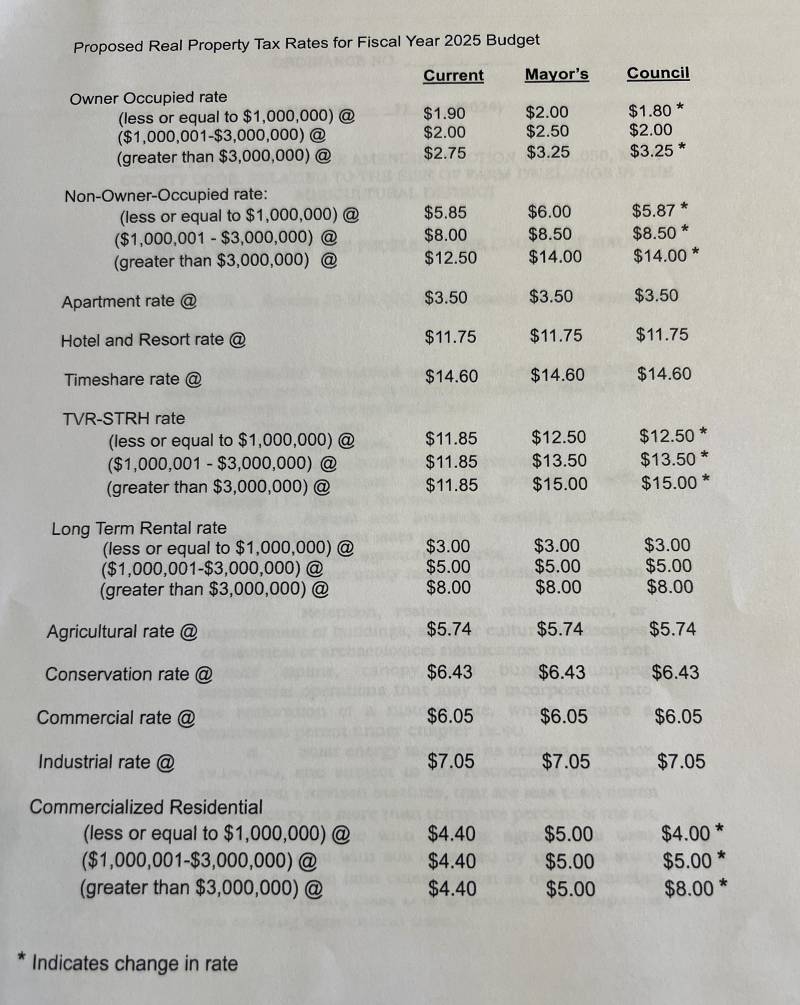

Highest Property Tax Rates for All Property Types in State of Hawaii

Maui STR high-end properties (assessed value of $3M or above) pay the highest property taxes of any type of property in the entire state of Hawaii. The county has recently implemented a new tiered system based on assessed values. Even the lower tier values are amongst the very highest of all property tax classifications in the State of Hawaii. The property tax rates and assessed values for short-term vacation rental properties have been on a precipitous rise in the last couple of years.

I can certainly understand the assessed values continuing to climb as aggregate market values have been following this trend. However, it appears to be very targeted by the County to see the extent in which STR properties are being taxed especially in light that Hotel Properties (think Hyatt, Marriott, Sheraton) have not risen for 3 years. In fact, the rate for even the lowest tier vacation rental properties (under $1M) is still higher than the Hotel Rate. I suspect that the hotels and their lobbying power have a strong grasp on influencing financial policies like these.

These properties are not to be confused with Hotel Zoned Vacation Rental Properties which are not targeted in the current legislation. In a previous post, I chat about these and list of the hotel zoned condos on Maui. Full List of Hotel Zoned Condo Short-Term Vacation Rentals on Maui

One of the main reasons that Maui County full-time residents enjoy some of the lowest property taxes (I don’t know of any lower in the County, but perhaps there are) is that these legal rentals are taxed to the moon.

Who picks up the bill should this be removed from their current allowed use?

This is the view from the independently owned legal vacation rental that I rented for my family and I during our recent Mother’s Day excursion to the North Shore of Oahu at Turtle Bay.

Housing Accommodations for Traveling Local Families

Legal vacation rentals provide the most reasonably priced accommodations around of the state of Hawaii for local families looking to travel inter-island. Try to stomach the rate of a hotel room any time recently?

