The Seller Buydown Playbook: The #1 Mortgage Strategy in a Rising Interest Rate Marketplace

Over the course of 2022, the Hawai’i housing market has seen an unprecedented increase in interest rates while home prices continue to rise. It comes as no surprise that affordability is becoming a growing concern among our residents. These days, it is critical that you have a realtor and loan officer that think strategically about how to structure deals in a way that is a win-win for all parties involved.

The strategy I am going to present to you is solving two problems:

- First, it relieves the prospective buyer’s fears regarding rising interest rates.

- And second, it helps the seller, who may be concerned about reducing the price on their home.

The solution is called a Seller Buydown Strategy, and it is defined as a process in which the seller provides a concession to the buyer so that the buyer can purchase discount points in order to obtain an interest rate that would be below market for them based on their qualifications.

I have been keeping an eye on the housing market across the state of Hawai’i and found that lately, many sellers are opting to reduce the price of their home by $5,000 to $50,000 if their home ends up sitting on the market longer than they intended. While this sounds advantageous to a prospective buyer, a reduction in price will not lower your monthly mortgage payment as much as you may think.

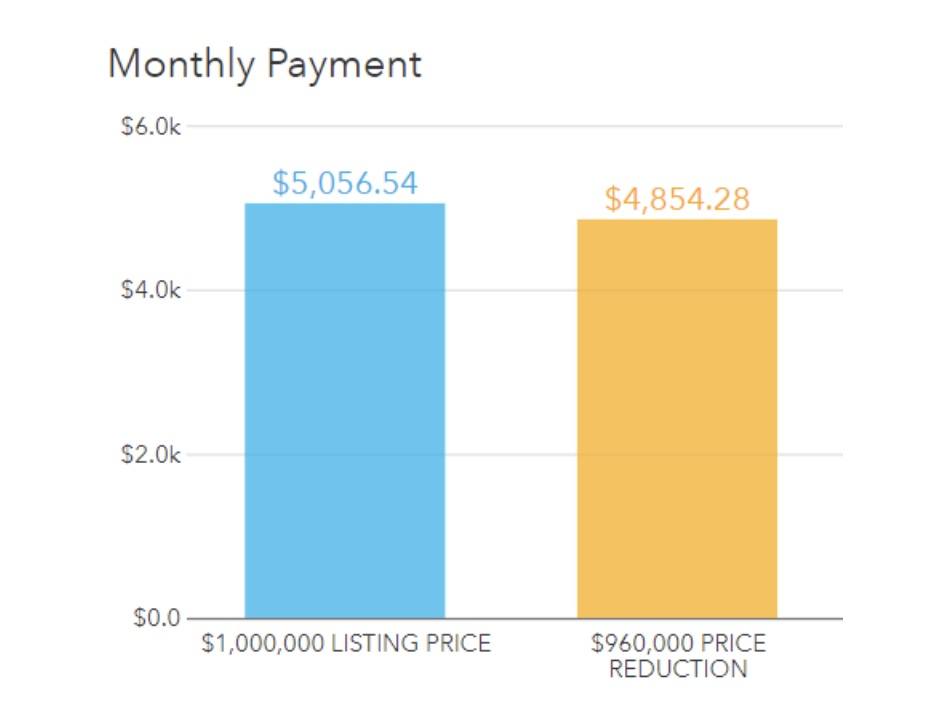

To illustrate this, I will use a home listed for $1,000,000 and will not include taxes, insurance, and other costs for simplicity’s sake. Assuming 20% down and a credit score of 740, the principal and interest payment on this property is $5,056. As shown in Figure 1, if the seller were to reduce the price by $40,000, the mortgage payment drops to $4,854, thus lowering your monthly mortgage payment by $202 per month.

Figure 1. Monthly principal and interest cost of a home that is listed at $1,000,000 versus a home that is listed at $960,000. These calculations were based on a borrower with a 740 credit score and a 20% down payment.

