Properly Transition a Hawaii Vacation Rental Property During a Purchase Part 1

You’ve got your dream investment property in escrow and are all set to close on your Hawaii Vacation Rental Property but you ask yourself — what does my professional representation and myself need to do prior to closing on the property and shortly thereafter?

My team and I have handled this process many times directly for clients whom we represent during the purchasing process. Alternatively, we have worked in a collaborative fashion with other agents whom represented the buyer then have referred their clients to our Stice Team of Hawaii Life Vacations professional vacation rental management. Because I have been doing this full time for the last 15 years, our team has fine tuned the process for our own clientele and we don’t usually encounter impediments. Nevertheless, we are constantly learning and refining this process. Additionally, when taking on new clients referred from other Realtors — we have seen the good, the bad, and the ugly. The purpose of this post is to help educate all (buyers, sellers, Realtors, and property managers) in this process so that we can focus on the most important things in life rather than pulling out our hair when things go awry. This was originally a beast of a blog post so I elected to break it into several parts with future additions shortly forthcoming. This post is not meant to be pretty but rather informative so I will make some plugs on my vacation rental inventory for eye candy throughout.

Walk in and immediately WOW yourself, then VOW that you will return to Mahana #508 time and time again. I helped my friends Todd and Autumn with the sale of their Kapalua Golf Villas 20T8 vacation rental property which I also still manage by doing a 1031 Exchange into their new beachfront property at the Mahana. It is absolutely amazing, check it out here. Mahana #508 vacation rental site. Before my clients closed on the property, this was managed by the front desk rental entity, Aston, which made the transition pretty seamless as there were no transferred reservations or funds, rather we just started from scratch. We immediately hit the ground running on this property and already have over $40k on the books so far during 2022 while just launching this a couple weeks ago.

Important Considerations When Drafting Your Offer on a Vacation Rental Property

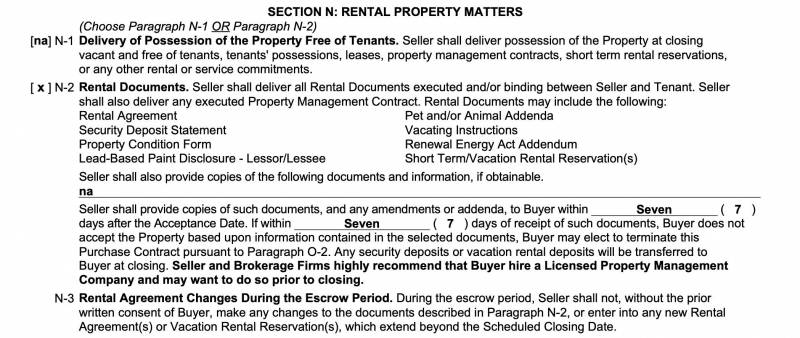

Something that you need to consider before even submitting the purchase contract is whether or not you want to, or the seller is making it a requirement for all existing confirmed reservations to be honored. Generally speaking, this is disclosed by the listing agent in the listing description or during the negotiation process. The two sections of purchase contract which deal with this are N-1 and N-2. If N-1 is checked to be applicable, it means that the property will be free and clear of all tenants or in this instance, short-term rental guests at closing. If N-2 is checked, it means that the list of current reservations will be provided during the review period. When this list is provided, buyers have the contractual right to approve this as it stands, ask questions, or negotiate modifications to said list.

The most common issue that I see arise in this process is that the buyer may get disgruntled about the sellers having blocked off a period of time in the future for a non-paid stay, discounted stays for special interest parties (friends or family namely), time blocked off that the buyer themselves wants to use, or sometimes just subpar rates for periods that should likely be higher.

Also noteworthy is that once a contract on a property has been accepted, all new bookings taken are at the mutual agreement of both the buyer and the seller. This is a paramount conversation for both the listing agent and the buyer’s agent to have immediately once escrow is opened as many booking sites are “live” and may need to be blocked when appropriate. I have seen some very sticky situations arise in this area especially if there is change taking place between the existing management company and the new one.