My family and I love to stay at the Hanalei Bay Resort on Kauai when we travel because it is a better setup for us personally and we can rent a 3 bedroom ocean view residence for less than a studio at the nearby Hotel One. We just recently traveled to the North Shore of Oahu and were able to rent a beautiful 3 bedroom villa for just a little bit more than a studio at the adjoining Turtle Bay Hotel. Speaking of which, Blackstone (massive hedge fund) just sold the Turtle Bay Hotel to a Maryland-based corporation for $725M and is now being re-branded as a Ritz Carlton.

These vacation rentals also provide temporary housing for traveling essential workers (think healthcare professionals) and potentially construction crews to help rebuild Maui.

What does supply and demand tell us about the prices of hotels if roughly 7,000 of these properties are eliminated from this use?

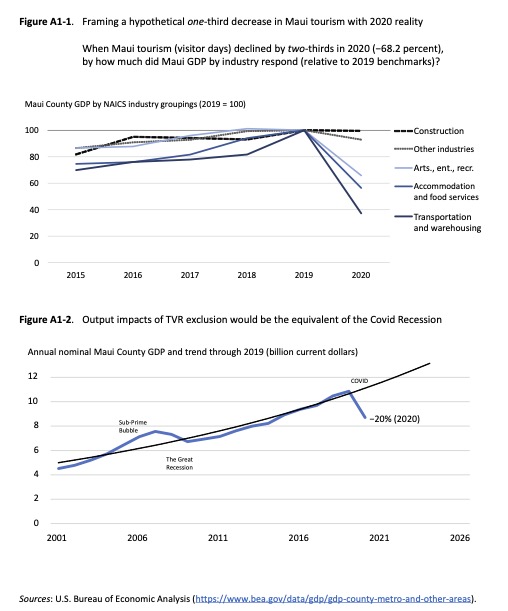

The Elimination of Apartment Zoned Vacation Rentals Equates to a 20% Reduction in Maui GDP

Maui County is currently contemplating commissioning a new economic study to analyze the impacts of this new legislation (see above Civil Beat article). However, in 2022, Paul Brewbaker, who is the State’s leading economist published a comprehensive white paper that studied the impacts of very similar legislation that arose a few years ago. Throughout this post, I will reference this study.

From the Executive Summary of Brewbaker’s report:

- Maui County aggregate output would decrease $2.74 billion.

- An additional $508.4 million in output would be foregone by Honolulu (Oahu), Hawaii, and Kauai counties through direct, indirect, and induced impacts of the Maui tourism decrease.

- Statewide total output would decline by $3.25 billion, including multiplier effects.

Further noted by Brewbaker:

“The 70-75 percent 2020 tourism decline contributed to a 10.8 percent decline in 2020 Hawaii real GDP, and a 20.4 percent decline in 2020 Maui real GDP. The temporary tourism collapse and initially weak household spending both began recovery in second half 2020. Stimuli from government spending increases and relief payments, and support for investment from low interest rates, restored economic growth, but from a deep hole. By mid-2022 real statewide GDP was still 93 percent of the 2019 level.”

As Brewbaker notes, the economic downturn due to Covid was temporary and there was recovery, where will the recovery come from here?

“Permanently removing one-third of Maui lodging would deindustrialize tourism. It would shrink the Maui economy. Jobs and incomes would decrease. Unlike transitory 20 percent tourism decreases associated with previous tourism shocks, a hypothetical reduction in Maui lodging of 6,749 units permanently would decrease tourism by 20 percent. It would be a Desert Storm, 9/11, Great Recession, or Delta and Omicron coronavirus waves without recoveries.”

1/3 of Travelers to Maui Stay in Vacation Rental Properties

Brewbaker continued:

This analysis assumed that Maui County visitors staying in condos and vacation rentals:

- Comprised about 1/3 of the Maui County visitor arrivals total

- Were among resilient travel segments (least likely to cancel, quickest to return, etc.)

- Spent approximately $200 per day.

- Had at least an 8-day average stay length.

This is important because many of our island visitors have specifically stated that if not for vacation rentals, they would not stay in Hotels and would not visit Maui. I know that there are some people may want that and I respect your opinion but I am not one of those people and I think it is important that we continue to strive for a healthy balance in tourism and overall economic vitality.