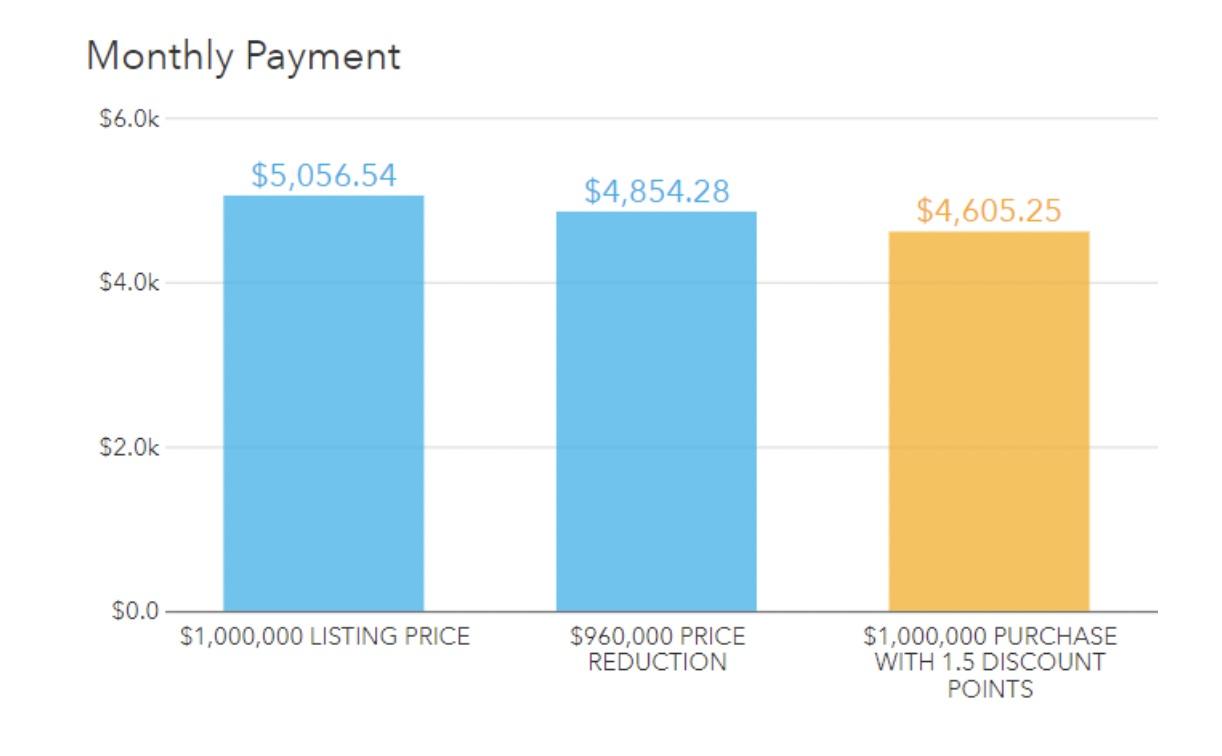

However, the most cost-effective way to reduce your monthly mortgage payment is to pay discount points. Discount points lower your interest rate in exchange for paying an upfront fee. Furthermore, the seller party is allowed to contribute money towards this upfront fee and other closing costs.

Using the same example of a home listed for $1,000,000, you can see in Figure 2 that using $12,000, or 1.5 discount points, will lower the interest rate by 0.875%. In turn, this will yield a savings to the buyer of $451 every single month.

Figure 2. Monthly principal and interest costs of a home with 1.5 discount points applied to lower the interest rate.