Kaanapali Shores #502, a Banging Bohemian style 5th. floor direct beachfront 2bd./2ba. Serene and Panoramic ocean view home away from home. Link to Kaanapali Shores #502 vacation site here. This is the Ultimate direct beachfront rental residence at over 1,500 sq.ft. of interior living area and you know exactly which property you are renting rather than going through the front desk. This pertains to this blog post as again this property was a front desk Aston property. Since we have launched this property late last year we have almost doubled the average daily rate for the property and we put more total revenue on the books in 90 days than the Aston did for of their average historical annual performance. I helped my buyer friends Steve and Laura with the sale of their Royal Kahana #610, which I still manage in order to do a 1031 exchange into purchasing KP Shores #502.

Important Steps to Better Educate Yourself and Discuss With Your Professional Representation

Decide whom will manage your property –– As a buyer you most often have three choices on this front. Manage the property yourself, hire the front desk rental entity if available, or hire an independent rental company to represent your interests. In a 2019 blog post, I dive into the specifics here: 3 Ways to Rent and Optimize Your Hawaii Vacation Rental Property

It is my personal opinion that you should really get into this process as part of your due diligence phase on your purchase process. If you decide that you want to self-manage the property, you will want to know the applicable laws that pertain to this, talk to property vendors (cleaners and service people), and develop a business plan, etc. If you want to hire the front desk entity like an Aqua-Aston, Outrigger, or Destination to name a few you will want to compare and contrast their offerings to what independent rental companies have to offer.

If the current management of the property appears to being going well and you have done all your due diligence on this front, it may be very wise to keep the property with the current management company in place. However, “going well” is certainly relative and it doesn’t hurt to understand how all the options line up coinciding with your personal goals. This is a big decision and your choice here will drastically impact your experience moving forward.

What Are the Booking Source(s) of the Rentals?

If a property has been self-managed, it is most likely that the owner of the property has relied on VRBO or AirBnB for the majority of their bookings. VRBO doesn’t allow you to transfer the site to a new owner or manager and the same can be said for reservations but they will allow you to transfer reviews provided that the seller provides written consent. I believe that AirBnB has more flexibility on this front but I can’t speak to it as much as I really don’t care for many aspects of AirBnB and try to avoid them as much as possible.

If the property is being professionally managed, then it is likely that the management company has a number of “direct” bookings that were booked directly on their platform, like ours here and not an OTA (Expedia, VRBO, AirBnB) as we call it in the industry. In this instance, if you feel comfortable doing a transfer of bookings and funds from one company to another — this can be facilitated between the two companies or the company and individual (if self-managed).

Also, within our system and many others guests will have the option to purchase Travel Insurance within 2 weeks of their new booking. We do explain to them that this is an additional service that they will be responsible for the cost of.

Papakea #B105, link to vacation rental site here, is a property that I helped friends Ed and Erica purchase last year and worked directly with the Seller of the property whom was self-managing the property. There were a lot of reservations that were extremely important to the Seller that they be honored and because of our attention to detail on this plus other compensating factors of our very strong offer, we were able to beat out stiff competition. The Seller was the most well prepared and cooperative Seller I have ever encountered in a transition process and it was in stark contrast to others that we have done so we were very grateful about this. The only downside on this one is that the Seller wasn’t very concerned about making the property as profitable as possible so we had many reservations that were far below market value but we advised our owner client to keep them at where they were and they obliged.

Straighten out the Reservation Details and Applicable Finances

If N-2 is checked as applicable, there needs to be a financial accounting of all reservation funds that are going to be transferred or rebooked with the guest at the same rate and generally the same contractual terms on another booking platform. This part can get messy as many sellers who manage their properties on their own don’t have the best record keeping and/or have interesting accounting practices. Transferring bookings from one management company to another is usually pretty straightforward unless the existing management company throws in a “free” car or other marketing enticements to their guests and then it can get complicated.