I was just chatting with my friend Mary (the owner of South Maui Fish Company), and she told me, referencing the Aug. 8, 2023 fires and since then, “We lost a lot of the boats that we purchased fish from. It’s a huge trickle down impact. People who stay in hotels don’t venture out like condo guests for sure. I think Maui County is going to be shocked when they see the downturn in GET and TAT that all of our local businesses generate.”

Mary Kerstulovich, a friend of mine, and her husband Hunter own South Maui Fish Co. They have huge hearts and are constantly giving back to Maui’s youth and community as a whole.

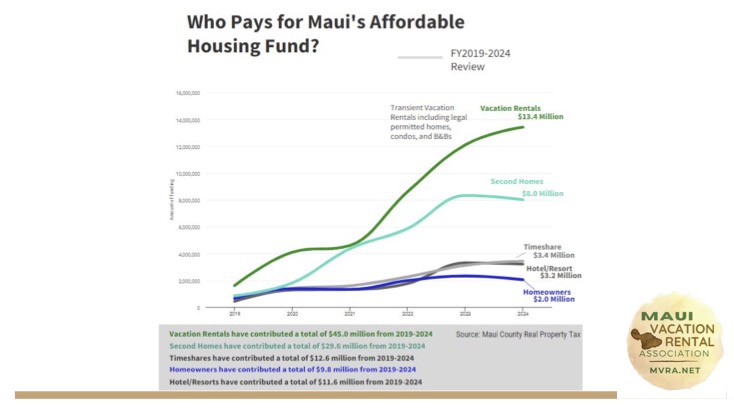

Legal Vacation Rentals Are the #1 Funding Source for the Maui Affordable Housing Fund.

Legal Short Term rentals have raised over $45 Million raised in the last 5 years. For comparison, all of the Hotels on Maui have contributed a total of $11.6M in the same time period. I recently saw an entry level residential condo in Kihei sold by one of my friends to the County of Maui for Kapuna housing- why aren’t we putting the $70M that the County has in their piggy bank right now to continue to purchase condos like this that fulfill immediate housing needs and isn’t a serious infringement on property rights as well as a litany of other issues?

Legal Vacation Rentals Provide an Estimated 16,000-18,000 Local Jobs in Hawaii

These are my dear friends Leo Szakacs-Kekona and Yuredi who own Blue Cleaning Company LLC. and clean over 20 vacation rental properties for our team. Leo was born and raised here on Maui like me and employs other hard-working locals of our Maui community.

In our studies, it is estimated that said jobs have an average pay rate of $39/hour for local citizens — how many hotel jobs or other corporate entity jobs do you know that pay this?

The handymen that we employ are paid anywhere from $40-100 per hour.

Paul Brewbaker:

“The structure of the economy dictates that tourism-oriented industries such as accommodation

and food services, retail trade, arts, entertainment, and recreational services, and transportation

services would express the largest shares of the decrease in tourism associated with the withdrawal of

productive capacity.”

Executive Summary Points:

- Maui County payroll employment would decrease by 14,126 jobs (incorporating labor productivity growth).

- An additional decline of 2,555 jobs would occur in the three other Hawaii counties.

- Workers’ earnings in Maui County would decline by $747.7 million

- Earnings in the other counties would decline by $137.6 million.

Growing up on Maui’s North Shore in Haiku, Fukushima’s was one of my absolute favorite mom and pop shops that sold the community favorite, local style hot dog with the “secret sauce” lots of onions and add jalepenos. Everyone was broken hearted to see Fukushima’s closed it doors in 2022.

Each Vacation Rental is the Financial Equivalent of a Mom and Pop, Brick and Mortar Store

When you think about the overall economic impact of these vacation rental properties, I think it is prudent that you compare them to a small “mom and pop” type shop. They generate just around $100K plus on annual basis and have very similar overall downstream economic impact. I can’t tell you how many of these small shops that I have seen disappear in my lifetime growing up here on Maui; it is really tough to do business here and we have to do everything that we can to support each other.

