Buying a home is a key component of the proverbial ‘American Dream.’ The home buying process is filled with contemplation, planning, excitement, and stress. And for military service members, there is the added component of future PCS orders. The unknown can be paralyzing and keep you locked into the safe zone of renting or living on base. But with the VA loan benefit, military service members have the ability to make the dream of owning a home a reality.

2020 VA Loan Benefits

The VA loan program offers military service members:

- No Money Down Home Loans

- Competitive Interest Rates

- Lenient Credit Standards

- No Mortgage Insurance

As with any loan program, there are details that are important to understand, and there have been some recent changes made to the VA Loan program. Let’s start with the exciting news that has been circulating; VA loan limits have been lifted. What does this mean? The Veterans Administration sets a limit on the price of a home that could be purchased with no money down, which varies from county to county. On the island of Oahu, the loan limit is currently set at $765,600. Wait, weren’t loan limits lifted? Yes, but let me clarify. If a service member has 100% of their VA eligibility available, then there is no VA loan limit on the home they can purchase with no money down. If the service member has a portion of their eligibility tied up in another home, then the loan limit is $765,600, on Oahu. If you were to purchase a home above this price point, the lender would require a 25% down payment for the amount financed above the loan limit.

Please keep in mind that the lender you choose to work with, may set their own loan limit for the VA loan, so be sure to ask your mortgage lender for their individual loan limit.

VA Loan On Oahu

The reason that this change is significant is that homes on Oahu are often priced above the county loan cap, which means military home buyers have had to come up with the 25% down payment for the amount that exceeds the loan cap. With no loan cap and 100% eligibility, more homes are options for our military home buyers stationed on Oahu.

Increased Funding Fee

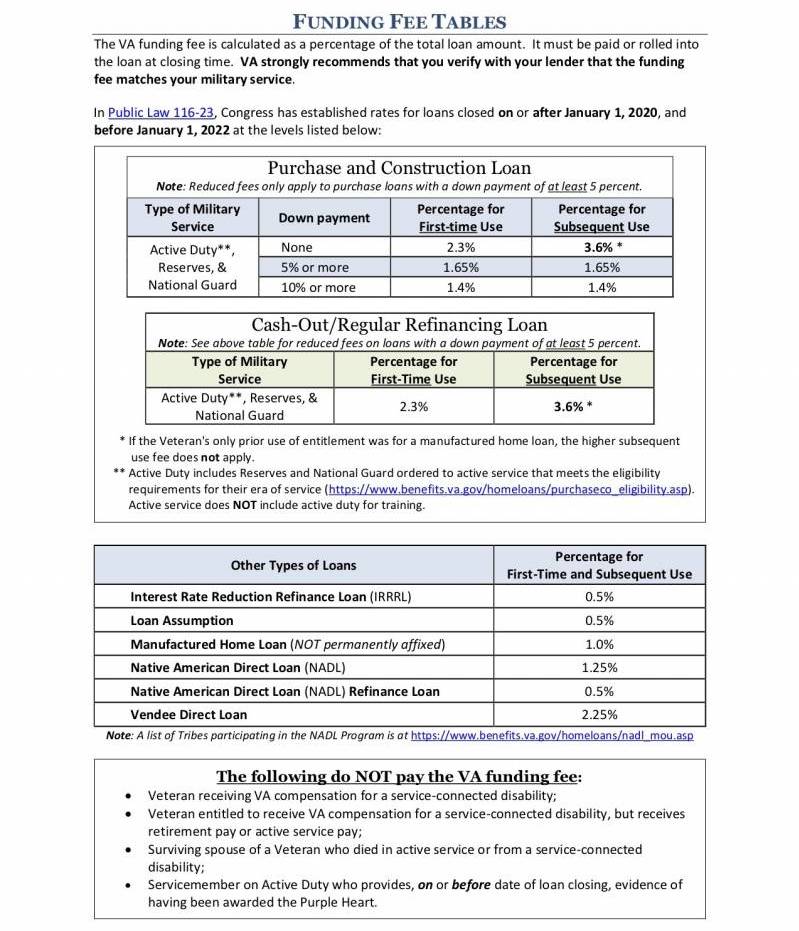

Another important change to the VA Loan benefit is the increase in the Funding Fee. While the VA loan benefit does not require a down payment, there is a fee involved. This is a one-time fee that can be paid up front or financed into the loan. Because VA loans are backed by the Department of Veterans Affairs, which guarantees partial repayment of the loan if the borrower defaults, a Funding Fee is used to offset that cost. This year, the Funding Fee has increased by 0.15%.

The amount of the Funding Fee varies, depending on whether you’re putting money down and if you have utilized your VA benefit before. For first time VA home buyers, with no money down, the Funding Fee is 2.3% of the purchase price. With a down payment of 5%–9.9%, the funding fee is reduced to 1.65% and down to 1.4% with a down payment of 10% or more.

Please see the chart below for the Funding Fee amounts for those buyers who have used their VA benefit before, known as “subsequent use.”

Want To Know More?

As a strong proponent of utilizing the military benefits of the VA loan and BAH (Basic Allowance for Housing) to purchase homes here on Oahu, or at any duty station, the news about loan limit removal has just increased my passion to help military service members invest in their future. If you are interested in exploring your home buying options on Oahu or another duty station, please reach out to me. I’d love to help!

Leave your opinion here. Please be nice. Your Email address will be kept private, this form is secure and we never spam you.