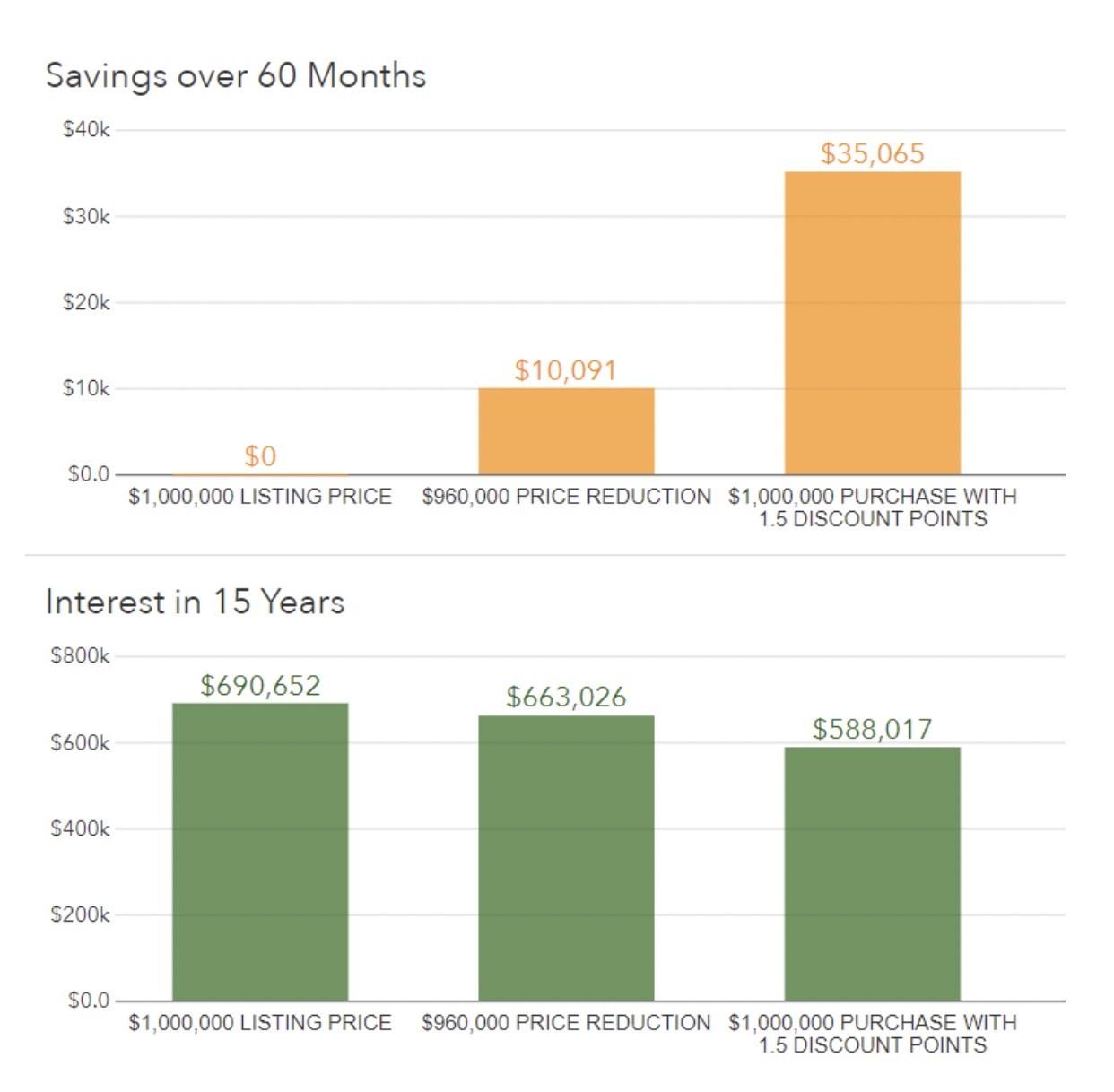

The savings obtained by using this strategy is astounding. Over the first 5 years of ownership, the buyer will have saved $35,000! And over the first 15 years of the mortgage, the buyer will have saved over $100,000 on interest payments!

Figure 3. Savings over 5 years and 15 years of mortgage amortization with 1.5 discount points applied to lower the interest rate.

