It’s looming and has not passed yet, but this proposed bill is aimed at residential properties in the City & County of Honolulu on the island of Oahu. The supplemental real property tax is focused on alleviating the housing shortage and homelessness crisis in Hawaii by promoting homeowners not to let their homes sit empty for more than 6 months of each calendar year. For homeowners who do not live in their property year round or use it periodically for family and friends, this tax would significantly impose a financial burden and impact. We have put together the scoop on what you need to know and how to navigate..

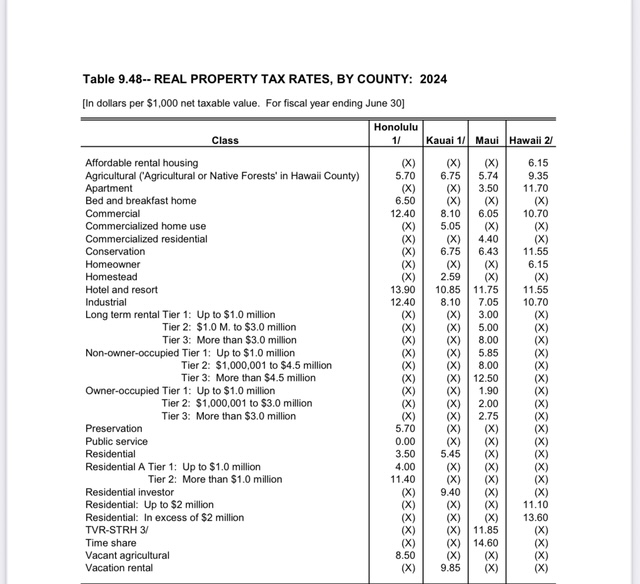

If you own a home on Oahu in the Residential A category, (a home that is not your primary residence), you will be subject to the following additional property tax, ON TOP of the tax rate listed in the chart below:

- 1% of the assessed tax value for the first year your home sits empty for more than 6 months in the calendar year.

- 2% of the assessed tax value for the second year your home sits empty for more than 6 months in the calendar year.

- 3% of the assessed tax value for the third year your home sits empty for more than 6 months in the calendar year.

THE BREAKDOWN..

Here is a chart of the 2024-2025 real property tax rates for all of the tax classes. This chart is taken from the City & County of Honolulu real property tax website:

If your Hawaii property is not your primary residence, refer to Code 1 and calculate accordingly.

THE CHALLENGES..

There are 15 exemptions written into this proposed law that an owner may be eligible for, such as; ongoing construction, probate cases, military deployments, and medical absences.

You will also want to consider how a homeowners association bylaw may hinder your ability to rent for less than a certain period of time. Some apartment buildings and subdivisions in Hawaii have restrictions on short-term rentals less than 30 days, up to 6 months.

Be sure you hire a seasoned real estate professional to help guide you through what buildings or neighborhoods would best suit your needs. It is possible to live part-time in Hawaii and be able to rent your home for the remainder of time to avoid this added tax burden.

THE OPTIONS..

This Castle Surf Penthouse on the famed “Gold Coast” in Waikiki/Diamond Head area rents for 30 days + terms between owner personal stays throughout the year.

Join the Fight, The Oahu Short-Term Rental Alliance has been the champion for owners and representatives that wish to continue renting their properties short-term. You can find out more or become a member here.

If you are not ready to sell your property, you can enjoy the best of both worlds and live part time in your Hawaii home, then rent it out for the rest of the time it would otherwise sit empty. This strategy would help you avoid this extra tax.

We handle a large portfolio of luxury properties with both daily and long-term rental opportunities. Our staff of reservationists, bookkeepers, marketing and admin teams are highly trained and focused on getting you top results.

We partner with trusted industry leaders such as VRBO, Airbnb, Booking.com, Expedia, Zillow, and many more platforms to get you maximum exposure.

We offer GET (Hawaii General Excise Tax) and TAT (Hawaii Transient Accommodation Tax) filing services as well as monthly and year-end owner statements. We also provide a detailed cash flow breakdown to simplify tax filing. We can also help you successfully register your vacation rental to obtain legal status as well as provide the required documents needed to prove occupancy periods for both short and long-term rental periods. Daily, weekly, monthly, or 6month term options can be tailored to suit your specific needs and requirements.