Locally Owned and Operated Management Companies

The vast majority of the companies that own and operate, legal vacation rentals are locally owned, employ almost all local labor, and pour massive amounts of dollars back into our local economy rather than shipping them offshore. I was born and raised here on Maui, I have busted my butt my entire life. I did plenty of out jobs that my parents helped me get when I was a keiki, I ran a small scale landscaping business in my teens, and I worked in Maui’s restaurant industry in my later teens and early adulthood. I attended business school in Boston, MA but greatly desired to return home to Hawaii so I got my real estate license at 23 and have been grinding the last 18 years.

Future Job Opportunities for Our Keiki

My wife and I have two keiki — one is in Maui Prep now and we hope to have our son there next year. We live in West Maui full-time and have dozens of local people who work on our properties that we manage. The vast majority of the money that we create from our business goes to support our favorite other local small businesses in Maui that we love. Nothing would make us happier if our kids chose to take over our business some day and I know future employment is on the mind of many others in Maui County for their future generations.

A recent Maui Now Article touches on this, Maui’s youth hope to come back after graduation. Will the economy let them?

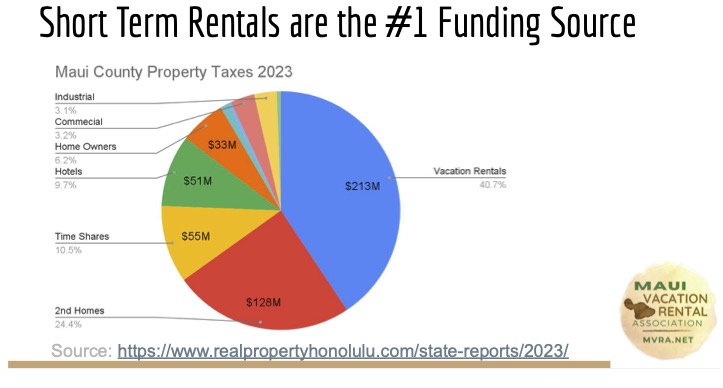

STR Properties are the #1 Funding Source for Maui County Real Property Taxes

Legal vacation rentals are by far the most significant funding source for the Maui county budget which was just recently increased by 34% year over year to just under $1.7 billion. In 2023, Vacation Rental contributed 40.7% of the Maui County Property Taxes to the County’s operating budget- property taxes are the #1 funding source for said budget by far. This number will be even higher in 2024 due to higher assessed values and and another very substantial increase in the rates for vacation rental properties.

Paul Brewbaker:

Maui County earnings would decline by $747.7 million, and earnings in other counties would decline by $137.6 million, for an earnings loss of $885.3 million statewide.

Above is the Papakea resort in upper West Maui. Papakea falls under the parameters of the proposed phase out legislation.

Vacation Rental Properties are Expensive to Own

Legal vacation rentals have very high operating cost and substantial special assessment projects that can run in the tens of thousands and hundreds thousand dollars in range. With prevailing mortgage rates hovering around 8% for full time residences, let’s use a figure of $600K as a purchase price with 20% down ($120K in cash) at a 30 Year Fixed Rate of 8%, this equates to a P&I monthly payment of $3,669 per month. Let’s then factor in HOA fees at another $1,300 (low end figure) we are at almost $5k per month before utility costs, contents insurance, property taxes, etc. That means a lender is going to want to see at least $10K in monthly income to qualify for said loan.

Historically, Papakea has had multi-million dollar property assessments to help fortify its seawall and repair sinkholes in the resort grounds. Now, Papakea is facing a necessary plumbing infrastructure upgrade assessment that is going to cost what is estimated to be $30M. The association will be taking out a loan to pay for said project but what this means is that HOA fees which will soon include the cost for the special assessment for Studio Units will be over $2K per month. The larger units, one bedrooms, two bedrooms, and three bedrooms will be paying even substantially more as all of these costs are allocated on price/sq.ft. of living area.

The Operating Costs for Legal Vacation Rentals will likely continue to increase at rates that far outpace inflation. Astronomically increasing insurance costs, aging infrastructure, and increased utility rates will likely be the leading causes. Many of the proposed properties are located on the oceanfront which are by far the most expensive to own and operate.

All of this translates to: in order for a property owner to likely consider renting his/her property out on a long-term basis they are going to want to rent the above illustrated property at $5,500 plus GET each month considering that they will also likely be paying around a 10% management fee to a local property manager.

