It’s really too early to know what effect the virus will have on our market. If the lava flow taught us anything, it’s that people have short memories. There will always be a demand for housing. If our financial institutions remain healthy, things will stabilize quickly. In the meantime, real estate may not be top of mind, but the pause offers the perfect chance to make plans and take advantage of opportunities. Here we go!

Is Refi Right for You?

If you are a homeowner, it may be time to think about refinancing. Interest rates are ridiculously low, and refinancing today could allow you to skip a payment while lowering your monthly out-flow. You must assess your savings before deciding to move forward. If this isn’t an option, the government has made provisions for deferment of payments. Remember, the government is not your lender.

But I Defer…

If you find it necessary to defer, be sure to ask your lender how your deferment will affect your credit score. Historically, deferred payments were reported according to the lender’s internal policy. Be aware, payments are not being forgiven, and additional interest will accrue. Some lenders are requiring a lump sum payment at the end of the deferment. Also, your credit card limits and interest rates could be affected if your loan is reported as late or otherwise not paid as agreed. Be sure to inquire so you can properly plan.

What About Buying and Selling?

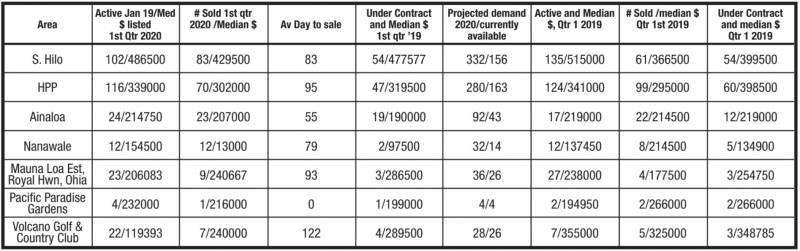

The numbers above still show strong demand. This could continue if we return to normal quickly. If this lingers, sellers with (especially) investment properties may begin to panic sell. Bad idea. If you need to sell for the normal reasons, get ready. But depending on price point, you may want to hold off listing for now. Listings with prices in reach of local buyers seem to still be moving, albeit at a slower pace. In fact, I received three offers on my listings this past week.

Buyers should be getting ready. Get your credit house in order. Be in touch with your REALTOR®. Contact a lender. Most good REALTORS® can give you a rough idea of how much you can afford. Once things normalize, local buyers should be ready to jump in. The window of opportunity prior to off-island buyers returning will give you a rare opportunity to limit the competition.

Listings above $350,000 tend to sell to off-island buyers. This group of sellers might consider waiting. I expect prices at the upper price ranges will soften. Remember, it’s supply and demand. Because we will continue to see demand at “local buyer” price points, these prices will probably not shift much.

What About Your Home?

Don’t see your neighborhood on the chart? Don’t have a computer? No problem. We’ll happily provide a custom report by email or snail mail if you just contact us. In the meantime, be strong and stay safe! More next week…

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.