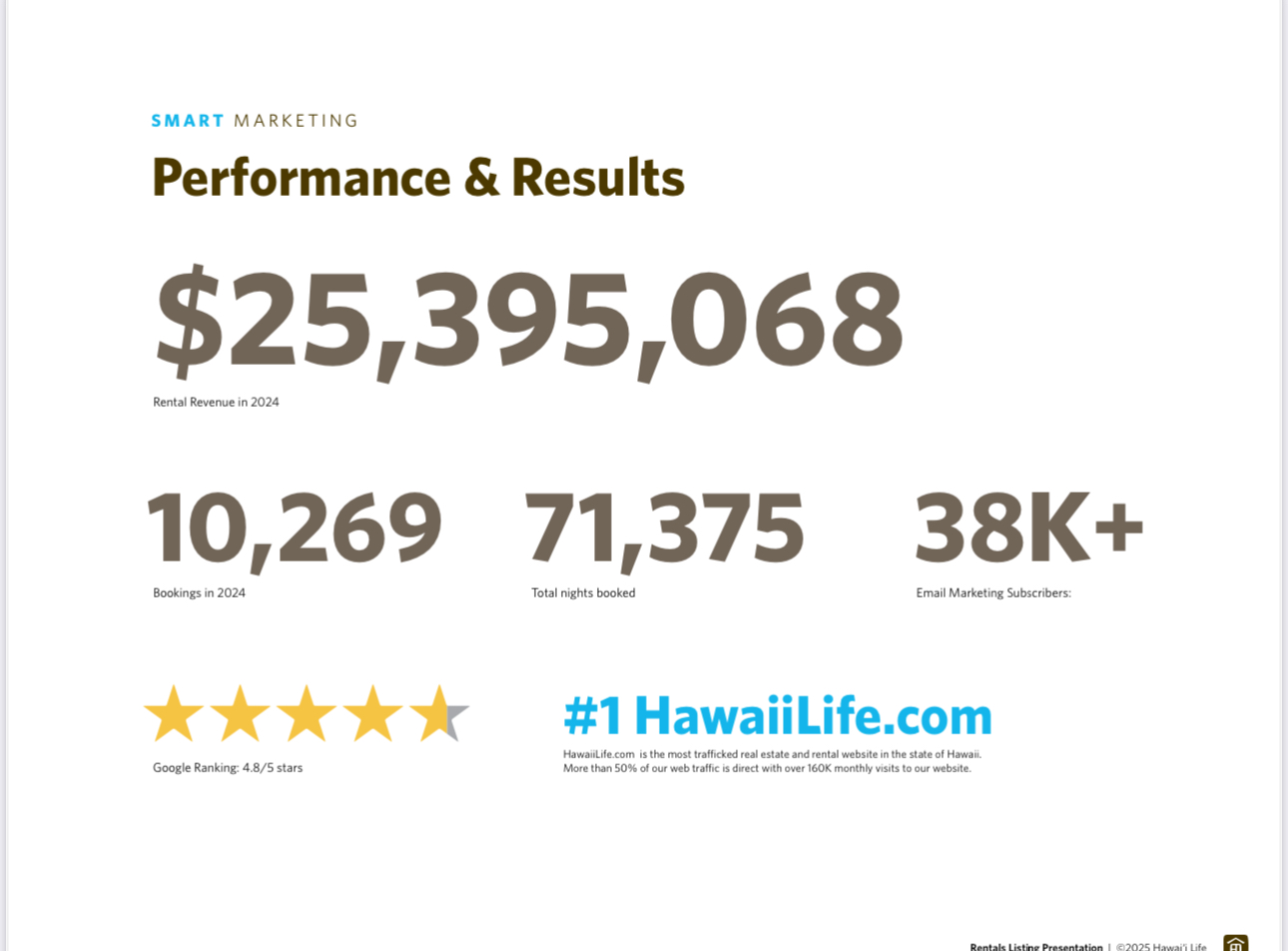

THE RESULTS..

We are the leaders in Hawaii rentals and will put our proven track record of success to work for you.

THE FACTS..

For more information, we suggest that you go to the Honolulu Real Property Tax website.

We are not tax advisors, so be sure to get advice for your trusted tax professional regarding the information we have shared in this blog.

We are here to assist you as your on the ground, seasoned, luxury property management team with over 30 years of combined service in the industry. Please give us a call or email us to discuss how we can help you achieve optimum results and provide you with stellar service.

Your peace of mind is just a phone call away..

Scott

March 19, 2025

Thank you for the informative post.

Cindy

April 30, 2025

I think this sounds very un Constitutional to me and I am sure, many other owners.

When so many of us, over the years, had the opportunity to buy a second home in Hawaii, this law was not present. No one seems to care about, “ not enough rentals,” to go around then and it was a problem way back, even 20 years ago.

I feel if this law does go into effect, anyone who purchased a home, up until this law passes? Should be exempt.

How can the politicians force you into the rental business, if your intent was to have a second home here and have your family come stay with you, or stay when you are not on the island, because they can’t afford the hotel costs? I don’t see hotels bing forced into becoming rentals to house people! This is picking on one kind of people and not others!

Maybe also the politicians should look into what a lot, not all of, what local families do to the properties they rent? We just had a neighbor who had a Meth family who almost completely destroyed his rental, to almost having to tear it down! The law is only looking at one side. If you are a renter, respect would go a long way!