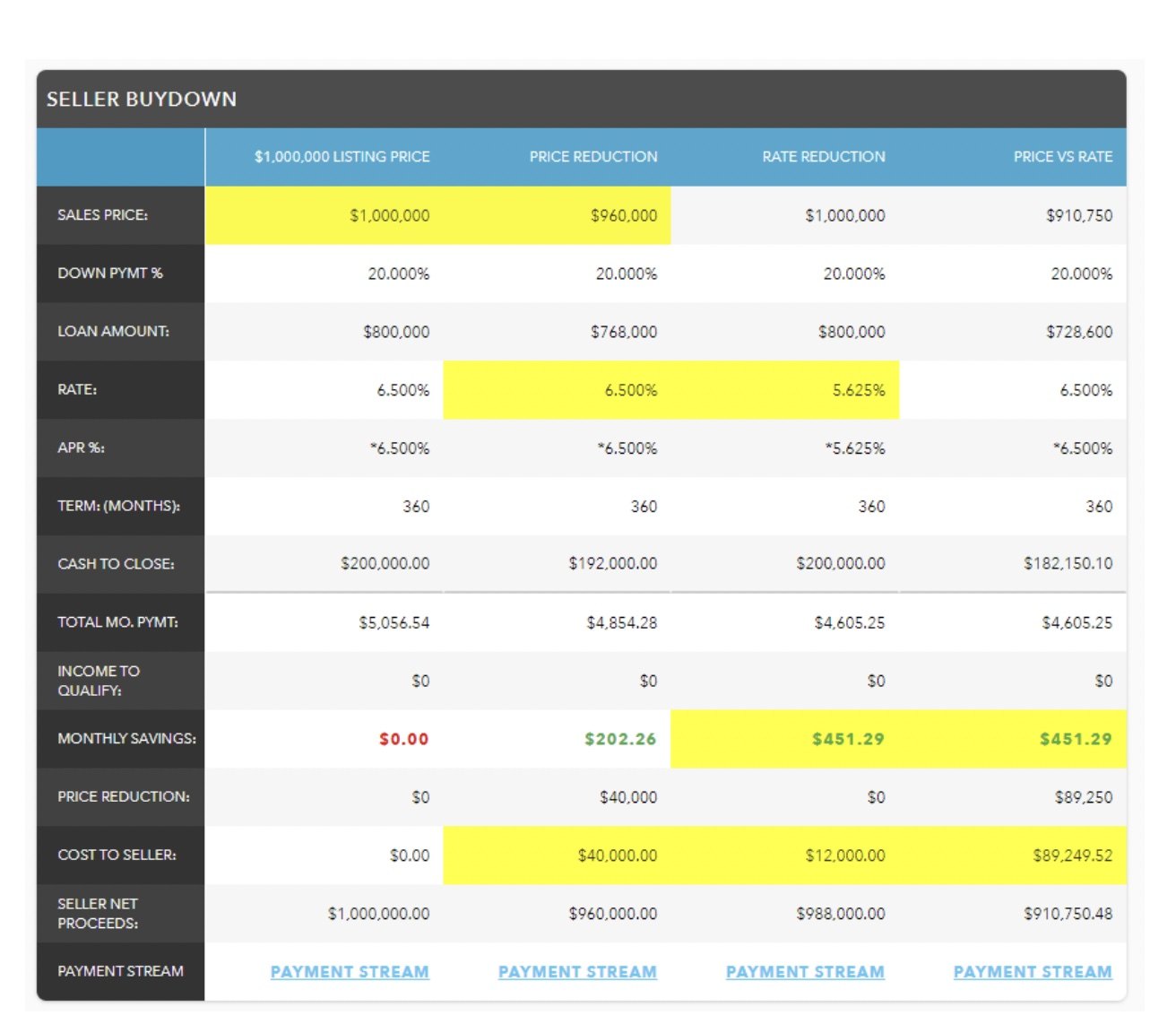

To obtain the same monthly mortgage savings from using the interest rate Buydown Strategy, the seller would have to reduce the price of this home by $89,000, as seen in the fourth column in Figure 4.

Figure 4. Total breakdown and cost analysis of Price Reduction versus Rate Reduction using the Seller Buydown strategy.

Utilizing this strategy can help sellers and buyers meet in the middle in this high interest rate environment. The seller retains tens of thousands of dollars by avoiding a price reduction while the buyer saves tens of thousands of dollars over the lifetime of their mortgage.

Additionally, a buyer utilizing this strategy is far more likely to get their offer accepted as they are proposing to purchase the home at list price, instead of undercutting the seller. This month, a realtor partner of mine and myself have structured two offers for our buyers employing this strategy, and both were accepted without hesitation.

So, why aren’t more people using the Seller Buydown Method? The answer is simply because they never knew this strategy existed, so spread the word! If you would like to see how this strategy can benefit you, reach out to me, your local lender, by phone or email, and I will make you a Seller Buydown Strategy tailored to your specific scenario. It only takes me a few minutes to draft these up, so don’t hesitate to ask – I’m here to help!

Whether you are a seller who has a home sitting on the market or you are looking to purchase a home and save the most money possible, I am your lending expert for structuring deals and borrowing money the smart way! I sincerely hope this helps you accomplish your goals of buying or selling your home while saving thousands of dollars along the way!

To get a free Seller Buydown analysis, please e-mail John at john.stengel@elementmortgage.com using the Subject line “Seller Buydown Request.”

Click this link to see a short video from John Stengel explaining the Seller Buydown Strategy using the Mortgage Coach platform.

Read other Blogs featuring John Stengel:

Spotlight on John Stengel – Marine Biologist turned Mortgage Professional

From Raw Land to Dream Home: Residential Land Loans on Hawai’i Island

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.