Most, if not all guests will expect all reservations to be transferred/honored at the same rates and terms as their previous reservation. Even if all the accounting is logical and complete, there is still work to do during the re-booking or transfer process. The allocation of specific fees- most notably cleaning fees, deposits, and credit card processing fees are often times different from one operator to the other and the guest will absolutely expect the grand total to be the same. Our team has to spend a considerable amount of time with some guests explaining that the total cost of their reservation is going to be honored but the way that it is delineated in our system may be different because of the templates and charges that we have.

Kahana Sunset #B4B is a property, link to vacation rental site here, that I helped clients secure in mid-2021 which was very interesting. During this time in Hawaii we were still in very strict pandemic restriction protocols. This property was professionally managed by another local firm and this management company was the very best that I have ever worked with on a transition. I have nothing but positive things to say about Leanna Roberts who owns iTrip vacations here on Maui- she and I met in person for a couple of hours to talk story about the transition plan which worked out very well. Dealing with the booked guests was the most challenging aspect namely because of people wavering whether or not they wanted to come to Maui during the pandemic.

Get All Specifics Related to N-2 of the Purchase Contract in Detail and in Writing

This is pertinent during the contract drafting process to spell out the specifics of how N-2 will be handled with bookings, property review transfers, the specifics of guest information provided as it is not properly covered under the default language of section N-2 or any other section of the Hawaii purchase contract. This specific shortfall can be overcome by having your agent write a special term in the contract relating to N-2.

Additionally, if this is not handled on the front end or there is any other material decision made by either party — it is paramount to get this information in writing by means of a contractual amendment to the purchase contract. I recently dealt with a property that was referred by another broker to my team where the seller agreed multiple times albeit not in writing to transfer the reviews on the property post closing but after closing on the property, changed their mind and decided not to. This has created quite the challenging situation for my team to have to deal with our disgruntled new owner client.

Understanding Previous Contractual Terms of the Prior Rental Agreements

Also covered under section N-2 of the purchase contract are the contracts that are used between the sellers and the renters directly (if self-managed) or the management company and the renters. In order to create goodwill and ingratiate yourselves with the renters of the property, I believe it is wise to follow the contractual terms of their prior agreement as closely as possible. This is especially challenging right now during the Covid-19 pandemic as guests are looking for very lenient cancellation policies and payment terms. Grace and flexibility with the guest is important but so is drawing the line of what is ethical, reasonable, and makes business sense.

We have had to walk away from potential renters who were not willing to leave a hard deposit with us in the past and when considering deposits usually range from $500-$1,000 for properties that are selling for what they are, it seems reasonable that you will not want to take on some of these.

It is to be expected that there will be attrition with reservations on this property as some people especially right now are looking for any reason that they can to get out of their rental agreements.

I just completed the transition of Kaanapali Plantation #32, link to vacation rental site here where I did not represent buyer or seller but because I was already managing the property prior to the sale, I was able to work seamlessly with the listing agent who is my cousin and the buyer’s agent who is a very close personal friend of mine to make it super seamless for the new owner. This was by far the most seamless transition I have ever done as the vast majority of the process just dealt with working the new buyer who is my new management client owner. We did need to work with their broker representation to create a contractual special term which involved some unpaid rental days for the Seller in exchange for other considerations of value for the buyer and then other than that we just had to pro-rate rental income as of the closing date and set up new management agreements.

Formalize Your Professional Arrangement with Your Management Company

I can’t recommend highly enough that you formalize your relationship with your management company as soon after you as you complete the J-1 Due Diligence of the property. Many of our cash purchases are written with 30 day escrow periods (financed purchases are usually 45-75 days to complete the loan process) and many J-1 periods are 14-15 days. So after you complete your due diligence, you only have another couple of weeks before you take ownership and RESPONSIBILITY of the property and the rental operation. This is covered in Bold Font as the last sentence of section N-2. There is a lot to take on to get started with a new rental; the more lead time that you have in addition to incorporating many of the steps that I mention throughout this post will lead to a much more successful transition to allow you to hit the ground running.