Local Maui Citizens Do Own Maui Vacation Rental Properties on Maui

There are Local Maui Citizens like myself and others who legal vacation rental properties and rent them out on a short-term basis to help provide for our families as well as building financial wealth. I am glad to see that there are a number of Maui full-time citizens who own vacation rental properties speaking up online about this fact.

One of my high school classmates that I grew up with here on Maui cleans and runs the vacation rental operation for the properties that his family owns on Maui most of which are located in Maalaea and all fall under the phase out legislation. This is the primary source of income for providing for his two young children and wife who call Central Maui their full-time home.

Vacation Rental Properties Not Set Up for Long-Term Residential Living

Vacation rental properties are not well equipped for long-term residential living- the square footage areas are significantly smaller than many homeowners want, parking options are extremely limited, storage is basically non-existent, and pets are not allowed at the vast majority of these complexes. I believe that roughly 80% of the vacation rental properties in West Maui are studio and one bedroom units- these do not provide the solutions that the community is looking for.

It is imperative that Maui County and all of the stakeholders (our citizens) be part of the discussion and efforts to help further develop real solutions for affordable housing on Maui rather than scapegoating vacation rental owners and coming up with band-aid solutions.

Mahalo for Your Consideration

Mahalo for taking the time to read my article here. While sharing the positive aspects about legal vacation rentals here in Maui, I realize that the system is far from perfect and constant input and improvement is imperative. I invite to share your thoughts below in a constructive and polite manner.

Cara Birkholz

June 11, 2024

Thanks for the article Jeremy. Should this proposed ban take effect, I suspect the real estate market will temporarily crash. However even at decreased prices, it’s unlikely many residents would be able to buy/afford the maintenance costs. Rather I suspect they’ll be scooped up as second homes for the wealthy and then sit empty a large amount of time, hurting Maui’s economy further (no housing and decreased economic activity due to low occupancy).

Theo W

June 11, 2024

Kenai Rawlins Fernandez, who is the Molokai rep on the Maui County Council, is a threat to the very future of Maui. Please look into her positions. She opposes almost anything that promotes jobs. Let her know how you feel at keani.rawlins@mauicounty.us

Grace Bertolozxi

June 11, 2024

Thank you for this good synopsis of a very misguided idea to phase out the Minatoya List of legal short term rentals. These A1 and A2 zoned properties sit shoulder to shoulder with hotel, zoned properties, and were never built or intended for long-term housing, nor are they set up for family life (tiny kitchens with limited storage, small square footage, limited parking, etc). The HOA fees alone are well over $1,000 a month making them unaffordable/unrealistic for long term rentals. These properties are aging and come with large assessment fees to redo pipes, roofs, landscaping and pools. To phase them out will crash real estate while still leaving these condos unrentable for Maui families. They will be purchased by richer people who can afford to leave them empty instead of renting them to people putting money back into Maui. Short term rentals are not the problem nor are they the solution.— the taxes they earn should go into improving infrastructure and making the permitting for new housing less restrictive. Given these properties pay the bulk of taxes into Maui, it would be foolish to phase them out. I suspect the hotels who pay less in taxes and a vocal anti-tourist minority is behind this foolish idea.

Jim L

June 11, 2024

Well researched and a good presentaion of a complcated topic. Ironic that STRs are the largest contributor to affordable housing. It would be interesting to see where affordable housing dollars actually goes? For your list for hotel zoned STRs I believe Ekahi Phase I is also hotel zoned.

Tracy S Stice

June 12, 2024

Jeremy, you have done a great job of analyzing the trickle down effects, not just the direct impact from the decrease in property tax revenues. The job losses all have a mutiplier effect the same as our state GET. Paul Brewbaker has also done many analysis on this subject which on the surface appears to be 4. 7 % of gross sales, but after the money changes hands a few times, it has the net effect more like 13 or 14%. The same is true if all of your service people lose their incomes, then they have less funds to invest, buying groceries, gas or even staying on Maui at all. Almost all of the people who worked on front street in restaurants and shops, that were not homeowners have left Maui. They have no jobs, no money and it is impossible to find a place to live. At least your employees and subcontractors are earning an income helping your company to service the short term vacation rental industry.

Ed Horstman

July 10, 2024

Well written, Jeremy. Your points are spot on.

Leif Nielsen

April 14, 2025

I hope the people on Maui council read this study. It they likely have their heads buried in the sand unfortunately