Tired of living on base in Hawai’i? Honorably discharged, or perhaps a reservist with over six years of service and want to buy a home in Hawai’i but prefer not to make a large down payment? You’re in luck as the Veteran Affairs (VA) Home Loan program is a wonderful opportunity for active duty members of the military as well as veterans, reservist and surviving spouses to buy a residential property (consisting up to 4 units). Whether this is your first time considering using the benefit, or a benefit you’ve used before, below is some information I hope you find helpful in your home buying process. First, and most importantly, below are the Veteran Affairs loan limits throughout Hawai’i:

2019 VA Limits for the Hawaiian Islands

Unlike other states in the country, due to the high cost of housing in Hawai’i, the 2019 loan limit throughout the Hawaiian Islands is $726,525.

Remember, no down payment is necessary. This is the full loan amount you can qualify for to buy a home, condo or multi-family (up to 4 units) in Hawai’i.

Also, if you want to buy a more expensive property, all you need to do is make a 25% down payment on the amount exceeding the VA loan limit. For example, you find your Hawai’i dream home that you want to buy, but the price is $980,000. You would then need to make a down payment of $63,368.75 ($253,475 x .25).

Basic Allowance for Housing (BAH) In Hawai’i

Although the cost of housing is expensive in Hawai’i, active duty military personnel receive a BAH that makes it possible to own a residential property in Hawai’i — without needing to make a down payment. I recommend that you always check with your accountant and/or financial planner but due to the historical appreciation of residential property in Hawai’i, it often makes financial sense to own your residence, rather than renting when living in Hawai’i. For me, one of the most appealing aspects of the VA loan is that you can buy a multi-family property (up to 4 units) with no money down.

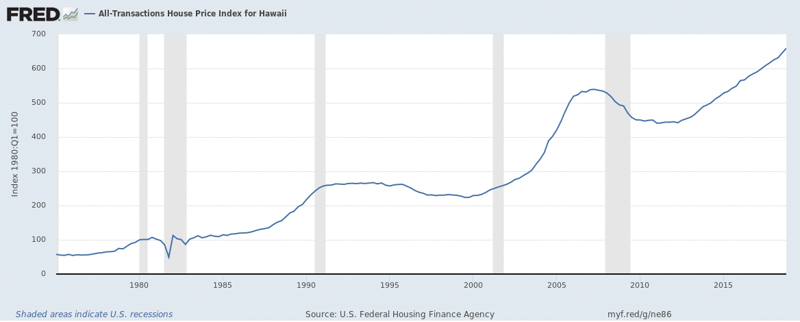

Here is a graph from the U.S. Federal Housing Finance Agency that shows home prices in Hawai’i from 1975-2019. You can see that long term holding of Hawai’i real estate has been lucrative for property owners.

Click on this link to view 2019 BAH Allowances in Hawaii (based on rank) for every county.

Who Qualifies for a VA Loan?

Active Duty, Veterans, Reservists, and surviving spouses are all eligible for a VA Loan

Borrowers must have a satisfactory credit history, sufficient income, and a valid Certificate of Eligibility (COE) to meet qualification requirements for a VA loan. Is it important to note that although the program does not check credit scores since funding is provided by a private bank, each borrower will have to satisfy all of the bank’s lending criteria.

Remember, your eligibility to qualify for a VA home loan never expires and it is a benefit that can be used more than once. Also, if you haven’t used all your eligibility on the first property you bought, you can use the remaining amount on another property.

Advantages of Buying a Home in Hawai’i with VA Financing

A huge advantage of buying a home, condo, or small multi-family property with a VA loan is that no down payment is required as long as the purchase price does not exceed the VA loan limit. Also, since the loan is guaranteed by the Federal Government, borrowers are not required to pay private mortgage insurance (PMI). Also, the interest rate charged to the loan, and the closing costs are both generally lower than a conventional mortgage.

It is important to note that foreclosed homes and short sale properties also qualify for purchase via the VA home loan program. As long as the property meets VA appraisal standards for value and minimum property condition requirement, you should not have a problem getting loan approval. Which brings us to…

Choose the Right VA Lender

There are numerous mortgage companies that offer an array of options for buying a property. Therefore, if you want to buy a home through the VA home loan program, I highly recommend you use a lender who has experience with this type of loan.

Things to Look for:

- How many VA loans does the lender typically do a month?

- How long will it take to get your loan approved and funded?

- Do they have dedicated contacts at the VA?

- How do they submit your application to VA?

If you would like a referral to a quality lender who specializes in VA loans, I’d be happy to recommend one to you.

Welcome to Hawai’i, best of luck in your home search, and if you have any remaining questions, or want to work with a reliable, dedicated, and trustworthy Realtor, please contact me as I’d be honored to serve you.

Sign Up For Bryan’s Monthly Newsletter

Troy Yazzie

April 14, 2020

I am a veteran and am interested in buying a home here in Hawaii. I would like to find out more information on this and what benefits there are to buying a home here in Hawaii for veterans. Thank you for your time.