I personally have a business practice of providing value propositions and strong insight to my potential vacation rental clients but I will not formally commit the resources of me and my team until a fully executed management contract is executed by all parties. Last year, I dealt with a scenario where a referred buyer under contract on the property delayed getting their contract executed until very late in the process and it made the transition process much more difficult than it needed to be.

This is it for part 1 of this series and please stay tuned for Part 2 where I touch on: how to properly transfer deposit funds or revenue through escrow, creating an entity for your property to vested in, tips on utility transfers, communicating with the current management company to, communicating with guests, property inventory, and getting your new rental site launched.

Why Hire Jeremy Stice

- Licensed since 2006 at age 23; Third Generation Realtor

- Top Selling Broker in the Entire State of Hawaii under age 40.

- $40M Sold in 2021 and a very consistent track record of vacation rental condo sales.

- Born and raised on Maui; Seabury Hall and Babson College educated.

- Honua Kai Homeowner Investor and Ka’anapali Coffee Farm property owner.

- Facts. Analysis. Performance.

- Expert negotiator and astute contractual knowledge.

- Comprehensive pricing Analysis- more valuable/insightful than an Appraisal.

- Complimentary In-house design and staging services by Laura Lancaster of WIBU Interior Designs.

- Commitment to stellar “white glove“ services.

- Driven, Knowledgeable, assertive, determined, and fun to work with.

- Solution-oriented and able to navigate very challenging issues.

- Listens well and has strong communication skills.

- Introduced and established Hawaii Life Real Estate Brokers, Hawaii’s Top Real Estate Firm to Maui in 2009.

Work with a True Vacation Rental Specialist

My wife and I have owned an investment property at Honua Kai since 2014, I have represented countless buyers and sellers on Vacation Rental Properties in Hawaii, and we operate a top performing vacation rental program operating within numerous resorts in Maui.

Jeremy Stice R(B) at Your Service

As the director of Hawaii Life’s West Maui Vacation Rental portfolio and one of Hawaii Life’s top-selling Brokers, my team and I are here at your service. I was born and raised here in Maui, am a third-generation Realtor, and my wife and I have called West Maui home for the last 10 years-we enjoy sharing our passion for it with all who are interested. I make a commitment to pick up my cell phone as best as I can, return voicemails, text messages, and email in a timely fashion. I also work 7 days a week so feel free to call me anytime you need me. I am here at your service, I look forward to sharing my passion and expertise with you. Want to follow my blog via email updates? Please enter it below. This will not be used for any other reason than automatic blog updates that I post. Subscribe to the Jeremy Stice Blog Roll Here

You might also be interested in these past articles:

- Maui Vacation Rentals Outpacing General Maui Market & Becoming More Valuable

- Key Amenities of a Succesful Hawaii Vacation Rental Property

- Sapphires to Diamonds – Ranking Maui’s Top Luxury Vacation Rental Properties

- New Hawaii Vacation Rental Loan Program with 20% Down Payment

- 3 Ways to rent and optimize your Hawaii Vacation Rental Property

- How to properly prepare for owning a Hawaii Vacation Rental Property

- 5 Ways to Protect your Hawaii Vacation Rental Investment Property

- Invest in a Hawaii Vacation Rental Property with as Little as 20% Down

- Maui County Publishes Maui County Short-Term Vacation Rental List

- Purchasing a Maui Vacation Rental? 3 Reasons to Call Us First!

- Maui Realtor Interviewing for Your Services Today

- Earn a Part Job in Hawaii by Purchasing a Vacation Rental Property

- Toolkit For Purchasing a Hawaii Vacation Rental Property

- How Technology Facilitates Maui Property Sales via the Internet

- Invest in Maui Property via an Internet Purchase with Jeremy Stice & Hawaii Life

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.